DAX: Confirming the consolidation mode

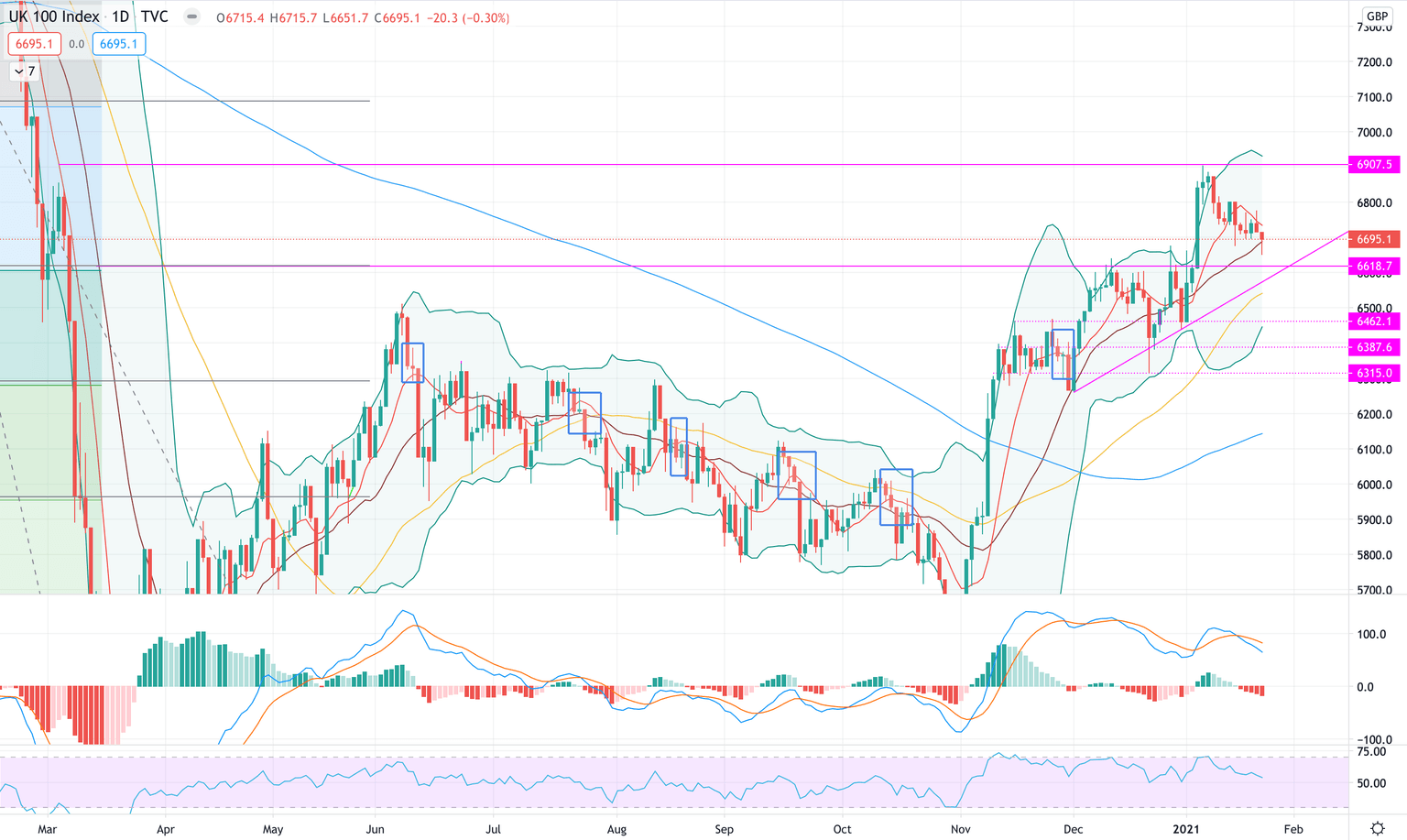

FTSE 100 (#UKX)

The #UKX had a negative week closing slightly in the red: the sentiment is negative as the news around vaccine and further restrictions, do not make the future much brighter at present.

From a technical perspective, on Friday the #FTSE touched the high of 29th December 2020 and then bounced back finishing with a hammer candle the week.

We can notice how since the top of 6,907 the Index has entered in a bearish direction, until such trendline is not broken, the direction is to the downside.

The MACD and RSI are both pointing to the downside, signalling that there is still room to go.

