Dollar struggles near three-year lows ahead of FOMC: What It means for the majors

- Dollar hovers around 98 after a three-year trough; bearish bias intact below 98.50.

- May CPI’s subdued 2.4 % YoY print keeps real yields capped, reinforcing expectations that the Fed will hold rates again on 18 June.

- The dollar’s safe-haven bounce during last week’s Israel-Iran flare-up was muted, underscoring waning demand for USD protection.

The greenback spent most of last week on the ropes, battered by a series of data points that painted a softer-than-expected picture of the U.S. economy just days before the Fed’s June 18 meeting.

Friday’s Middle-East flare-up briefly revived haven buying after Israel struck Iranian nuclear and missile sites, but the bounce was fleeting as investors turned to gold and Treasuries instead of the greenback.

Unless the Fed pushes back hard against the easing narrative, last week’s data suggest the path of least resistance for the dollar remains lower.

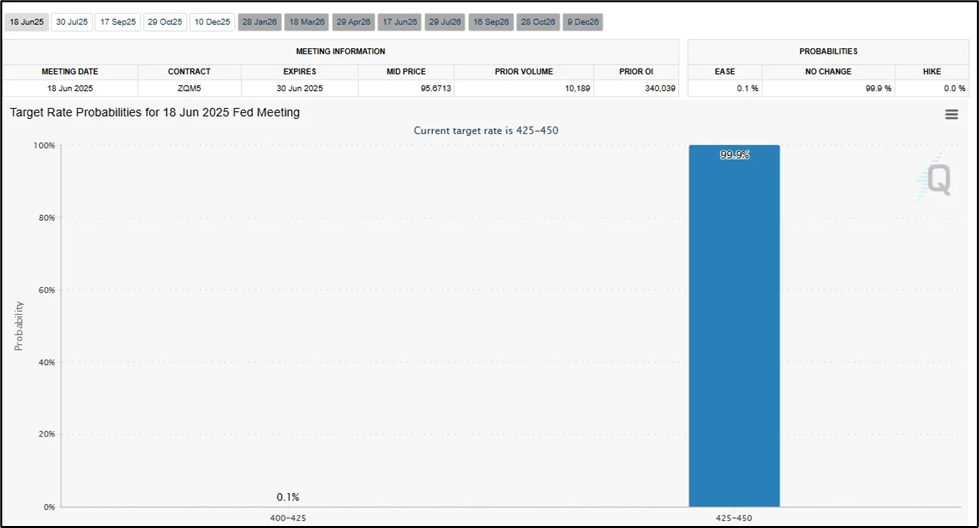

FOMC - Rate hold priced-in

With the Federal Reserve already pricing in a rate hold for this week’s Fed Rate Decision, dollar is now poised for another run for a downside continuation unless the Fed hints a prolonged pause or inflation risk stays a little longer.

This could shift if:

- The tone of the FOMC shifts from dovish to hawkish.

- Powell’s press conference language.

Overall, we will still be, like the Fed, be data-dependent.

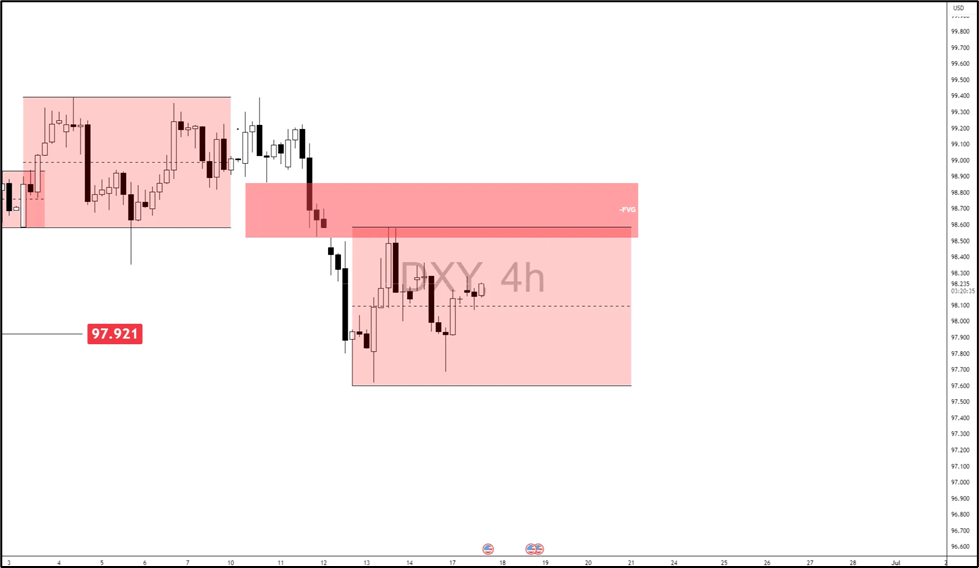

Technical outlook

As the dollar hovers around the 3-year all-time low, we are waiting for a catalyst whether the dollar would gain traction and go for a potential reversal, perhaps sparked by a hawkish twist in Wednesday’s FOMC guidance, a hotter-than-expected inflation release later in the month, or an abrupt burst of global risk aversion that restores the dollar’s safe-haven shine. Or a continuation is already impending, with new lows on the horizon as a stack of softer data and dovish central-bank rhetoric that keeps rate-cut expectations alive, bleeding carry appeal from the greenback and making every rally attempt look like a selling opportunity.

