Dollar strengthens on Fed outlook

The Dollar index has traded steadily at around the $105 level as the market anticipates further monetary tightening by the Federal Reserve.

The Dollar index has traded steadily at around the $105 level as the market anticipates further monetary tightening by the Federal Reserve. Short-term U.S. bond yields have surged past 5%, while downward pressure faced by Wall Street amid the Fed's hawkish stance. On the contrary, the Japanese yen remains weak as speculators challenge the Japanese authorities' tolerance for a declining yen. Strategists suggest that the Bank of Japan (BoJ) may not intervene until the yen weakens to the 150 mark against the USD. Meanwhile, oil prices continue their steady climb, defying the strengthened dollar. The API's weekly crude oil report indicates an optimistic oil demand scenario in the U.S., with a larger-than-expected decline in oil stockpiles.

Market Movements

Dollar Index

The US dollar has made a resounding comeback, reaching a six-month peak, thanks to a backdrop of positive economic data. What's driving this surge is the remarkable performance in the services sector, marked by a surge in new orders and businesses paying higher prices. This surge suggests that inflationary pressures are persisting, and the US economy is showing its resilience. The Institute for Supply Management (ISM) has delivered a positive surprise by reporting a significant uptick in the US ISM Non-Manufacturing Purchasing Managers Index (PMI). It surged from 52.7 to 54.5, exceeding market expectations pegged at 52.5.

The dollar index extended its gains following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 105.25, 106.25.

Support level: 104.25, 103.05.

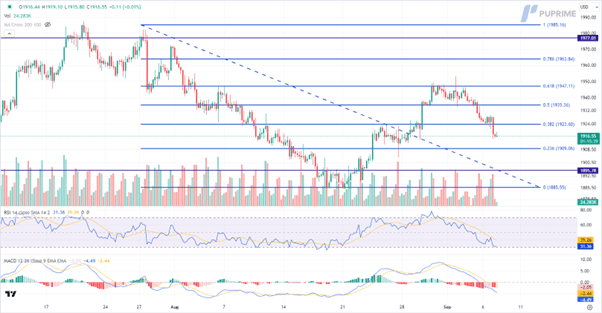

XAU/USD

Gold is grappling with extended losses, primarily in response to better-than-expected ISM non-manufacturing data. Investors remain on the edge, eagerly anticipating more insights from the Federal Reserve, particularly from several upcoming monetary policy committee speeches. These speeches are poised to provide crucial clues on the central bank's decision-making, shaping the outlook for gold and other assets in the near term.

Gold prices are trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the commodity might enter oversold territory.

Resistance level: 1925.00, 1935.00.

Support level: 1910.00, 1895.80.

EUR/USD

The euro has experienced some relief from its recent sluggish performance, just ahead of the critical release of eurozone GDP data today. The euro managed to maintain its position around 1.0700 against the strengthening dollar yesterday, with hopes that the GDP figures would surpass expectations, providing support for the ECB's hawkish policy stance.

The EUR/USD has eased from its bearish trend and consolidated at above 1.0700. The MACD is about to cross at the bottom while the RSI has climbed out of the oversold zone, suggesting a potential trend reversal for the pair.

Resistance level: 1.0760,1.0850.

Support level: 1.0700, 1.0640.

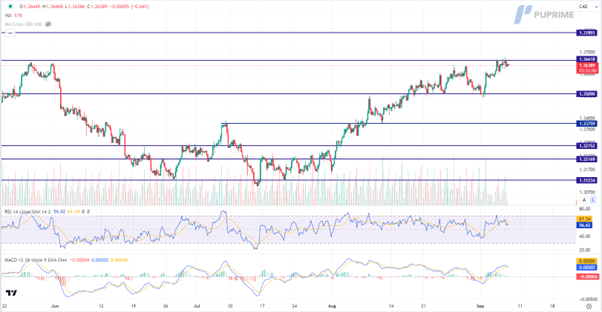

USD/CAD

The Canadian dollar continues to exhibit bearish tendencies following a dovish statement from the monetary policy committee (MPC) of the Bank of Canada. The BOC has opted to maintain benchmark interest rates at 5%, signalling concerns about weaker economic growth and persistent inflationary pressures.

