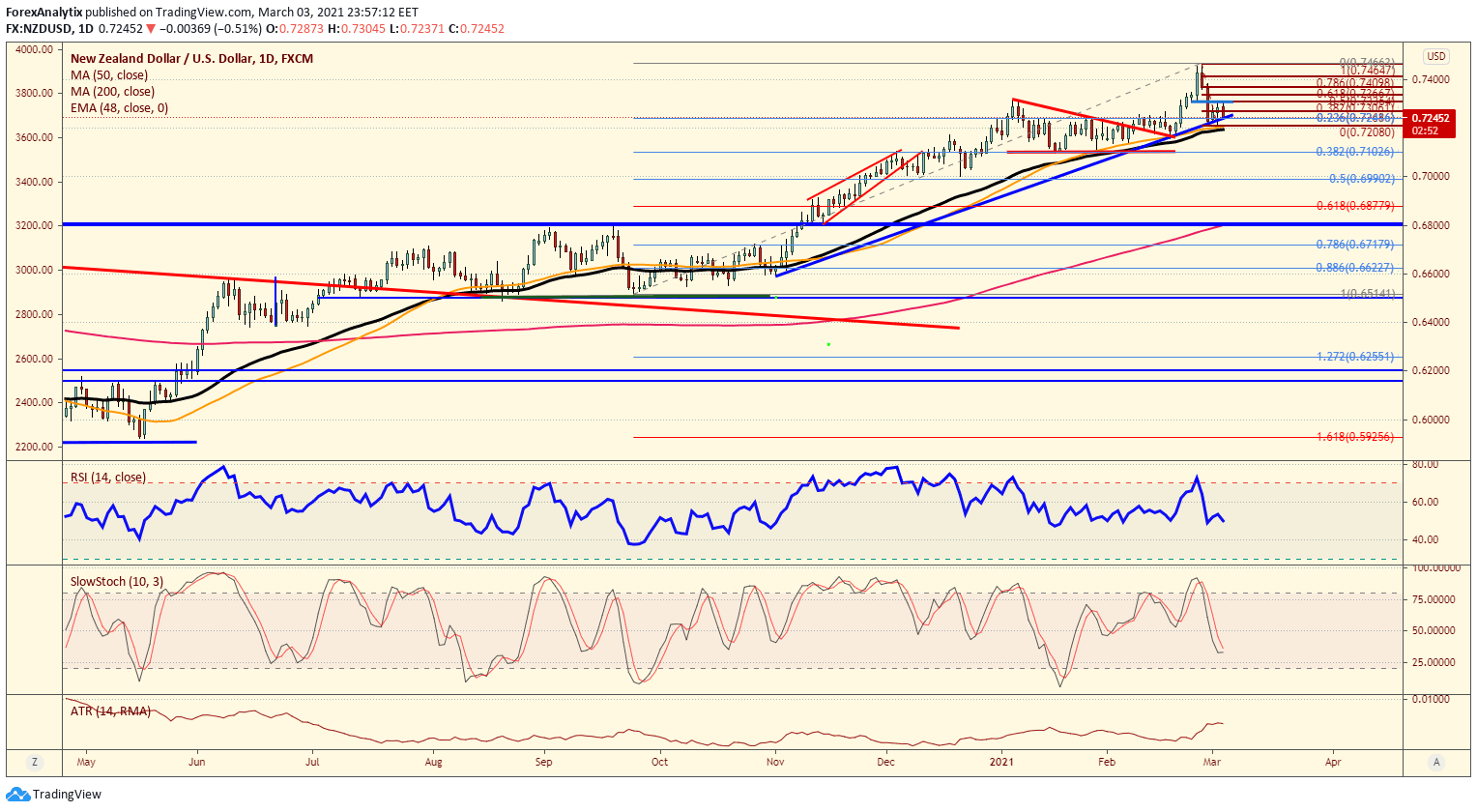

Chart of the Day: NZDUSD

The bearish argument for the NZDUSD has to be made at this level. First, the rally at the beginning of this week didn't even allow for the Kiwi to break the 38% retracement of .7306 of the spike high to .7447 to the low of .7208. A shallow bounce means that the risk is for a move lower now. Another issue that the Kiwi has is that last week we may have put in a 'false" breakout above the .7320 level and this week (thus far) we have not been able to break that level either. Next, stocks (in the US) look weak and with risk appetite weighing the risk may be for the NZDUSD to follow lower and break the 5 month trend line. The 50dma is at .7210 and that is this week's lows and multi month trend line. A break of this level should allow for a move back to .7100 and possibly lower.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.