Dollar Index outlook: Bulls may take a breather after cracking key barriers

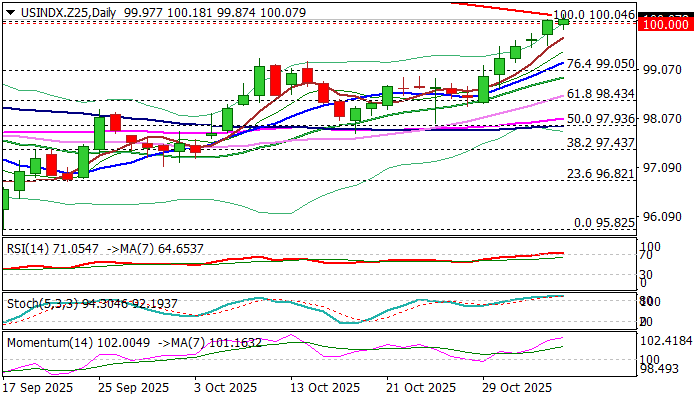

Dollar Index

The Dollar index keeps firm tone and riding on the fresh wave of risk aversion, to crack psychological 100 barrier (also former top of Aug 1) and nearby falling 200DMA (100.15) on Wednesday.

The recent more hawkish than expected remarks from Fed chief Powell faded high expectations for another rate cot in December and boosted the greenback.

Absence of key labor data for the second consecutive month, due to US government closure, added to Fed’s argument about more cautious approach to monetary policy that cooled market bets for December rate cut from 92% to 75%.

The only available report – ADP private sector payrolls, showed better than expected results in October, bringing a dash of optimism about the condition of the US labor sector that would also contribute to current lowered expectations for December policy meeting.

Sustained break of these barriers would generate fresh bullish signal and further strengthen firm bullish structure on daily chart, however, overbought conditions warn that bulls may face headwinds at this zone and pause for consolidation / limited correction.

Potential dips should find footstep above supports at 99.30/20 zone (former top / 10DMA) to keep bulls intact and offer better levels to re-enter bullish market.

Res: 100.18; 100.40; 100.74; 101.10.

Sup: 99.87; 99.53 99.20; 99.05.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.