With the index closing below the 9MA, we might expect for the coming week a push to the upside till 6,770 to then continue to fall further: once the level of 6,620 is touched we might re-consider the overall direction.

We confirm Support at 6,618 and resistance at 6,907.

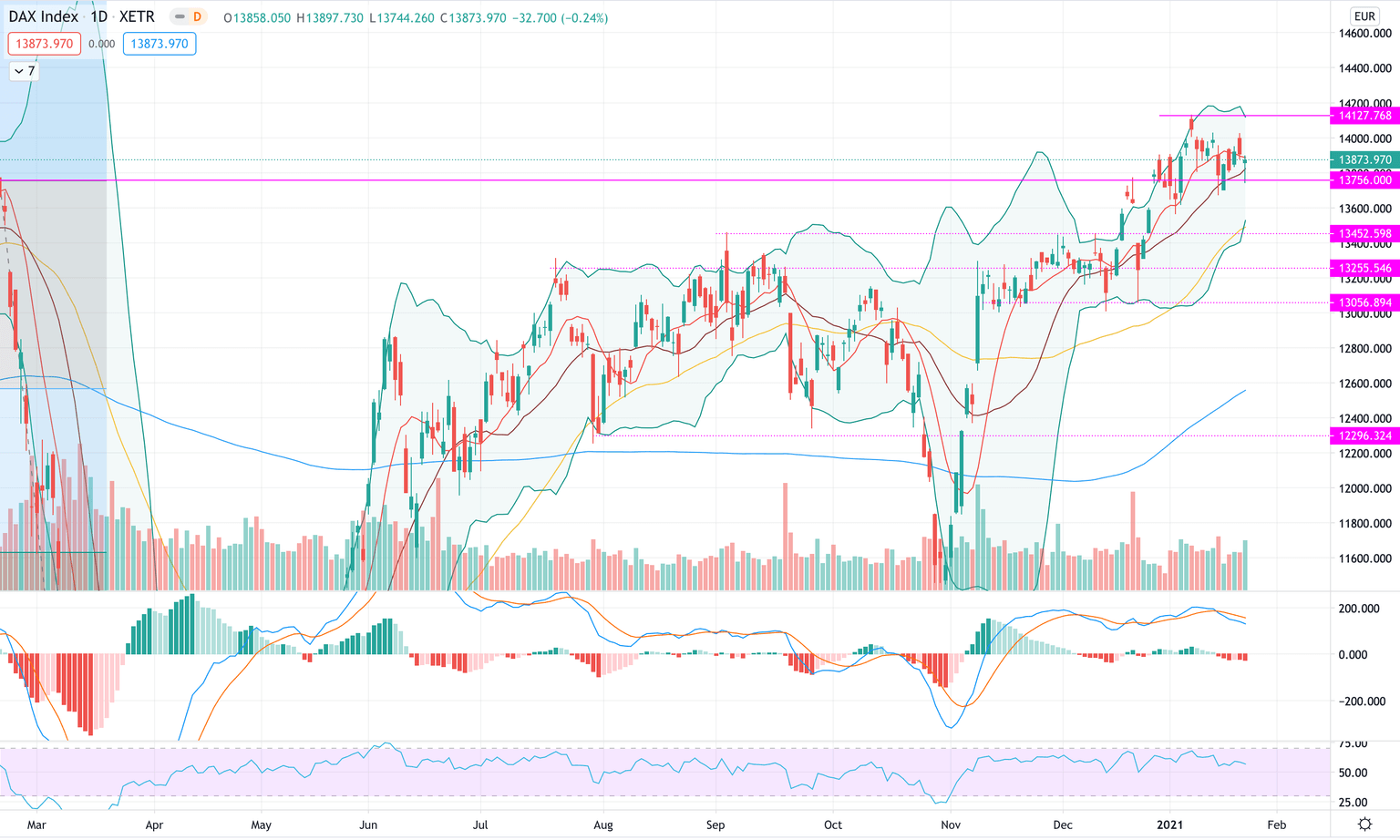

DAX (#DAX)

The #DAX managed to have some gains during the week and closed slightly above, however from a technical perspective we see how the Index has been moving sideways.

The German index is still between current support and 9MA, confirming the consolidation mode: on Friday, the #DAX touched the support and moved back.

Given the MACD and RSI that are both pointing to the downside with no particular sign of recovery, we expect for the coming week the index to continue to move sideways and eventually break the support at 13,756.

At present, we confirm support at 13,756 and resistance at 14,217.

