ECB preview: Central banks take a lurch to the dovish side, but how much further can the ECB go?

- ECB expected to cut rates today.

- Inflation and growth forecasts are also expected to be cut.

- But, how much further can the ECB cut rates?

- Will they need to remind the market of the other tools they have to combat a tariff induced slowdown?

- We look at where the euro can go next, and why EUR/JPY could be ripe for a recovery.

- Will Christine Lagarde stay at the ECB?

A theme is emerging as we move towards the final weeks of Q2, central banks are getting more dovish. ECB and Fed members’ speeches have become notably more dovish in recent weeks, while reports on Wednesday suggest that the Bank of Japan is considering slowing the pace of its bond tapering programme next year.

A dovish tilt for central banks will have big ramifications for financial markets, it could feed risk sentiment and keep equity markets elevated for the foreseeable, it could also play out in the FX market, with a race to the bottom for the major currencies.

ECB: Is the rate-cutting cycle nearing the end point?

For now, the ECB is winning the interest rate-cutting race. It is widely expected to cut rates by another 0.25% to 2% later today, which would be the 8th cut in a year and could see the main ECB interest rate fall to its lowest level since 2022. While other rate cuts are expected, we don’t think that the ECB has too much room to cut rates further, even though clear signs are emerging that the ECB no longer has an inflation problem.

Headline CPI retreated to 1.9% last month, and wage growth is slowing sharply. Unionized wage growth grew by 2.4% in Q1, down from a 4.1% growth rate in Q4 2024. This data sealed the deal on a rate cut for this month, and there is just over one further rate cut priced in by the market for the rest of 2025. There is a 54% chance of another cut in September. Once the ECB gets below 2% for interest rates, they will be in negative real interest rate territory. This could hinder euro strength, and it could also leave them without much ammunition If a trade agreement with the US does not lead to a large downward revision for tariffs.

Next steps for the ECB

The ECB will also release their latest staff economic forecasts later today. These are expected to show inflation hovering just below the 2% target rate for the medium term. If these forecasts show a larger deterioration in the inflation outlook, then the ECB could face a tricky scenario. With interest rates expected to fall to 2%, there is not much room for further cuts. This is a concern, since the damage from US trade tariffs may get worse from here. If the ECB sees a marked deterioration in the growth outlook for the currency bloc, then the only option it may have to boost demand is to reinstate some form of quantitative easing.

ECB follows Fed with focus on uncertainty

We do not think that QE will come up in the ECB statement at this month’s meeting. Firstly, the economy is stable, even if Germany is showing signs of weakness yet again. Secondly, the US and the EU are still negotiating a trade agreement, and we expect the ECB to reinforce the point that the currency bloc’s economic outlook is uncertain. For now, QE is not on the menu at the ECB, but it may be part of the toolkit if the economy deteriorates and the ECB runs out of room to cut interest rates further.

What is next for Christine Lagarde?

The elephant in the room in Frankfurt on Thursday will be EBC President Christine Lagarde’s future at the ECB. Although she has 2.5 years left in her role as President, recent reports suggest that she is lined up to take over at the World Economic Forum. Thus, the press conference could be dominated by questions about her future. We do not think that this will have a big impact on financial markets at this stage. Firstly, Lagarde is experienced at dealing with the press and she is unlikely to give them an inch when it comes to her future at the ECB. Secondly, even if Lagarde does leave the ECB, the other members are shifting towards a dovish consensus, so we do not think that it would signal a major shift in policy from the Bank. However, we think that Lagarde will want to stay on at the ECB, at least until the bulk of the tariff turmoil is over. Unless Lagarde surprises everyone and announces that she is considering leaving the ECB (unlikely, in our view), then we do not think this conversation will have much of an impact on the euro later today.

The Euro outlook

Since the start of May, the euro has been one of the weaker performers in the G10 FX space and has only risen vs. the USD, as you can see in chart 1. Interestingly, the euro has still managed to gain ground vs. the USD over the past month, even though European bond yields are lagging the US, and interest rate expectations remain low. EUR/USD still looks like it is in a strong uptrend, however, it could find resistance around $1.1550, the high from mid-April.

Chart 1: EUR vs the G10 currencies since the start of May 2025.

