It was certainly a busy day in the economic space on Wednesday.

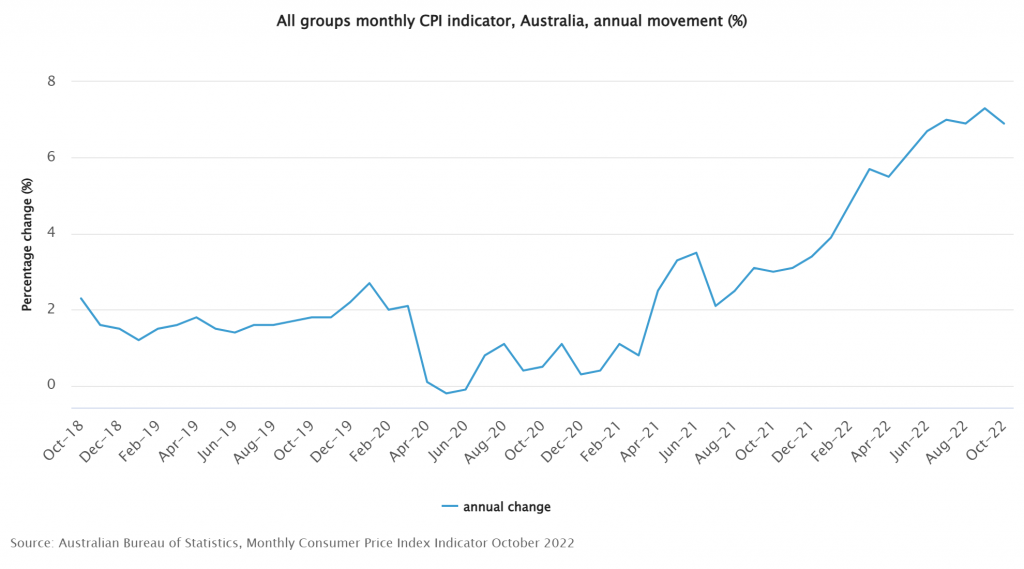

Australian annual inflation eases

Early hours witnessed annual inflation (CPI) slow in October to 6.9%, following a 7.3% increase in September, according to the Australian Bureau of Statistics. Price rises were greatest in housing (10.5%), food and non-alcoholic beverages (+8.9%), furnishings, household equipment and services (+7.8%) and transport (+7.4%). The aftermath of the release observed a moderate spike lower in the AUD/USD currency pair to a low of $0.6670, though price retested pre-announcement levels shortly after and rallied to dethrone $0.67. Post the inflation print, the ASX 200 also observed an acceleration to the upside, rallying 0.6% in the space of 20 minutes before levelling off around 7,279.

Michelle Marquardt, ABS Head of Prices Statistics, said:

“This month’s annual movement of 6.9 per cent is lower than the 7.3 per cent movement in September, however CPI inflation remains high.”

“Typically, annual updates to the weights have limited impact on the overall CPI. This year, however, the significant changes in spending patterns over 2021 and 2022 meant that the reweight had a larger impact on the CPI than usual. The annual movement of the monthly CPI indicator in October, using the previous weights, would have been 7.1 per cent compared to 6.9 per cent using the new weights.”

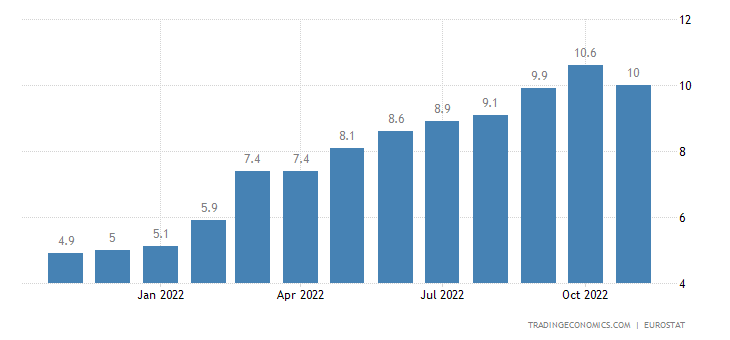

Euro area annual inflation slows

Mid-morning trading in London greeted the latest euro area inflation. On a year-over-year basis, the consumer prices index (CPI) eased to 10.0% in November, down from 10.6% in October and beating economists’ estimates of a 10.4% increase. According to Eurostat, energy prices slowed to 34.9% in November from October’s 41.5% print. There was, however, a moderate increase in prices for food, alcohol and tobacco, rising to 13.6% on the month from 13.1% in October. This underpins the possibility for a smaller rate hike at 15 December meeting, with markets currently pricing in a 56.5% probability for a 50 basis-point increase over a 43.5% chance of another 75 basis-point hike.

Netherlands saw the largest deceleration in consumer price increase, slowing from 16.8% for October to 11.2% in November. Latvia, Lithuania and Estonia currently have the highest annual inflation—all in the low 20s—with France, Malta and Luxembourg boasting the lowest annual inflation rates of between 7.1% and 7.3%.

