Consumer confidence: Inflation worries lead to 12-year low in expectations

Summary

Consumer confidence continued a four-month string of declines in March, and consumers reported a broad deterioration in their assessment of the inflation outlook and business conditions. The Expectations Index fell to its lowest point in 12 years, as the uncertain impact of tariffs continues to cloud the outlook for consumers.

Consumer confidence corroborates sour sentiment surveys

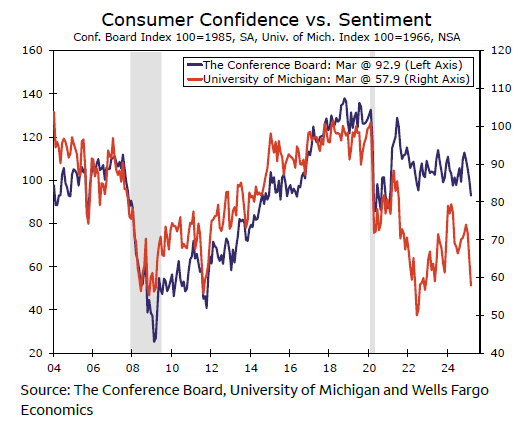

The Conference Board's measure of consumer confidence came in at 92.9 in March, over a point below the Bloomberg consensus estimate. Following four months of consecutive declines in consumer confidence, the index is now at its lowest point since early 2021. The sour mood evident in March's survey is in line with other sentiment surveys that note consumers reporting increased uncertainty (chart).

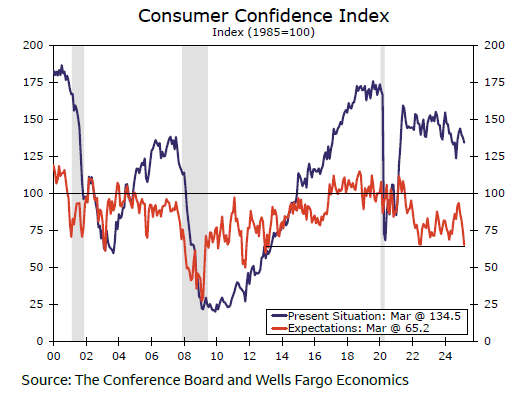

The Present Situation Index, a gauge of consumers' current assessment of economic conditions, fell to 134.5, its lowest reading since September. The Expectations Index, a measure of consumers' short-term outlook on the economy, registered a stark 9.6 point decline to 65.2. The forward-looking measure has now declined 29 points since November and is at its lowest point in over 12 years (chart). The report noted that there were "more references than usual to economic and policy uncertainty" in write-in responses. Inflation and trade policy remain a major concern for consumers as they assess their household finances, as they have since the start of the year.

Author

Wells Fargo Research Team

Wells Fargo