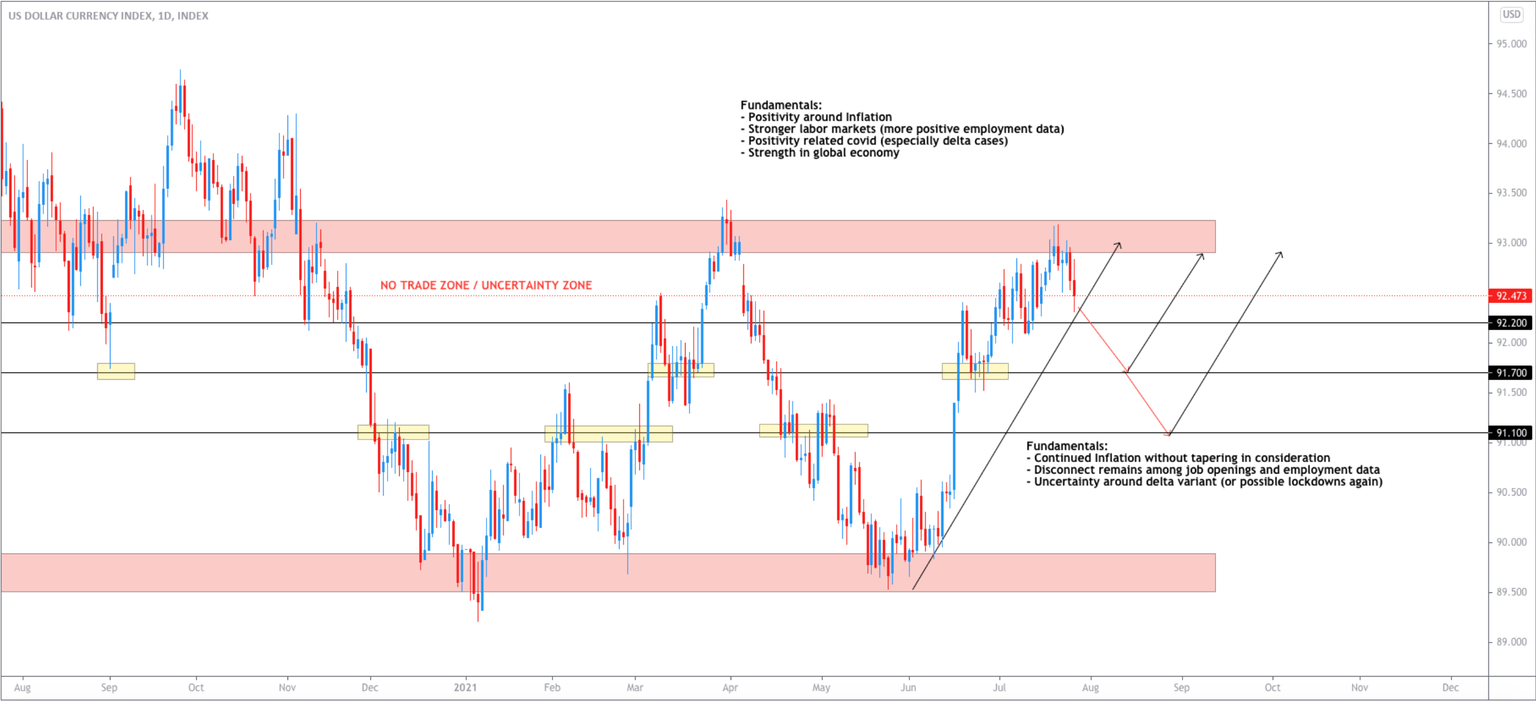

DXY fundamental and technical analysis and outlook

Fundamental Analysis:

In yesterday’s monetary policy statement, the FOMC maintained the interest rates and an accommodative policy as the employment data is improving, transitory inflation is expected to decrease as the supply bottleneck transitory effects decrease, and two new repo establishments are introduced as backstops for the markets in the domestic market and international market.

In the last few press conferences, Fed Chair Powell has stated that the Fed is not considering increasing interest rates until there is substantial progress. When asked about what ‘substantial progress’ entails by a reporter yesterday, Powell referred to the dual mandate of maximum employment and price stability. Substantial progress in maximum employment means consecutive strong employment numbers where there is a decrease of the disconnect between job openings and employees returning to work. The three reasons outlined by Powell for this disconnect are:

-

People are now searching for new job opportunities, which is a labor and time-intensive process.

-

Many people still feel vulnerable to COVID and the new variant; thus, they are holding back from returning to work, especially in public-facing sectors.

-

People are still enjoying the generous unemployment benefits, which will be retracted soon.

Throughout the monetary policy statement and the press conference, FOMC members and Fed Chair Powell maintained a positive sentiment as they emphasized the improvement in the employment data, COVID impacted sectors, and economic conditions. The major concern of investors, inflation, was also addressed in a positive manner. Powell stated the inflation is caused by the supply-side shock and is transitory which will resolve over time. The current inflation is above the 2% target of the central bank but is still in alignment with the longer-term goals.

Technical Analysis:

The US Dollar Currency Index (DXY) is ranging between a historically significant zone of $89.5-93. As seen in the monthly timeframe, the current zone is a liquidity zone after which strong momentum is evident. With the support of fundamentals, the dollar strength is determined at this key level. On the weekly timeframe, the DXY tapped into the strong resistance level of $93, rejected it, and flipped bearish after the press conference yesterday. The next levels to be cautious of are $92.2, $91.7, $91.1, and $89.5, along with fundamentals. The upcoming data related to PMI, employment data, and inflation data will be essential to find the direction of the US Dollar as the major investors wait on the sidelines to enter.

Author

Vrajeshwari Bhardwaj

SharmaFX

Vrajeshwari started SharmaFX in 2020. She holds a BA in Economics with a minor in Finance from San Jose State University. She is also pursuing an MS in Analytics with a concentration in International Economics and Markets from American University.