China: What’s next after the trade talks

September trade data reflects increasing damage from the trade war. Will this change after the trade talks? And what about the yuan?

In this article

-

China trade as bad as expected

-

Dive in China-US trade

-

Trade war hits exports and imports

-

Focusing on future of China trade

-

China is unlikely to change the yuan mechanism

China trade as bad as expected

China's exports were down 3.2% year-on-year, with imports down 8.5% YoY. As imports contracted more than exports, the trade balance increased to $39.65 billion in September, up from $34.8 billion in August.

Dive in China-US trade

There were very big drops in exports to and imports from the US, at -10.7% year-on-year year-to-date and -26.4% YoY YTD, respectively. This is clearly a result of the trade war.

Exports to Vietnam grew 15.3% YoY YTD. We believe China is re-routing US-bound goods to Vietnam for simple processing in order to avoid tariffs on its direct exports to the US.

Trade war hits exports and imports

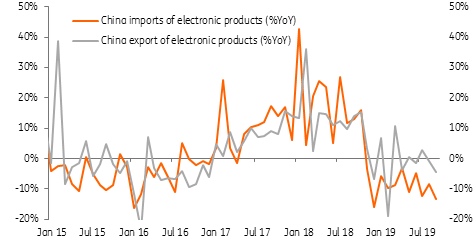

The overall fall in exports came despite a 60% monthly rise in smartphone exports. In general, trade in electronic products was weak, with exports falling 4% YoY and imports down 13% YoY in September.

Tariffs also had a widespread impact on exports of shoes and lighting, which dropped 12% month-on-month and 21% MoM, respectively.

We continue to see declines in exports of rare earth products, with a 29% MoM drop in August followed by a 14% MoM drop in September. This is quite clearly a strategic move by China to limit rare exports to competitors in the technology arena.

The deterioration in exports had a negative impact on imports. Soybean imports fell, of course, but pulp imports were also down 17% MoM, auto parts fell 26% MoM, and LED panels declined by 11% MoM.

Focusing on future of China trade

China said it had made "substantial progress" with the US after Friday's meeting and again emphasised that "respect" is the key to future successful trade negotiations.

Still, there is a five week period for the two sides to write down exactly what they agreed to in the meeting. This raises questions about how much "progress" has really been made. We think there are probably some important disagreements on the terms of a deal, which could include the yuan mechanism.

A statement is scheduled to be released in November. The timing is important because planned US tariffs are due to go into effect in December, hitting an additional $160 billion of Chinese-made consumer goods. If the two sides cannot release a draft agreement as planned in five weeks, it will not bode well for a trade truce.

China is unlikely to change the yuan mechanism

China has always stated that the yuan mechanism is being reformed but we don't think it will announce any significant changes to this in the draft statement. Still, the US is likely to continue to press China to appreciate the yuan, and this issue will make future negotiations tough.

The recent appreciation of the yuan is really just a result of the weak dollar rather than any deviation from the trend. We therefore do not think that the USD/CNY will fall below 7.0. Our forecast for 2019 year end is still 7.20.

China exports and imports of electronic products

Read the original article: China: What’s next after the trade talks

Author

Iris Pang

ING Economic and Financial Analysis

Iris Pang is the economist for Greater China, joining ING Wholesale banking in 2017. Iris was previously employed by Natixis and OCBC Wing Hang Bank. She earned a PhD in economics from Hong Kong University of Science and Technology.