Dow Jones Analysis - Are We in an Irrational Euphoria?

Disney launched its Disney + streaming service on Tuesday despite experiencing some technical difficulties. Disney reported that its streaming service already has 10 million subscribers as of Tuesday.

Following this announcement, Disney shares (NYSE: DIS) climbed 7.35% on Wednesday. Netflix (NYSE: NFLX) shares tripped 3.1%. The advance of DIS prompted the Dow Jones index to close with an increase of 0.33%

Despite the technical errors, more than 10 million subscriptions were registered, who can enjoy a free trial period for seven days. After the trial period, the subscription costs $ 6.99 per month, while Netflix charges $ 12.99 for its most popular plan.

Although it is still too early to compare Disney + leadership on the leader, Netflix, we will have to wait if the total subscriptions registered on the first day become permanent subscriptions.

Technical Overview

-637093445105650239.png&w=1536&q=95)

The structure watched on the chart could correspond to a fifth wave of Cycle degree incomplete. If it is correct, according to the Elliott wave theory, the price could make a bullish move in five waves.

The next chart corresponds to the Average in an 8-hour range. From its timeframe, Dow Jones continues in a bullish sequence that looks incomplete.

-637093446118168478.png&w=1536&q=95)

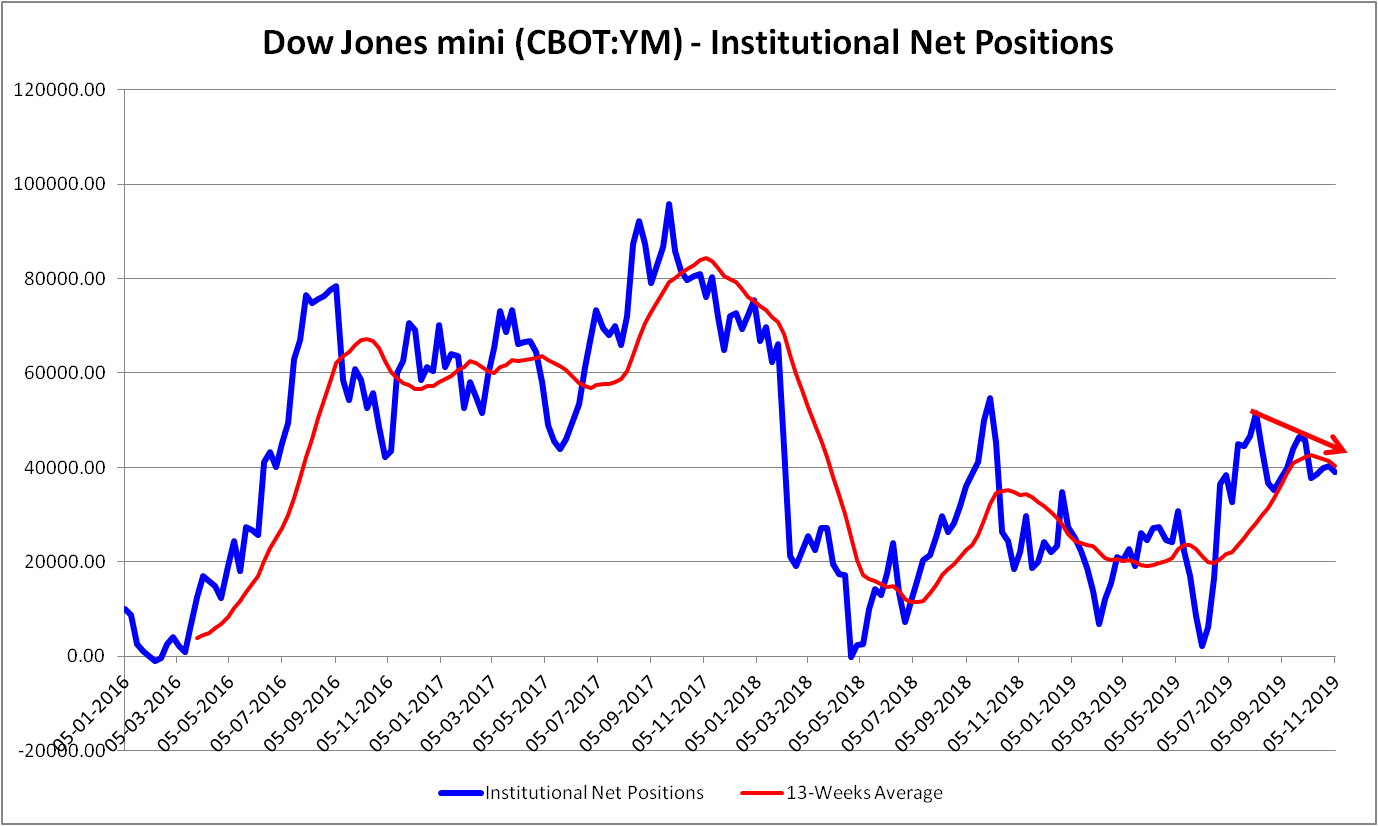

The reading observed from the latest CFTC report exposes that the bullish bias remains.

Institutional traders reported a modest increase by 0.66% (WoW)on their long positions. On the bear-side, speculative positioning jumped to 13.78% (WoW).

With this increase, institutional traders on the sell-side boosted their short positioning to 18.69% from 16.63% informed on the previous release.

Concerning to the Institutional Net Positioning, traders of the Dow Jones mini futures reported a decrease till 39,087 contracts from 40,353 reported in the previous week.

In summary, both the price action as the Commitment of Traders report, reveals that the bullish bias remains. However, it is essential to take into consideration that Dow Jones, in its big-picture, shows exhaustion signals, and it is likely a reversal move soon.

Try Secure Leveraged Trading with EagleFX!

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and