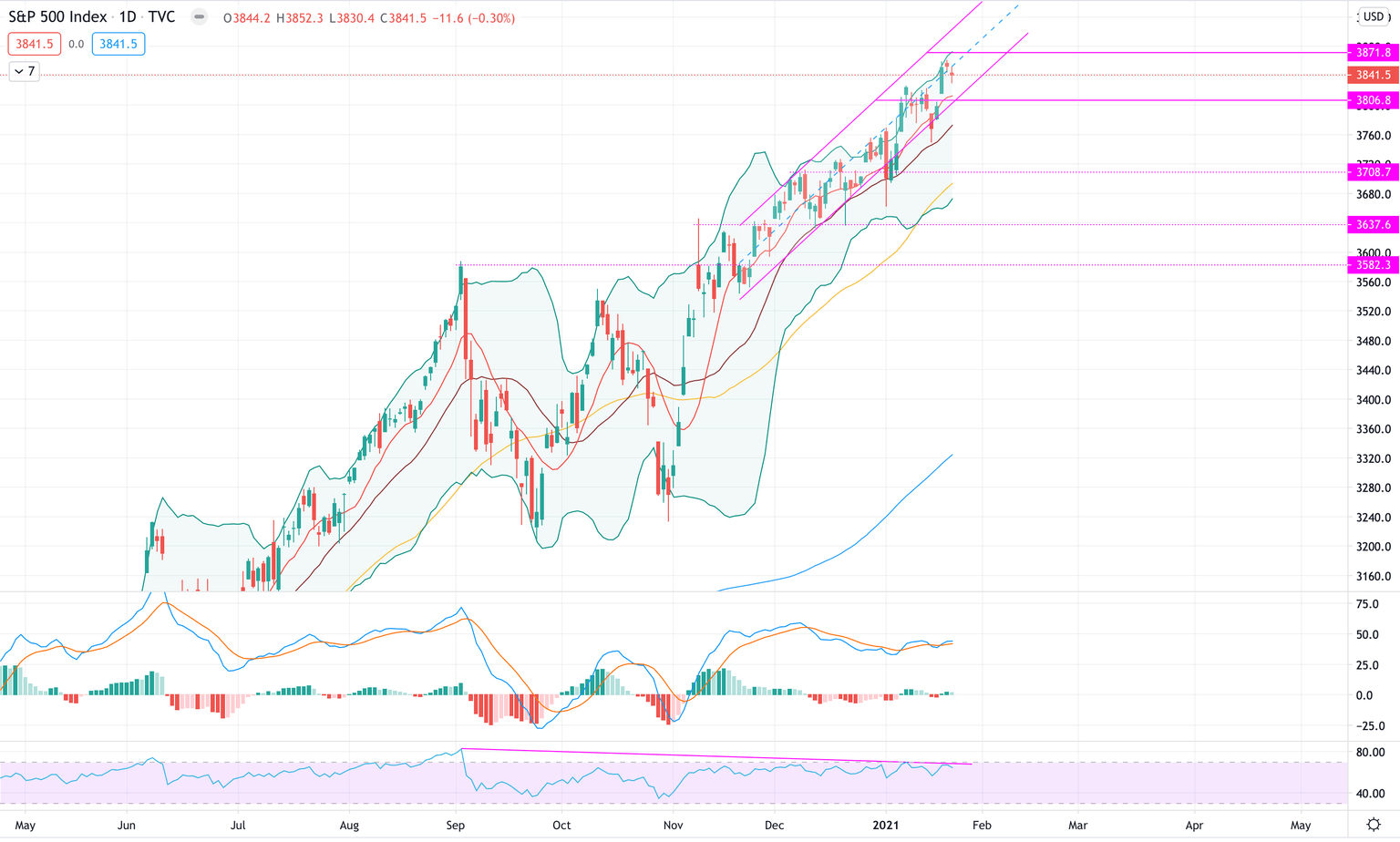

S&P500 (#SPX)

The #SPX, like the major US indexes, had a good week and continue making new high: from a technical perspective, the index managed to break resistance and move higher. Based on the pattern of the last two trading days, we might see a test of support level going into next week.

The MACD, despite slightly curving down, is signalling a loss of momentum as didn’t move much despite the positive weekly performance. Same consideration for the RSI, which in addition, is also showing divergence with the price.

For the coming week, we expect the #SPX to touch support level before considering moves in either direction. In case the index will manage to exit the current upward channel, we might see a continuation to the downside.

At present, see support at 3,806 and resistance at 3,871.

