Could EUR/USD reach the 1.0685 level?

AUDUSD a little lower as expected to 6696 but unexpectedly reversed to close unchanged leaving a minor bullish candle in oversold conditions. Holding above 6745/35 signals further gains today targeting 6760 & first resistance at 6770/80. A high for the day is possible in the bear trend. Shorts need stops above 6800.

Failure to hold above 6730 risks a retest of 6700/6695. A break lower can target 6670/60.

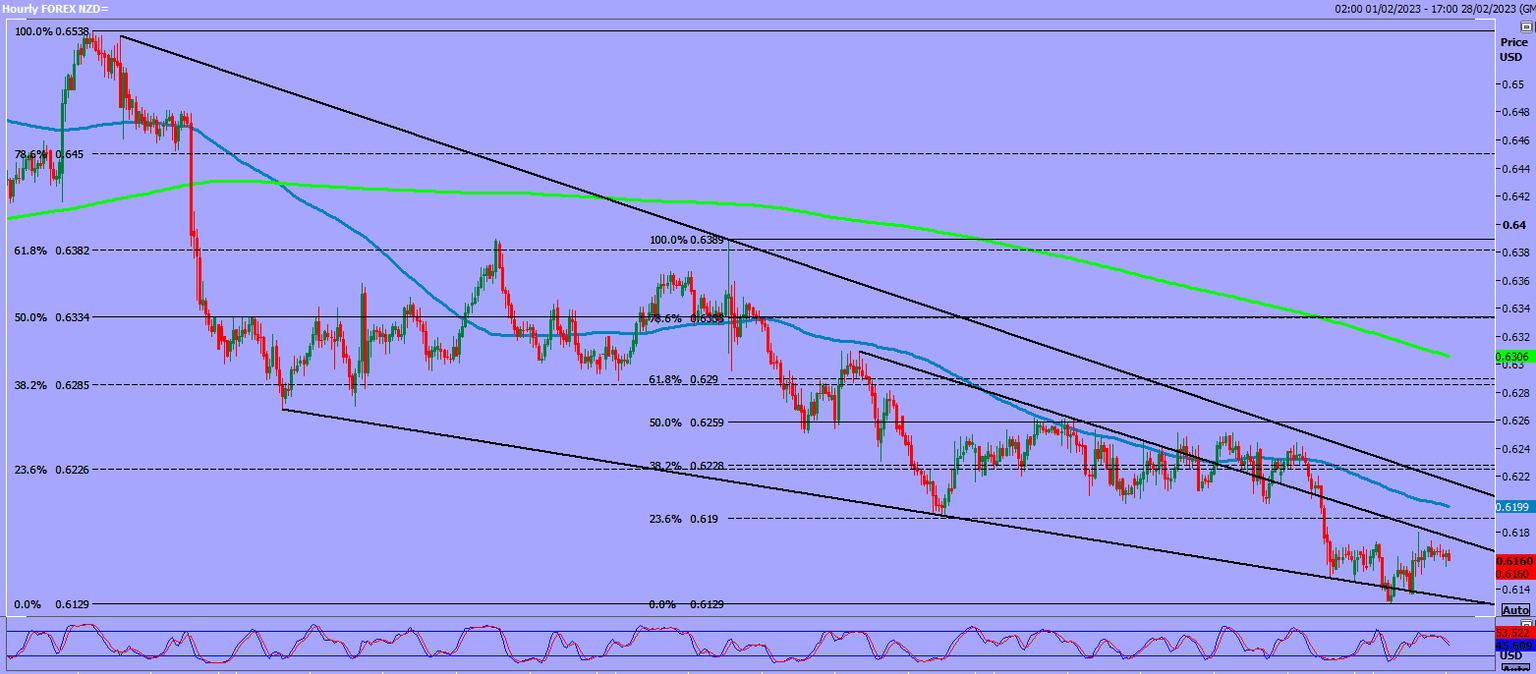

NZDUSD made a low for the day 11 pips below 38.2% support at 6150/40 & the pair is recovering towards first resistance at 6190/6200. A high for the day possible here but shorts need stops above 6215. A break higher can target 6145/55.

Shorts at 6190/6200 can target 6150/40 for profit taking. Longs need stops below 6125. (Let's see if we establish a new range from 6150/40 up to 6190/6200). Be ready to sell a break below 6125 to target 6100/6090, probably as far as 6040/30 for profit taking on shorts.

CADJPY took a long time to finally reach my target & Fibonacci resistance at 100.55/65. A Doji yesterday suggests we will struggle here in overbought conditions. Shorts need stops above 100.80. A break higher sees 100.65/55 act as support to target 101.25/35.

Shorts at 100.55/65 can target 100.00/9990, perhaps as far as a buying opportunity at 9950/40. Longs need stops below 9920.

USDJPY longs at buying opportunity at 134.10/133.90 hit my target of 135.45/55 & 135.80/90 before reaching strong resistance at 136.65/85. What a great run for our longs!!

Shorts need stops above 137.10. A break higher is a buy signal for this week targeting 138.00/20.

Shorts at 136.65/85 can target 136.00, perhaps as far as first support at 135.50/30 for profit taking. Longs need stops below 135.15.

NZDJPY remains in a tight sideways range - only useful for scalpers. Resistance again at 8450/80. A break above 8510 therefore should be a buy signal.

Shorts at 8450/80 can target 8400/8390 & 8370/60, perhaps we can fall as far as 8310/8290 eventually.

EURUSD unexpectedly bounced from 1.0534 & beat strong resistance at 1.0575/85. I think today's resistance is at 1.0590/1.0610. Shorts need stops above 1.0630. A break higher can target 1.0650/60, perhaps as far as 1.0675/85.

Shorts at 1.0590/1.0610 can target 1.0580/75 & 1.0545/35. If we continue lower look for 1.0510/00, perhaps as far as strong support at 1.0470/50. Longs need stops below 1.0430.

USDCAD beat 4 month trend line resistance at 1.3570/90 so we must obviously hold above here this week to maintain a buy signal targeting 1.3700.

Longs at 1.3590/70 stop below 1.3550. This was nasty yesterday because we spiked down to 1.3533 then immediately recovered. USDCAD remains difficult to read. We have been in a bull trend for 2 weeks but with deep pullbacks making it tough to hold a long position.

Dollar Index higher last week as predicted on Monday. By Friday we hit my first target of for the 105.15 & should be headed for 105.80 this week, perhaps as far as 106.10/30.

First support at 1.0505/104.95 broke but we saw a low for the day at strong support at 104.75/60. However a break lower meets strong support at 104.30/20. Longs need stops below 104.00.

EURCAD I am going to wait to see if a head & shoulders forms.

A high for the week exactly at the 50 day moving average at 1.4440/50 helps this pattern to develop. A break below support at 1.4230/20 this week will be the sell signal targeting 1.4150 & 1.3980.

GBPUSD bounce from strong support at 1.1960/40 has reached 1.2068. I expect strong resistance at 1.2090/1.2110. Shorts need stops above 1.2130.

Shorts can target 1.2040/20, perhaps as far as strong support at 1.1960/40. Longs need stops below 1.1910. A break below 1.1910 is a sell signal for this week targeting 1.1865/55, perhaps as far as 1.1810/00.

Author

Jason Sen

DayTradeIdeas.co.uk