Until one of these storylines decisively wins out, the market will keep probing for fresh lows, treating any bounce as suspect and bracing for the possibility that the dollar’s three-year downtrend still has room to run.

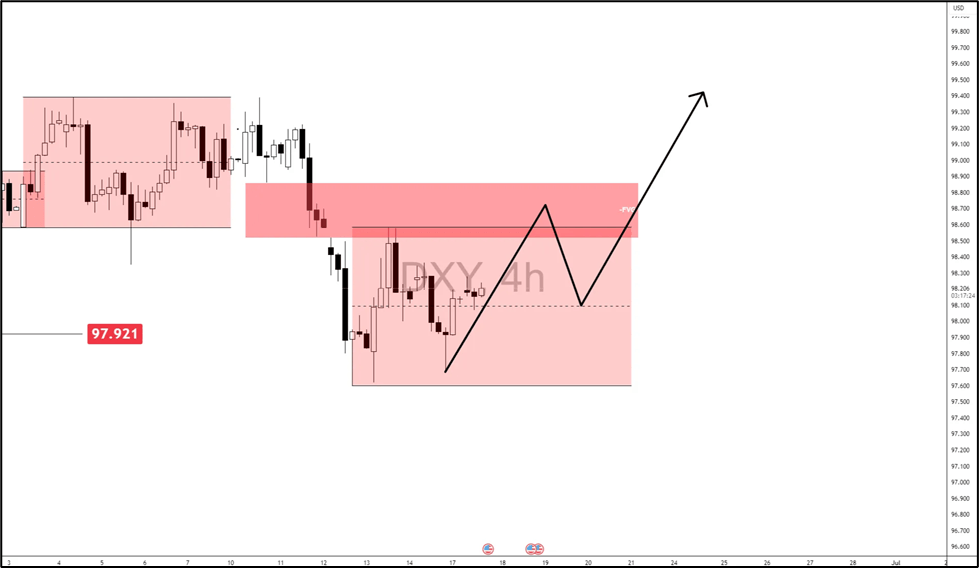

Bullish scenario: Break of range – Bearish FVG invalidation

A hawkish-leaning FOMC (dot-plot shows only one cut in 2025, balance-sheet run-off continues) or a risk-off shock (e.g., another Middle-East flare-up that spills into oil and equities) sparks short-covering.

- Dollar trades above the equilibrium.

- Breakout of the range.

- Invalidation of the 4-hour FVG resting at 98.519 - 98.862.

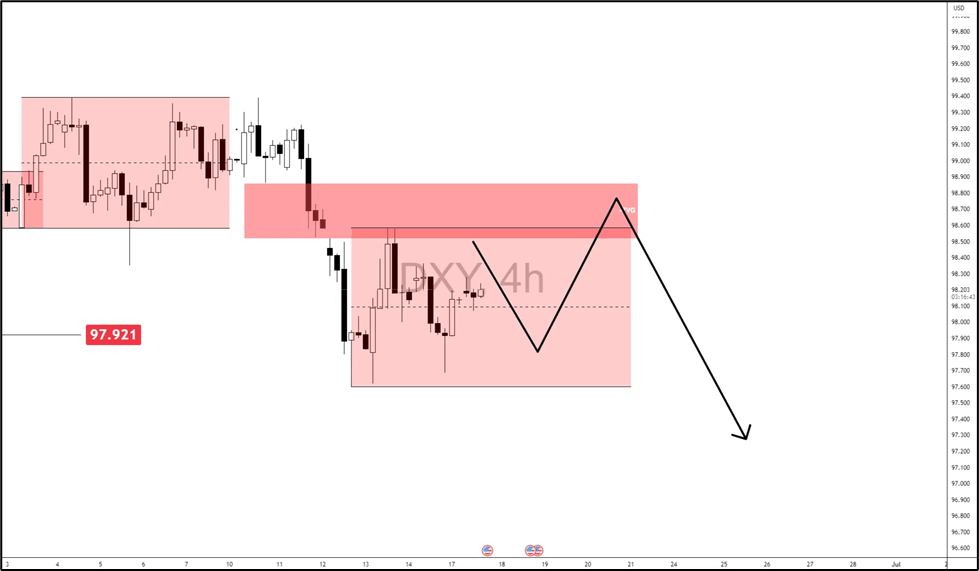

Bearish scenario: Resistance – bearish FVG holds

The Fed confirms a September cut and signals balance-sheet tapering could slow; soft NFP/ISM data reinforce growth concerns. Risk sentiment stays firm, so the dollar loses its haven bid.

- 4-Hour FVG Resistance 98.519 - 98.862.

- Range resistance holds.

- Break below equilibrium.

Impact on the Majors if Each Scenario Plays Out.

Bullish Scenario: Foreign pairs falls out with Dollar strength.

Bearish Scenario: Dollar takes a downside continuation, giving foreign pairs a lift.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.