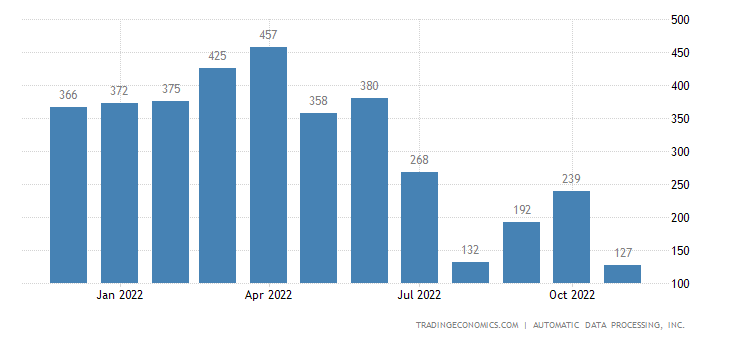

US ADP payrolls surprises to the downside

Over in the US, we saw that payrolls, according to the payroll processing firm ADP, slowed considerably in November, adding a paltry 127,000 new payrolls, down from 239,000 in October, and far under the consensus median estimate of 200,000.

“Turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains,” said Nela Richardson, chief economist, ADP. “In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting and the post-pandemic recovery is stabilizing.”

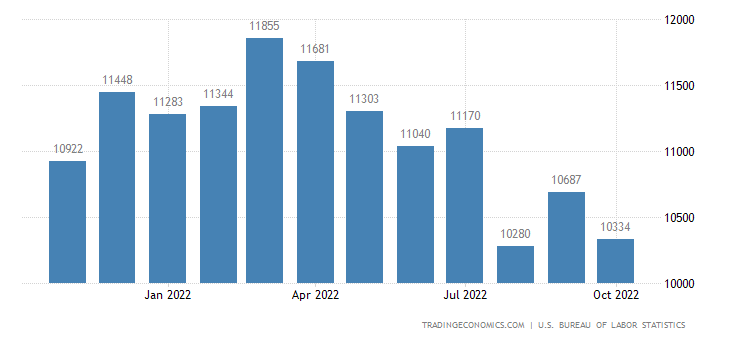

US job openings and labour turnover survey (JOLTS) elbows lower

Job openings—the total number of open and available positions—in the US nudged lower to 10.3 million in October, according to the US Bureau of Labour Statistics. This follows September’s downwardly revised increase of 10.69 million and almost matched economists’ median estimate of 10.3 million. This also shows the labour market is displaying signs of cooling as the US Federal Reserve is poised to raise the Fed Funds Target range in mid-December by 50 basis points to 4.25-4.50%, according to Fed Funds futures data.

US Federal Reserve Jerome Powell speech

Key comments from speech (Reuters):

-

Inflation remains too high.

-

We will stay the course until the job is done.

-

We have a long way to go in restoring price stability.

-

History cautions strongly against prematurely loosening policy.

-

Likely to need to hold policy at restrictive level for some time.

-

It seems to me likely rates must ultimately go somewhat higher than policymakers thought in September.

-

Have made substantial progress toward sufficiently restricting policy; have more ground to cover.

-

Time to moderate pace of rate hikes may come as soon as December meeting.

-

Price stability is Fed’s responsibility.

-

Moderation in labour demand growth will be required to restore labour market balance.

-

Have so far seen only tentative signs of moderation in labour demand, wage growth.

-

Expect housing services inflation to begin falling sometime next year.

-

Job’s data today show a continued imbalance between demand and supply of workers.

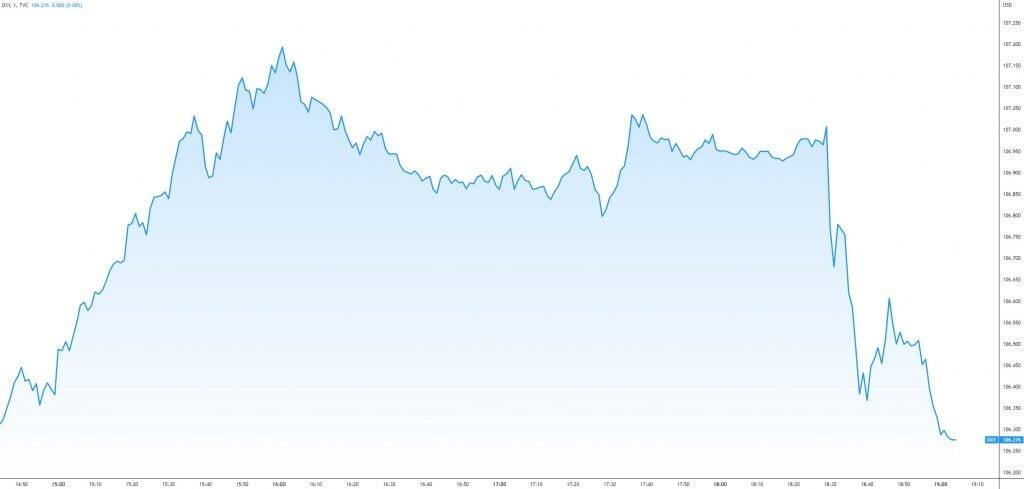

The US Dollar Index pushed lower following Powell’s comments.

(TradingView)

Economic calendar today

-

Annual Swiss Inflation Rate for November at 7:30 am GMT (Expected: 3.0%; Previous: 3.0%).

-

Year-Over-Year US PCE Price Index for October at 1:30 pm GMT (Expected: 5.9%; Previous: 6.2%).

-

US Weekly Jobless Claims for the Week Ending 26 November at 1:30 pm GMT (Expected: 235,000; Previous: 240,000).

-

US ISM Manufacturing PMI for November at 3:00 pm GMT (Expected: 49.8; Previous: 50.2).

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.