ECB Preview: What’s in store for EUR/USD amid upbeat forecast (leak), negative inflation and euro surge?

- The ECB is likely to leave its monetary policy settings unchanged in September.

- The bank’s take on the euro surge amid negative inflation in focus.

- The ECB forecasts (leak) show more confidence in the economic outlook.

The European Central Bank (ECB) monetary policy decision is much-awaited on Thursday, as the bank remains concerned about the appreciation in the euro, increasing deflationary pressures and uncertainty around the coronavirus situation in Europe.

Despite the recent negative developments, the ECB is set to announce no changes to its monetary policy settings for the second straight month in September, having expanded its Pandemic Emergency Purchase Program (PEPP) with EUR600 billion in June.

The interest rates on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will likely remain unchanged at 0.00%, 0.25% and -0.50%, respectively while the PEPP will be maintained at EUR1,350 billion.

President Christine Lagarde will address the post-policy press conference at 1230 GMT after the release of the policy statement at 1145 GMT.

More stimulus on the cards?

The closely-watched Eurozone inflation turned negative in August, as the annualized consumer price index fell 0.2% versus July's 0.4% rise. A sub-zero reading cast a shadow over the effectiveness of the June stimulus expansion, raising expectations to do more.

Note that the ECB has already expanded its balance sheet from EUR4,500 billion to EUR6,424 billion since March to combat the economic impact of the coronavirus.

Eurozone’s long-term inflation expectations showed further deterioration, with a key gauge falling to a fresh monthly low of 1.17% on hopes of a supportive stance by the ECB.

Verbal intervention amid euro strength

Lagarde’s take on the appreciation in the euro will be closely eyed. The bank’s policymakers voiced their concerns over the euro surge, which is seen undermining the nascent economic recovery and could exert additional downward pressure on inflation.

Chief Economist Philip Lane said last week, “The EUR/USD rate does matter. If there are forces moving the euro-dollar rate around, that feeds into our global and European forecasts and that in turn does feed into our monetary policy setting."

With the rates likely on hold, the least the ECB could do is continue with the verbal intervention to contain the rapid rise in the shared currency and ease the concerns. EUR/USD reached the highest levels in two-years at 1.2011 last week, having gained 7% in the past six months.

ECB’s forecasts to show economic optimism

The central bank’s outlook on the economy will also hog the limelight, as the second-wave of the virus tightens its grip across Europe, which could slow down the economic recovery.

However, the leak of the bank’s forecasts, as reported by Bloomberg, points to more optimism on the outlook. The ECB is said to revise its 2020 GDP estimates higher amid stronger private consumption. Given the strong Retail Sales, the mild upward revision to the forecasts could have a temporary positive impact on the euro.

The news of the forecasts leak saved the day for the EUR bulls, as EUR/USD jumped from 1.1760 to 1.1830 region. The main currency pair trades at 1.1825, adding 0.45% on a daily basis.

The cause for concern for the market still remains the ECB’s inflation forecasts, which could be revised down amid stuttering recovery.

EUR/USD: Key technical levels to watch

Daily chart

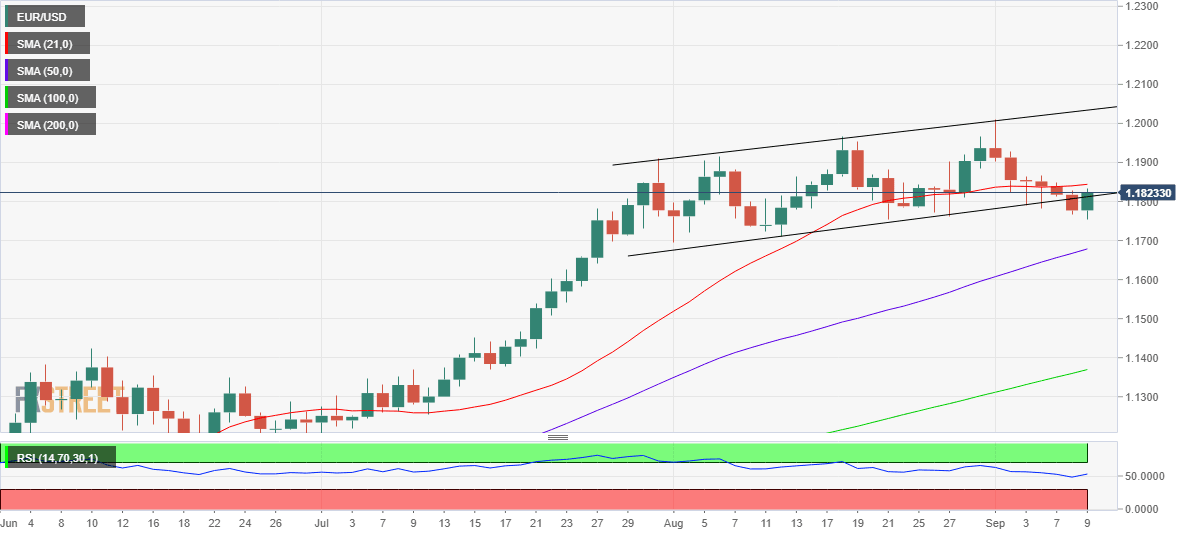

Holding onto the said support prompted a solid bounce in EUR/USD on Wednesday, although a daily close above the horizontal 21-day Simple Moving Average (DMA) at 1.1844 is critical to negate the bearish momentum in the near-term.

The daily Relative Strength Index (RSI) saw an upturn above the midline, currently at 53.15, which could allow an additional upside.

A further jawboning of the exchange rate and/or downbeat inflation forecasts could recall the sellers, with the robust support at 1.1757 likely to be retested. A sell-off towards the upward-sloping 50-DMA at 1.1678 cannot be ruled on a break below that strong support.

To the topside, the 1.1900 mark will be back in sight if the ECB comes out less dovish, with the bulls set to challenge the 2020 highs once again.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.