CPI jumps on energy but don't expect that to last

The CPI jumped 0.6 percent in June according to the BLS. The jump was energy related.

Following an unprecedented 3 consecutive month decline in core CPI. the BLS reports the CPI jumped 0.6% in June with the core CPI up 0.2%.

Key Points Month-Over-Month

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in June on a seasonally adjusted basis after falling 0.1 percent in May.

- The gasoline index rose sharply in June after recent declines and accounted for over half of the monthly increase in the seasonally adjusted all items index.

- The energy index increased 5.1 percent in June as the gasoline index rose 12.3 percent.

- The food index also rose in June, increasing 0.6 percent as the index for food at home continued to rise.

- The index for all items less food and energy rose 0.2 percent in June, its first monthly increase since February.

- The index for motor vehicle insurance increased sharply in June after recent declines.

- The indexes for apparel, shelter, and medical care also increased in June, while the indexes for used cars and trucks, recreation, and communication all declined.

CPI and Core CPI Year-Over-Year

Key Points Year-Over-Year

- The all items index increased 0.6 percent for the 12 months ending June; this compares to a 0.1-percent increase for the 12 months ending May.

- The index for all items less food and energy increased 1.2 percent over the last 12 months.

- The food index increased 4.5 percent over the last 12 months, with the index for food at home rising 5.6 percent.

- Despite increasing in June, the energy index fell 12.6 percent over the last 12 months.

CPI, Medical CPI, and OER

CPI Distortions

Anyone buying their own medical insurance, those in college, and those looking to buy a home, and those in areas with high rent a home will dispute the stated CPI.

The BLS does not directly factor in the price of homes into the CPI. Rather the BLS goes through a ridiculous process in which it asks people how much they would rent their their own house from themselves and uses that number as Owners' Equivalent Rent (OER).

Nor does the BLS factor in soaring equity prices. And that is the primary place inflation has turned up now.

CPI Jump Won't Last

Inflationistas will point to the 0.6% rise and once again say "here we go".

But those expecting a big jump in the CPI as calculated will be wrong again.

Covid accelerated trends toward more work at home, less driving, less eating out, and fewer business meetings in person.

These factors will easily outweigh government stimulus and Fed manipulations.

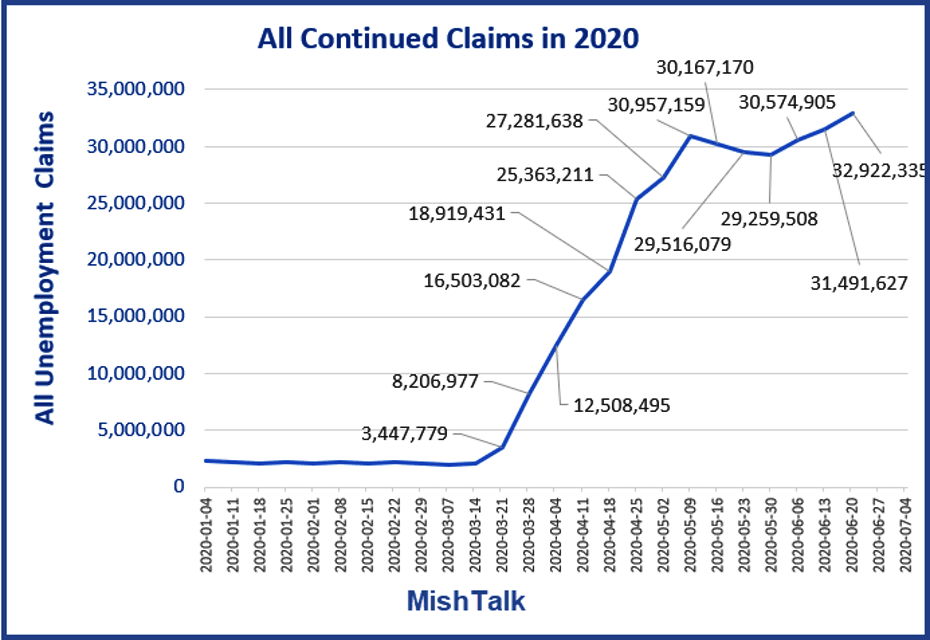

State Claims Decline But All Unemployment Claims Are on the Rise

There is nothing inflationary about the above trends.

Importantly, some 20 million to 30 million people are out of work and will remain out of work, on life support of State Unemployment Insurance plus pandemic assistance.

Demand destruction is massive. It is too great for the CPI, as constructed, to jump on a sustained basis.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc