CFTC Positioning Report: EUR net longs increased to multi-month highs

These are the highlights of the CFTC Positioning Report for the week ending April 15. During this period, the tariff narrative remained well in place, while concerns over a potential economic slowdown in the US did nothing but increase.

Speculative net longs in the Euro (EUR) went up to around 69.3K contracts, the highest level since September 2024. Commercial players, in the meantime, increased their net shorts to nearly 118K contracts, also multi-month peaks. Open interest rose past 708K contracs, or five-week peaks. During the period, EUR/USD extended its multi-week recovery, hitting yearly highs around 1.1470.

Commercial traders reduced their net longs in the US Dollar (USD) to the lowest level since early September 2024 around 1.8K contracts amid an acceptable increase in open interest. The downward bias in the US Dollar Index (USD) has picked up pace, breaking below the psychological 100.00 mark, or three-year lows, and extending the post “Liberation Day” sell-off pari passu unabated concerns over a potential stagflationary scenario in the US.

Speculators increased their bullish bets on the Japanese Yen (JPY), prompting net longs to advance to new highs in the proximity of 172K contracts, in line with an increase in commercial traders’ net shorts beyond 190K contracts. The correction in USD/JPY has gathered extra pace on the back of tariff-led increased demand for the safe-haven universe, taking the pair to the 142.00 neighbourhood for the first time since mid-September 2024.

Net longs in the British Pound (GBP) retreated to seven-week troughs around 6.5K contracts as non-commercial players trimmer further their gross longs. The move came along with a small increase in open interest. GBP/USD’s uptrend remained well in place, reaching new highs around the 1.3250 zone, extending at the same time its breakout of the critical 200-day SMA.

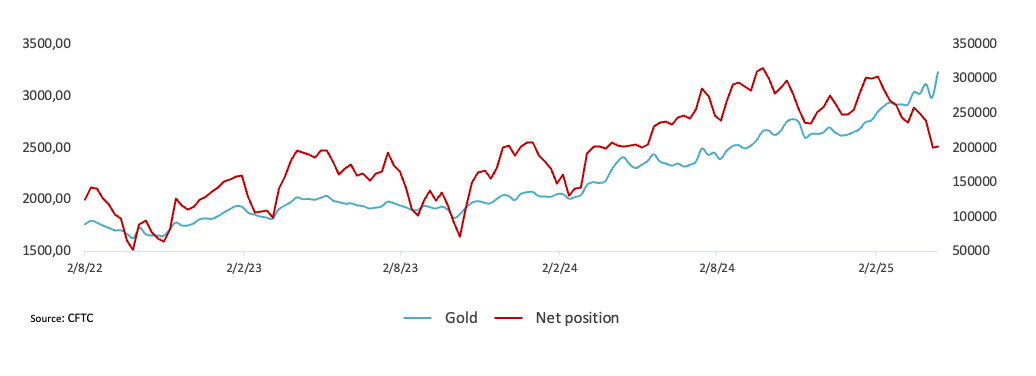

In the commodities’ space, Gold prices continued to hit all-time highs, this time blasting through the $3,200 mark per troy ounce, as investors piled in on the metal’s traditional safe‑haven allure amid renewed tariff concerns. In the period, speculative net longs climbed to two-week highs around 202.2K contracts. On the latter, it is worth noting that the bullish positioning has remained in levels last seen in April 2024, hinting at some potential loss of impetus in buyers, or even opening the door to some respite in the metal’s impressive climb.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.