Dollar weakens after CPI and claims miss: Gold extends gains

Macro background

The U.S. inflation release for August showed headline CPI at 0.4% m/m (above the 0.3% forecast), while core CPI matched expectations at 0.3% m/m. On a yearly basis, CPI rose 2.9% y/y, slightly above consensus.

However, the surprise came from the labor side. Unemployment claims jumped to 263K, well above the 235K forecast, reinforcing the picture of a cooling jobs market after the weak Nonfarm Payrolls last week.

In fact, this mix, sticky inflation but soft labor data, leaves the Fed in a difficult position: inflation is not yet fully under control, but growth cracks are widening.

Market reaction

In essence:

-

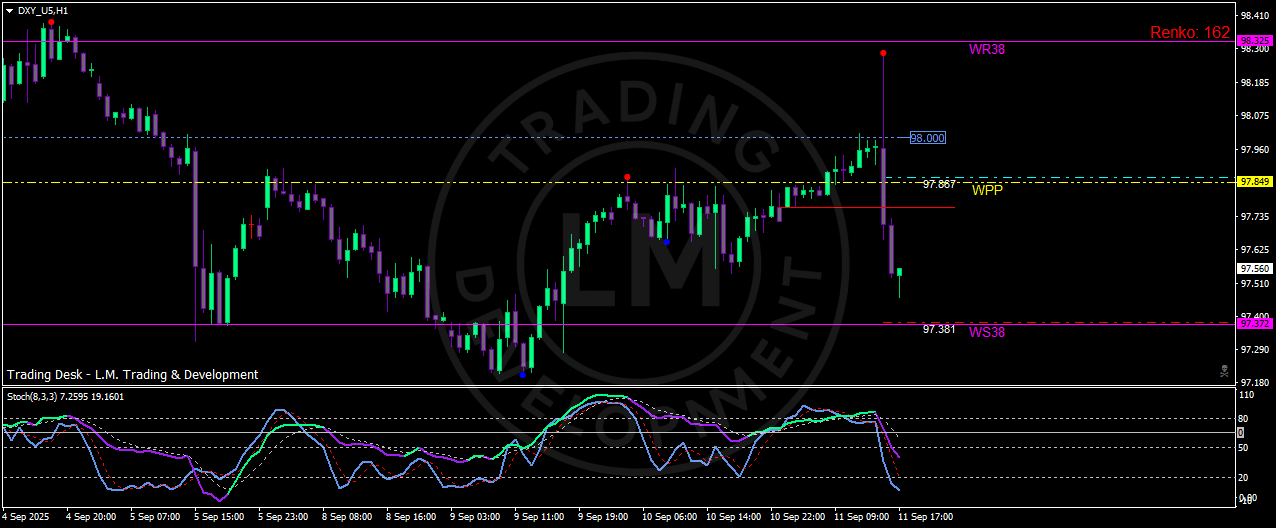

Dollar Index (DXY) initially spiked to test the 98,00 level on the CPI surprise but quickly reversed lower as jobless claims underscored weakness in employment. The index dropped back under the weekly pivot at 97,85, with downside momentum accelerating toward support at 97,56.

-

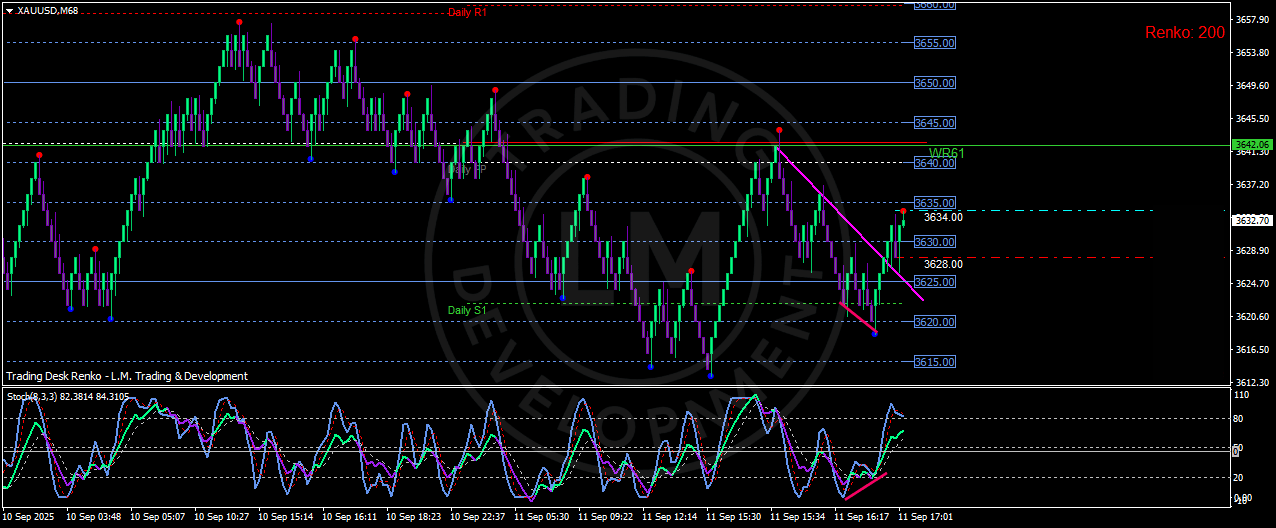

Gold (XAUUSD) took advantage of the softer dollar. After holding firm above the 3620–25 support zone, the metal extended gains to challenge the 3635–3640 resistance area. On the chart, the move coincided with a bullish divergence on the stochastic oscillator, reinforcing the breakout’s credibility.

-

U.S. Treasury yields and equities: initially jumped but then fell back as rate-cut expectations dominated. The 2-year yield erased early gains, reflecting doubts that inflation alone could prevent the Fed from easing. Equities also stabilized, as traders bet the Fed would prioritize growth risks over sticky inflation.

Policy angle

For the Fed, the policy dilemma is intensifying:

-

Inflation data argues against rushing into aggressive cuts.

-

Labor market weakness, however, points to urgent easing.

Traders see at least a 25bp cut as baseline in September, while a 50bp move is increasingly debated if incoming labor data continues to deteriorate. CME FedWatch now shows over 70% odds of a quarter-point cut, with nearly 30% probability for a half-point move.

Technical Levels:

-

DXY

-

Resistance: 98.00, WR38 at 98,32.

-

Support: 97,56, then 97,38 (WS38).

-

-

Gold (XAUUSD)

-

Support: 3620–25, then 3615 (Daily S1).

-

Resistance: 3635, then 3640–42 (WR61).

-

Bias: bullish above 3625; momentum favors a retest of 3645–50.

-

What traders should watch

The key isn’t just today’s mixed data but how markets are splitting by asset class. Gold is proving more responsive to shifts in Fed expectations than oil or equities, underlining its role as a clean hedge when the dollar weakens.

For intraday traders, the 3625 level remains the key dividing line: holding above keeps the bullish bias intact, while slipping below makes the long setup much more fragile.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.