Dollar correctness

It is finally here, the death of the U.S. dollar! I mean, just look at it fall! Dollar bears have been calling for the demise of the U.S. dollar for a long time, to no avail. They called for the dollar’s demise when the Fed starting “printing” money after the Great Recession of 2008. The dollar rallied. They called for its demise after the introduction of the PetroYuan in 2018. The dollar rallied. Now, here we are in 2020 with the dollar bears once again calling for its demise on the back of the Fed’s “unlimited QE”. Why will this time be any different?

Let’s take a look at the DXY (U.S. Dollar Index) which is the measure of the dollar against a basket of 6 major currencies (with the Euro making up about 58% of the basket). The chart below shows where DXY currently sits, about 93.00 upon time of writing. Since the dollar’s spike back in March, it has sold off roughly 10%. The dollar bears have been out in full force calling this the beginning of the end for the Global Reserve Currency as we know it. But, let’s take a closer look. As we know, the DXY is heavily weighted in the euro. That makes the inverse relationship between the euro and the USD quite strong. This correlation rarely breaks down. Put another way, euro strength = dollar weakness and vice versa. As you can see (below) the euro has been very strong against the dollar, up over 11% since the March lows.

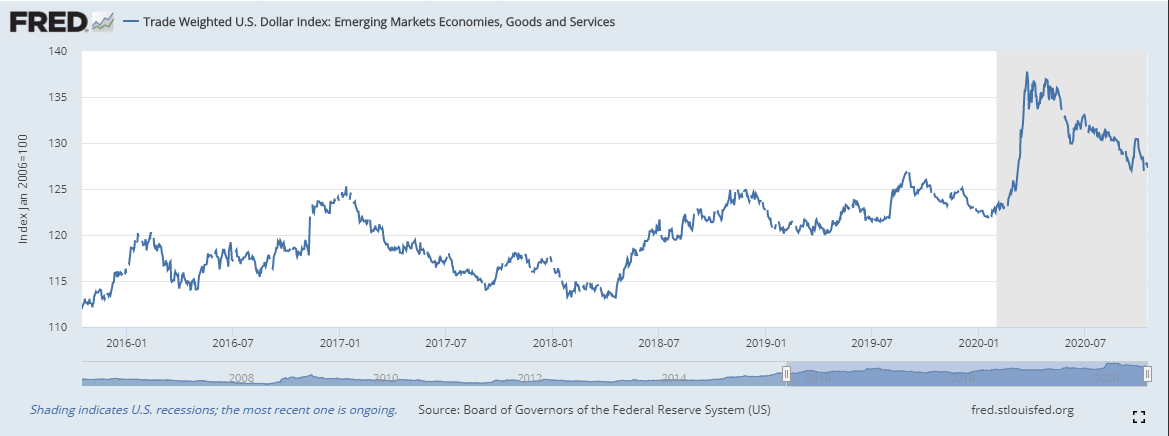

However, if we are to take a look at the Trade Weighted U.S. Dollar Index (below), which calculates the purchasing power of the U.S. dollar against 26 trading partners, as opposed to the DXY which only measures the dollar against 6 major currencies (with a majority weighting in the euro) you can see that it has held up much better since its highs in March. The DXY has broken well below where it spiked up from in March, whereas the trade weighted dollar has not. Given the difference in calculations between these two dollar indexes, the trade weighted dollar appears to be the more reliable of the two. Hardly the selloff many are making it out to be.

What does the dollar mean for the global economy? Typically, the global economy has seen stronger periods of growth when the dollar depreciates and slower periods of growth when the dollar appreciates (as seen below). As the largest consumption nation, the U.S. benefits from a strong dollar because it makes imports much cheaper. But, for the rest of the world, especially EM (emerging markets) economies, a strong dollar causes problems. A strong dollar makes servicing dollar-denominated debt much more difficult. EM economies tend to borrow in dollars more than developed nations do, however, their assets are usually denominated in their local currency. This creates issues when EM nations need to service their dollar-denominated debts as their weaker currency must be converted into dollars to do so. In a crunch, developed nations that own U.S. assets can sell them to obtain the dollars they need, whereas the EM nations do not have such flexibility.

