Dollar rises further on hot US inflation

The dollar accelerated higher after US inflation data on Friday and hit the highest in three weeks.

Much hotter than expected inflation fueled expectations for more aggressive Fed in coming meetings, although the central bank already showed its hawkish stance and readiness to use all available tolls to bring soaring prices under control.

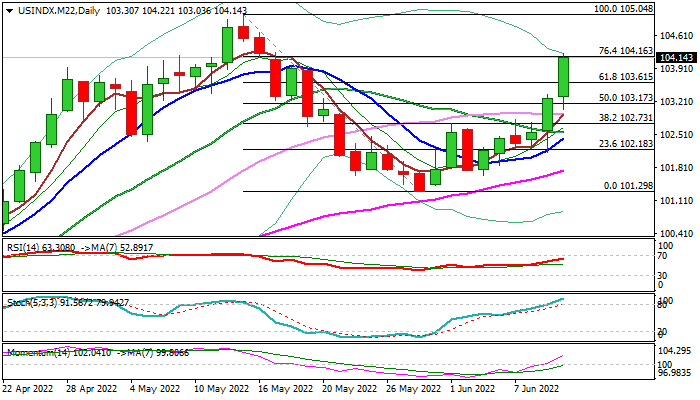

From the technical point of view the picture remains firmly bullish, as today’s rally surged through key Fibo resistance at 103.61 (61.8% of 105.04/101.29 bear-leg) and also cracked the next level at 104.16 (Fibo 76.4%), 14-momentum is in stee=p ascend in the positive territory and rising thick daily cloud continues to underpin the action.

Also, the index is on track for strong weekly gains (around 2%) and completed reversal pattern on weekly chart, signaling that 105.04/101.29 corrective pullback is likely over.

Short-term outlook remains bright for the greenback, as inflation is expected to remain red-hot for some time (until Fed’s measures start to give results) and geopolitical uncertainty over the Ukraine crisis will continue to boost demand for safe-haven dollar.

Overbought conditions suggest bulls would face headwinds on approach to key barrier at 105.04 (2022 high) with limited dips to offer better buying opportunities.

Res: 104.68; 105.04; 105.93; 106.48

Sup: 103.92; 103.61; 103.17; 102.94

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.