Dollar Index outlook: Bears accelerate after Fed, on track for third consecutive weekly loss

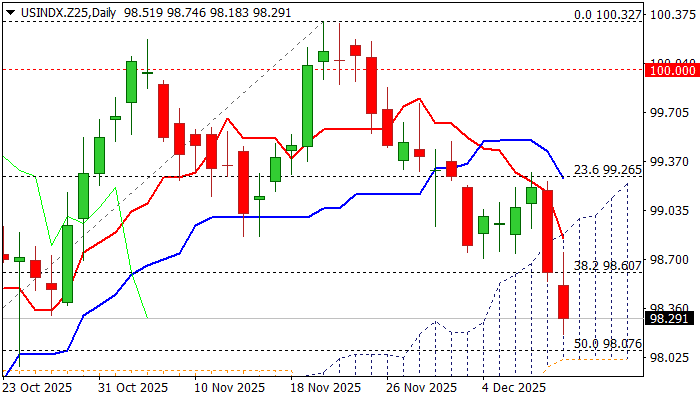

Dollar Index

The Dollar Index extends steep-post-Fed fall into second straight day, hitting the lowest in six weeks on Thursday.

Fed’s 25 basis points rate cut and relatively dovish Chair Powell’s comments deflated the dollar across the board, with 0.85% drop in past 24 hours, contributing to broader weakness and keeping the index on track for the third consecutive weekly loss.

Fresh acceleration lower penetrated into ascending and thickening daily Ichimoku cloud and broke below Fibo 38.2% of 95.82/100.32 rally, bringing in focus key supports at 98.07/01 (50% retracement/cloud base.

Violation of 98.00 zone would generate fresh bearish signal for extension towards 97.54 (Fibo 61.8%) and 97.10 (Oct 1 higher low).

Meanwhile, increased headwinds at cloud base should be anticipated, with consolidation / limited correction to be ideally capped by broken Fibo 38.2% (98.60) and limited upticks to stall under cloud top (98.87) to keep bears in play and offer better levels to re-enter bearish market.

Firmly bearish daily studies support scenario.

Res: 98.60; 98.87; 99.00; 99.30.

Sup: 98.01; 97.76; 97.54; 97.10.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.