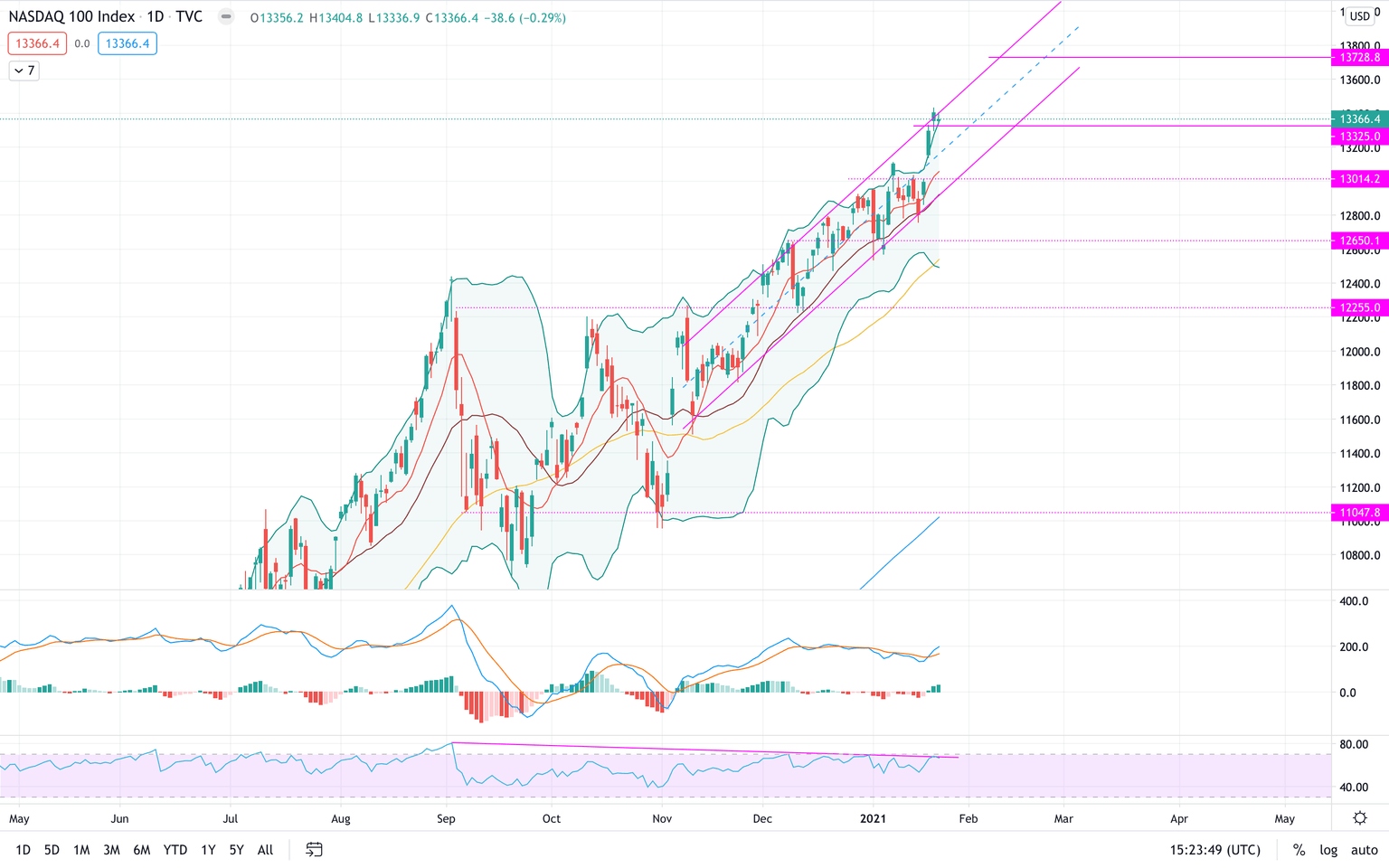

NASDAQ (#NDX)

The Nasdaq had a positive performance up 3.44% over the week. Among all is for sure the Index that has the stronger setup.

The #NDX keep trading within the current upward channel, however the current distance from the 9MA may trigger light moves to the downside.

From a technical perspective, the MACD is positive and overall bullish. On the other side, the RSI is giving a loss of strength of the index, by not moving much over such a strong week. In addition, it remains a strong divergence with the price.

For the coming week, we believe the Index may retrace till 13,150 before either bounced back or continue to the downside.

Given the fact, the #NDX is seating above support, we see support at 13,325 and resistance at 13,728.

