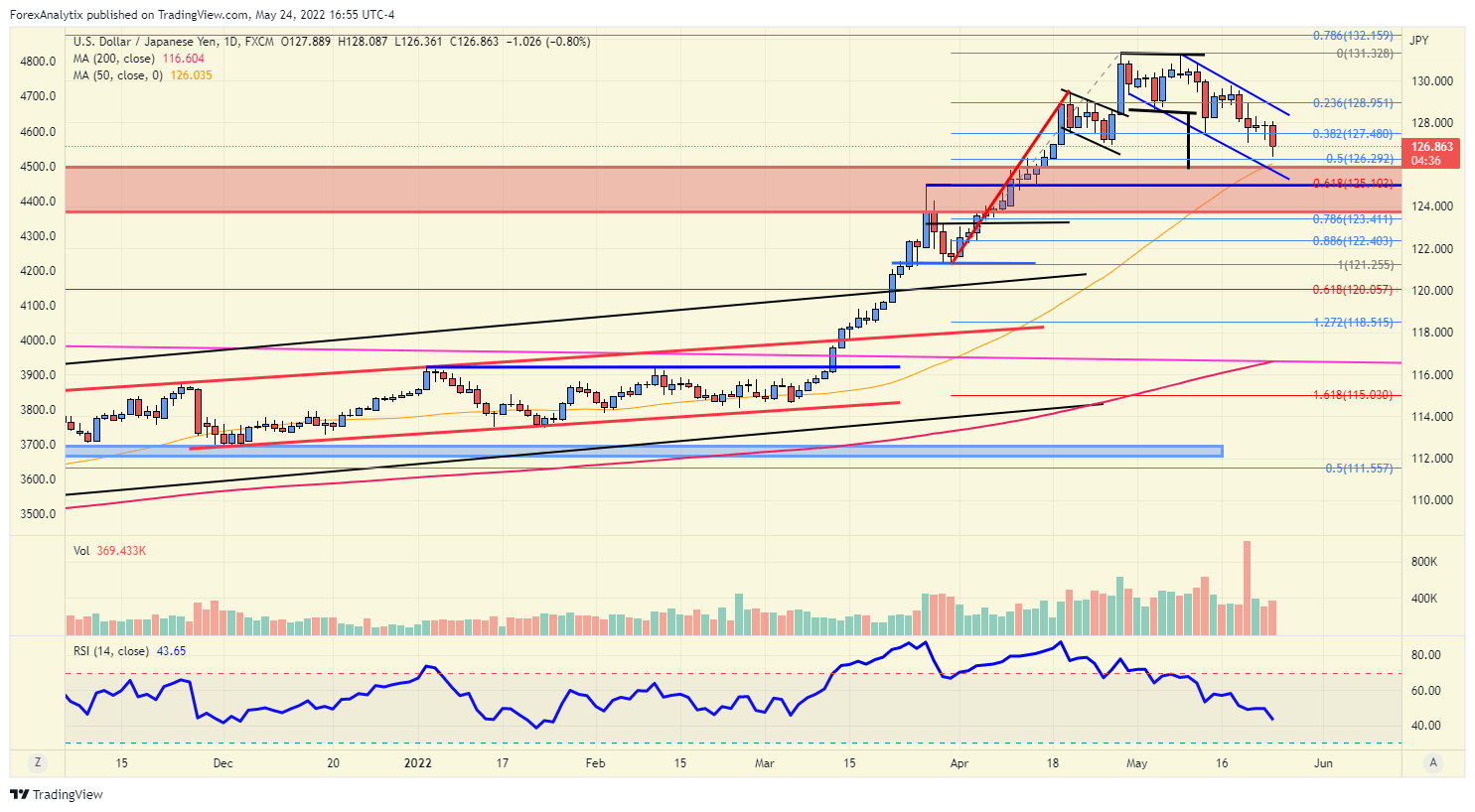

Chart of the day: USD/JPY

A couple reasons for the USDJPY to continue lower:

- The double top target from the 131.35 highs from April and May targets the 125.80 level.

- The breakout point and previous highs from June 2015 is at 125.85 as well, it should act as a magnet.

Near term, the descending channel support also comes in around there, and with 10yr yields dropping this level may come into view overnight. If this is the case, those of you who are JPY bears may have an opportunity for some USDJPY longs.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.