Source: XTB and Bloomberg

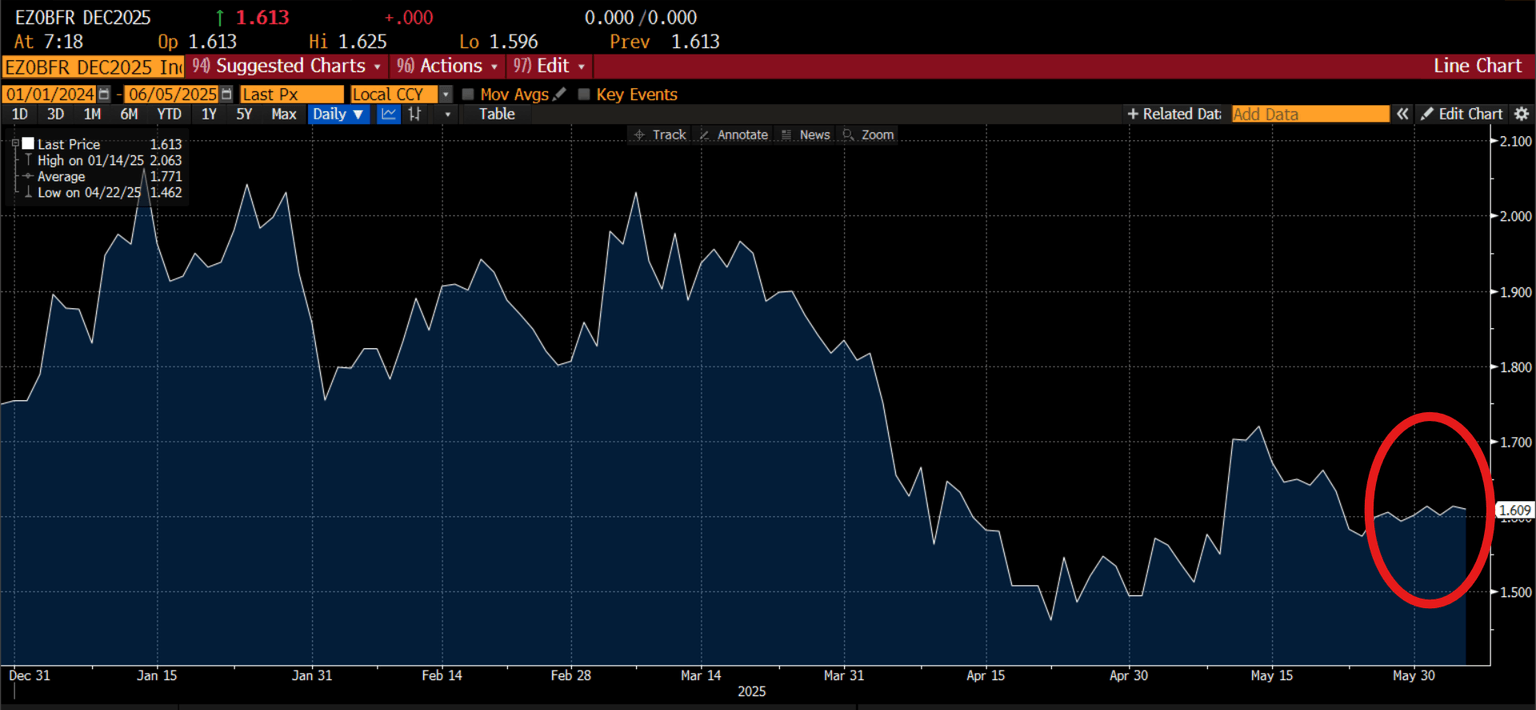

The USD is weak, which explains EUR/USD’s strength, however, the broad-based weakness against the rest of the G10 FX space can be attributed to persistent expectations for lower interest rates. The market is currently expecting interest rates in the euro area to end the year at 1.61%, which is close to the lowest levels of the year.

Chart 2: Market based interest rate expectations for the ECB for December 2025

Source: XTB and Bloomberg

A large downward revision to the ECB’s inflation forecasts could limit EUR/USD upside in the short term, and EUR/USD is lower this week. We also think that EUR/JPY could be worth a look. If the BOJ is going to slow its bond tapering programme, then this could help EUR/JPY to strengthen and potentially to break out of its recent range. 165.00 is decent resistance, while the 50-day sma at 162 is good support.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.