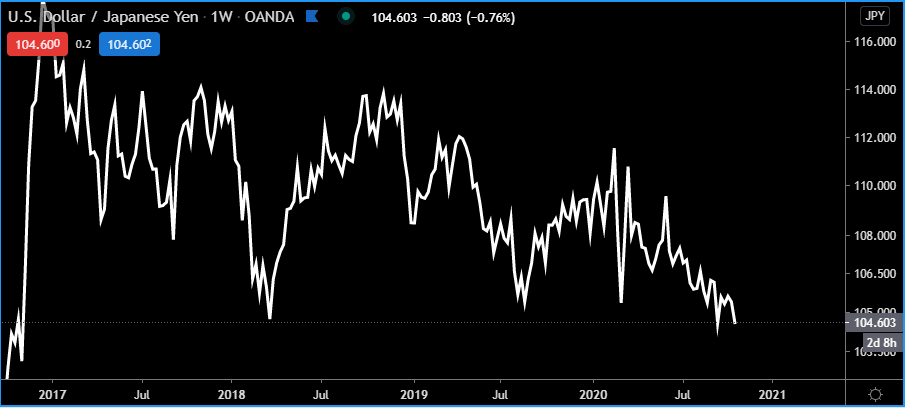

Now, let’s take a look at the trade weighted U.S. dollar against EM economies. As you can see (below), the dollar has held up much better against emerging markets, post-pandemic, than it has against developed nations. And both trade weighted dollar indexes have held up much better than the DXY, or should I say euro. We can even look (below) at the Japanese Yen which holds the second largest weighting of the DXY, with close to 14%. Since March, the dollar has fallen roughly 6% against the yen. Between the euro and the yen, that makes up approximately 72% of the DXY, yet people are seeing the fall in the DXY as the dollar’s death and not what it really is, euro and yen strength.

Euro and yen strength – does that sound fishy? Or rather, contradictory? Euro strength means dollar weakness and dollar weakness (should) mean growth, or in this case recovery, from the recession. If you were to put the euro side-by-side with the S&P 500, you would see a positive correlation. At the same time though, we have yen strength. The yen is a classic “safe haven” asset that generally rises in times of economic stress and uncertainty and falls during times of economic prosperity and confidence. Why would the euro and yen be rising at the same time? Perhaps the market doesn’t really believe in this post-pandemic “recovery”. Is there any other evidence out there suggesting that the euro is overpriced and that the recovery isn’t happening like the euro and U.S. stock market seem to convey?

If we look at gold (below), we can see that it broke out of its consolidation back in June 2019 and has been on an upward trajectory ever since. Gold has historically been a safe haven and a store of wealth. Recently (post 2008 recession), it has also been a hedge against failed monetary policy. Gold, similar to the dollar and the yen, generally rises during times of economic stress. Since the selloff in March, gold has been one of the best performing assets, right alongside equities.

U.S. treasuries are one of the deepest, most liquid markets in the world. In times of uncertainty, money flows to safe, liquid assets like US treasuries. If we just take a look (below) at the 10 year note and 10 year yield we can clearly see how well it is has performed since October of 2018. The bond market had been screaming something was wrong in the economy since October 2018, preceding the March selloff by almost a year and a half. Since March, we can see the 10 year note made new highs and has stayed bid, despite this economic “recovery” we are supposed to be experiencing. Sure, you could argue it’s because the Fed has been purchasing government bonds in the open market via QE. But, the bond market was giving off recession signals well before the Fed decided to started expanding their balance sheet again towards the end of 2019. Also, since about July 1st of this year, the Fed has been almost non-existent in their purchases of US treasuries, yet capital continues to flow into the safe, liquid asset. If history is any indication of the accuracy of the bond market in predicting where the economy is heading, then we are in for a rocky road ahead.

To wrap up, the dollar’s “weakness” has been driven on the strength of the euro and the yen more than anything else. Despite the new all time highs in the S&P 500 and Nasdaq, capital continues to flow into safe, liquid assets: U.S. treasuries, gold, and the yen. Seems like equities have gotten way ahead of themselves (again). Recent economic data is also showing that the recovery has not only slowed, but is failing, right in line with the strength of the safe, liquid assets. What does all of this mean? We are not out of the woods yet, not even close actually. It just a matter of time before we see more household and business insolvencies, exposing the true conditions of our economy, post-pandemic. When that happens we will see another selloff in risk assets accompanied by a dollar spike. Equities and the euro are due for a correction. We could see equities correct 20-30% and if things get really bad maybe even retest the lows last seen in March. As for the EURUSD, we could see a move back to the level that created this big upside move, which is around 1.10. In the short-term we could see more downside in the dollar but over the medium-term, the inevitable will happen. Sorry dollar bears, there is more pain to come.

Author

Ryan Miller

Ryan Miller Trading Economics

Ryan Miller received a Bachelors Degree in History from William Paterson University. Through his studies of U.S. history, he developed an interest in the implications the financial markets have on the economy.