CFTC Positioning Report: Speculators remained bearish on the Dollar

The latest CFTC Positioning Report, reflecting the week ending April 29, covers a volatile stretch shaped by mixed US economic data, the Federal Reserve's communications blackout, and a flicker of optimism surrounding US-China trade relations.

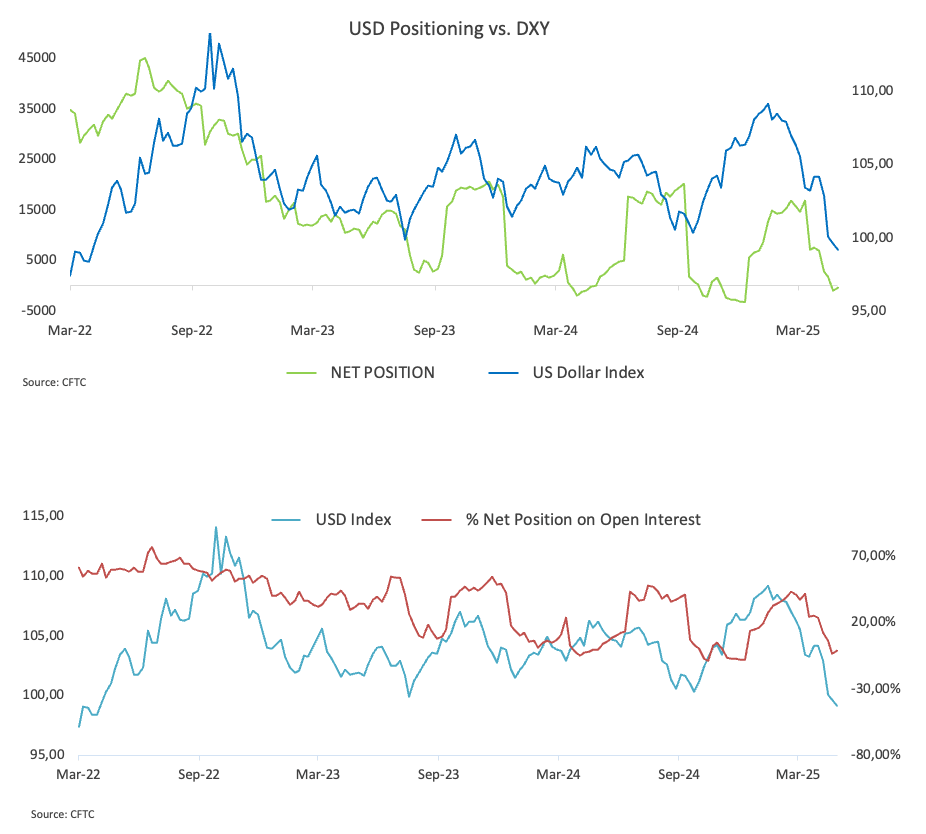

Speculators remained net short on the US dollar (USD), though they pared back positions slightly—cutting exposure by nearly 500 contracts amid a modest dip in open interest. The US Dollar Index (DXY) continued to trade with a choppy but generally bearish tone, finding tentative support around the 99.00 level.

Net long in the Euro (EUR) rebounded, climbing to roughly 75.8K contracts—levels last seen in early September 2024—after a steady decline. Commercial traders also ramped up their net short positions, pushing them to multi-month highs near 131.5K contracts. Open interest rose in tandem, hitting a seven-month peak around 730.2K contracts. During the reporting period, EUR/USD saw choppy price action, stabilising around the 1.1300 area after having surpassed yearly highs above 1.1500 the previous week.

Speculative net long in the Japanese Yen (JPY) extended their climb, surpassing 179K contracts—marking fresh highs—while hedge funds and other commercial traders increased their net shorts to nearly 202K contracts, all amid the continuation of the upward trajectory in open interest. USD/JPY traded with similar choppiness to its peers, though with a more constructive bias, pulling further away from sub-140.00 lows seen the previous week.

Net longs in the British pound (GBP) gained traction, climbing to a four-week high of around 24K contracts, accompanied by a continued rise in open interest. GBP/USD extended its upward trend—albeit in a choppy fashion—breaking above 1.3400 the figure to reach levels last seen in late February 2022.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.