Dow Jones Bounces After Losing Record Highs

Dow Jones index futures bounce on Tuesday is driven by the rumor that both, the US and China, are close to signing the tariff agreement called "phase one."

Dow Jones advances 0.42% or 115 points, climbing to 27,620 points, the S&P 500 index advances 0.26%, reaching 3,102 points. In Europe, for its part, DAX amounts to 110 points or 0.84%, reaching 13,108 points.

The advancement of stock markets comes after an unidentified source was pointing out that the two largest economies in the world are getting close to reaching an agreement on the number of tariffs that would be reduced in the "phase one" trade agreement.

That source added that it is probable that the phase-one agreement would be signed before the US deadline to impose additional tariffs on China on December 15.

This agreement would occur despite tensions in Hong Kong and the statements made by President Trump at the beginning of this week.

Later, US President Donald Trump, when consulted at a press conference during the NATO meeting, said that "the talks with China are going very well."

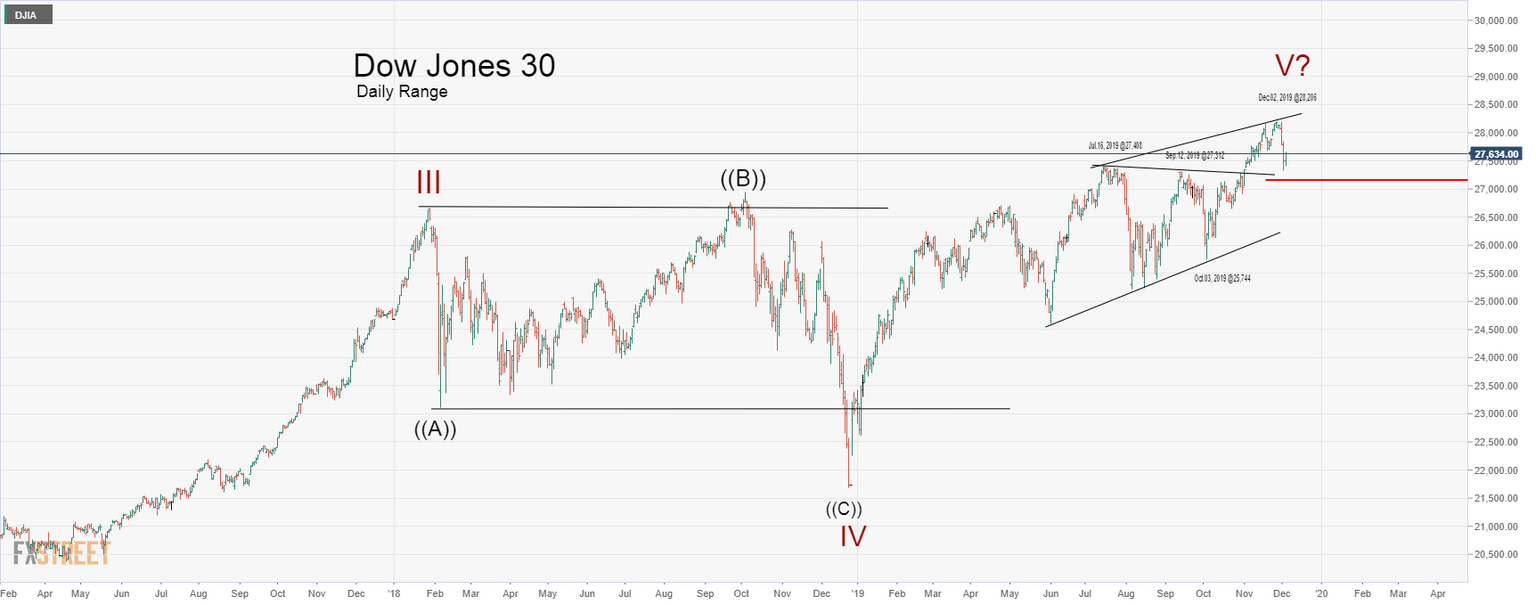

Technical overview

Dow Jones on his daily chart shows a bearish corrective move that has retraced in a first move more than 50 percent of the progress made in November. This Tuesday, Dow Jones found support in the area of the peak of September 12 to 27,324 points.

The drop and close below the last swing at 27,705 points, its latest bullish impulsive movement, suggests that we could see more declines in the main stock US index.

On the 4-hour chart, we can see how, on Tuesday, the Dow Jones index found support at the three tops of 27,357 points. On the other hand, on the RSI oscillator, it is observed how the price found support under the 20 level, which suggests that the price action should develop a bullish corrective movement. A movement that could drive the price to 27,700 points to look for more sellers.

In conclusion, the possibility of a trend change to the downside increases despite the possibility of an agreement between the two largest world economies.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and