USD/CAD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the pair might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 1.3660, 1.3790.

Support level: 1.3510, 1.3375.

USD/JPY

The Japanese yen is on the rise, bolstered by increasing expectations of yen-intervention measures. Japan's top currency diplomat, Masato Kanda, has issued a stern warning against speculative moves in the currency markets. This is the most severe warning seen since mid-August, signalling the Japanese government's readiness to take action to protect its currency's value.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the pair might extend its gains toward resistance level.

Resistance level: 148.25, 149.30.

Support level:147.20, 146.20.

Nasdaq

The Nasdaq Composite Index has experienced a noticeable decline, primarily dragged down by a significant drop in Apple Inc.'s stock, which tumbled by more than 3%. This decline comes in the wake of reports that China, a key market for Apple, has instructed government agencies not to use foreign devices, including iPhones. This directive, driven by national security concerns, raises the spectre of heightened trade tensions between the United States and China, dampening overall risk appetite in the global financial markets.

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains toward resistance level.

Resistance level: 15935.00, 16580.00.

Support level: 14610.00, 13660.00.

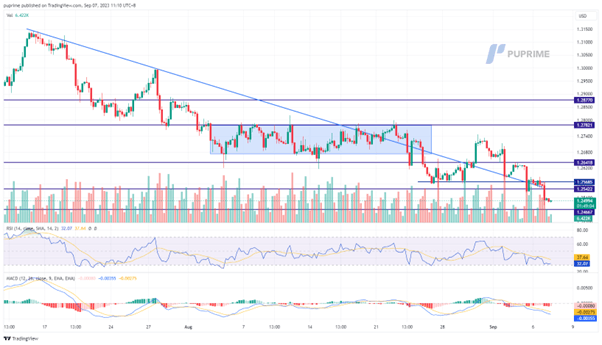

GBP/USD

The British pound (GBP) continues to exhibit a bearish trend against the US dollar (USD), facing ongoing downward pressure. The dollar's recent strength, as seen with the dollar index reaching $105, has weighed on the pound. Investor concerns regarding the lacklustre UK economy, coupled with the recent bankruptcy declaration by Birmingham City Council, have eroded confidence in the pound, leading to selling pressure.

The Sterling traded at its lowest since June and has failed to defend its psychological support level at 1.2500, suggesting the bearish momentum is strong. The RSI is approaching the oversold zone while the MACD continues to move lower, suggesting the bearish bias for the Cable.

Resistance level: 1.2570, 1.2650.

Support level: 1.2460, 1.3900.

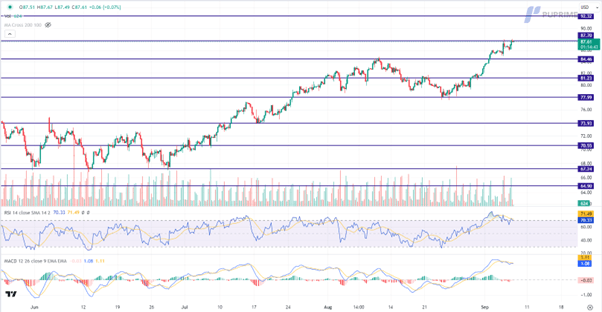

CL Oil

The oil market maintains its robust stance, firmly rooted in the wake of substantial supply reductions orchestrated by Saudi Arabia and Russia. Saudi Arabia's decisive 1 million barrels per day (bpd) cut, combined with Russia's contribution of a 300,000-bpd reduction, has sent ripples through the market. As investors closely scrutinise this intricate dance of supply dynamics, their attention now pivots to the eagerly awaited crude oil inventories data, slated for a potential release later today.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 87.70, 92.30.

Support level: 84.45, 81.25.

Author

PU Prime team

PU Prime

PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX, Commodities, Indices, Share CFDs and Bonds.