Dow Jones (#DJI)

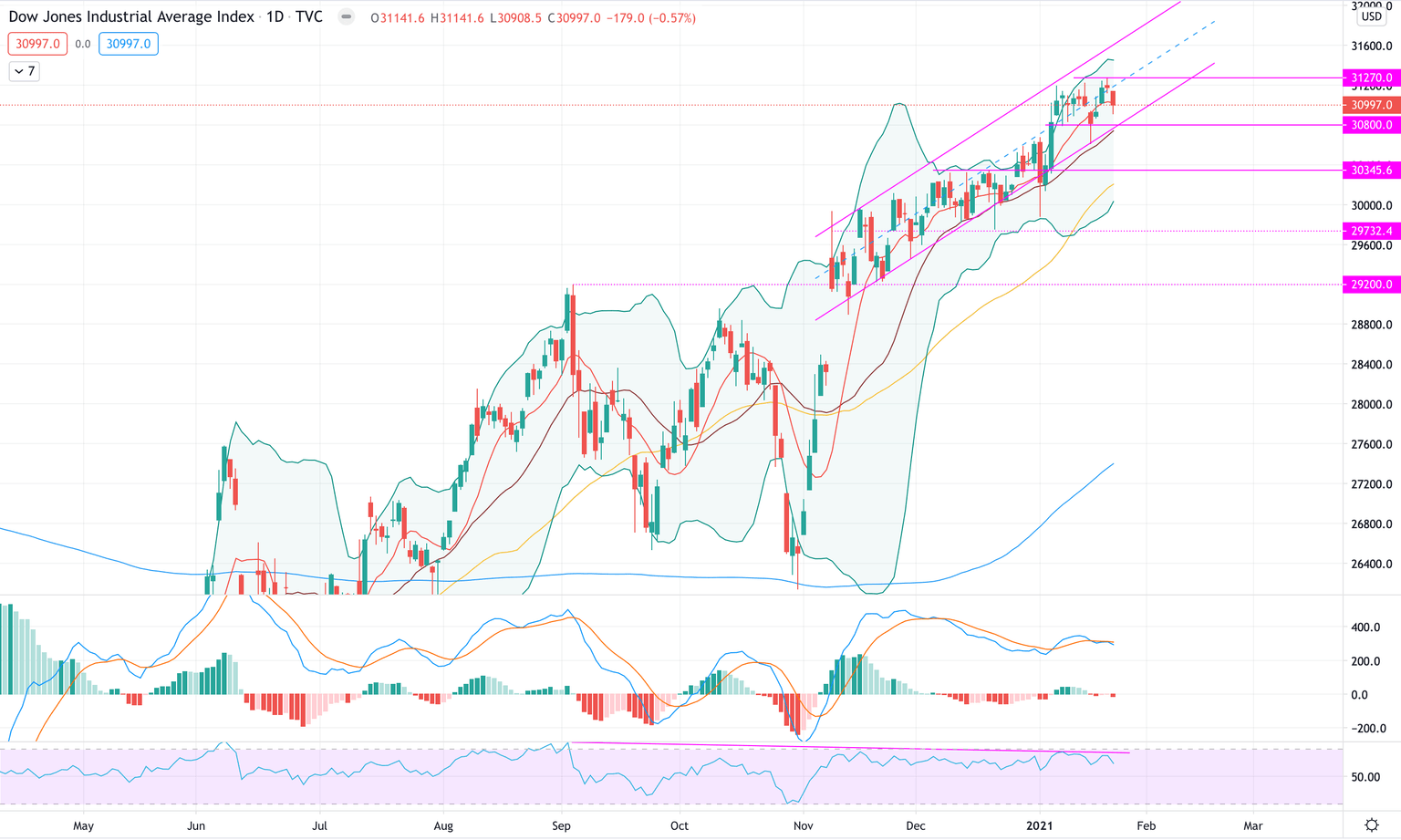

The Dow had a positive week where it kept itself within current levels and has entered a phase of consolidation.

From a technical perspective, the MACD is confirming the consolidation as we can notice it didn’t move much during the week. On the other side, the RSI is curving to the downside.

Based on current indicators, we expect for the week to keep trading sideways and test the current support level at 30,800.

At present, we confirm support at 30,800 and resistance at 31,270.

Author

Francesco Bergamini

OTB Global Investments

Francesco, BSc Finance and Msc in Business Management, graduated with Merit, is a professional with experience in the financial services industry and a keen interest in the financial markets.