Central Europe: Moving up the value chain

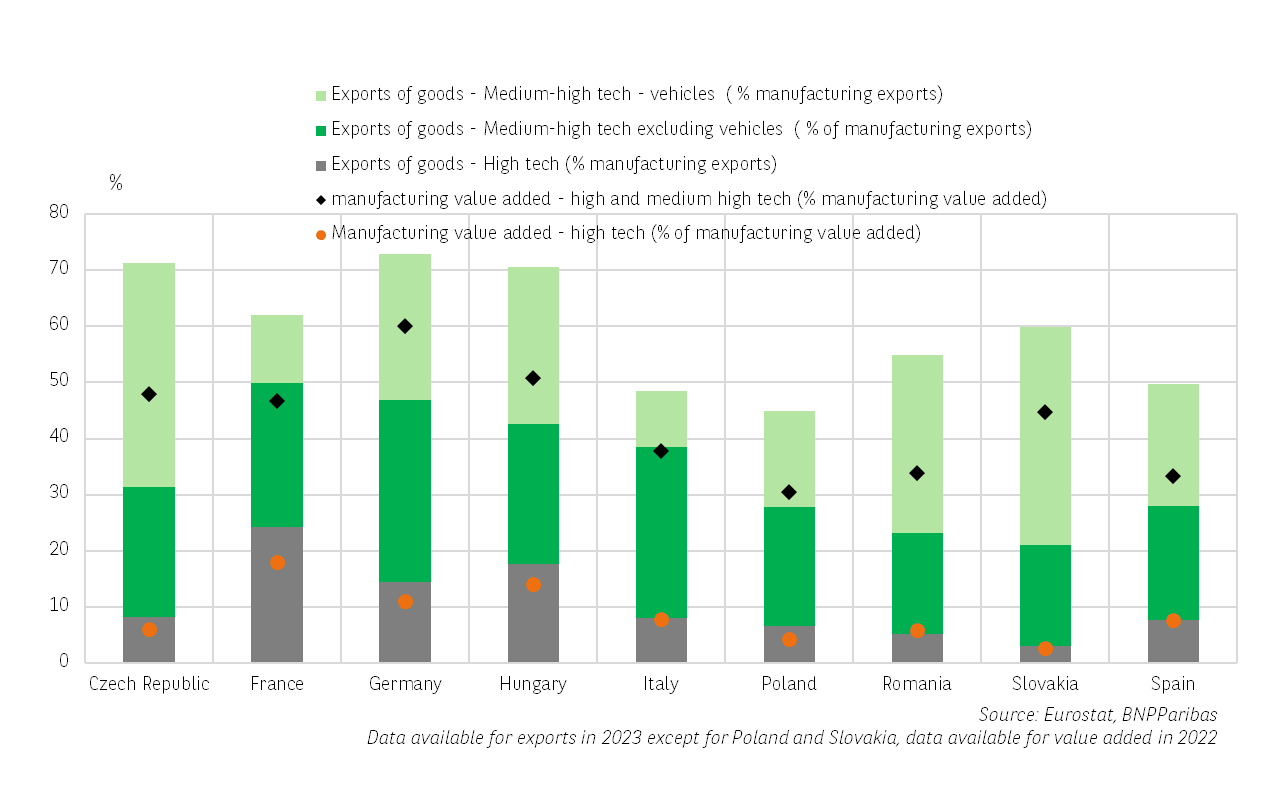

Central European countries are relatively well-positioned in industrial sectors with high technological content. However, there are differences, with regards to the respective percentages of tech products in value added and in manufacturing sector exports. The share of the high-tech sector, consisting of only three segments in the sector approach (pharmaceuticals, IT/electronics/optical and air/spacecraft), is relatively modest, but the percentage of “medium-high-technology” sector (chemicals, weapons, electrical equipment, machinery, motor vehicles, other vehicles, medical devices) is high. However, these two sectors are also very technology-intensive. “Medium-high-technology” sectors therefore need to be taken into account for a more comprehensive overview of their significance in Central Europe.

Central Europe : Economic activity with strong technology content

The entry of Central European countries into the EU (2004: Poland, Hungary, the Czech Republic and Slovakia; 2007: Romania) was accompanied by an influx of both European funds and of foreign capital in the form of foreign direct investment (FDI). This contributed to an upgrading of their manufacturing industry in the value chain. Contrary to popular belief, their industrial base is not confined to just the automotive sector, although this base is significant.

This chart also shows that Hungary stands out by the size of its high-tech sector (17.6% of exports from the manufacturing sector), driven by the IT/electronics/optical sector. The more moderate percentage in Czech Republic and in Slovakia may be surprising. It can be explained by the criteria applied for the sectoral approach (NACE), which includes “electrical equipment” and “machinery” items not in the high-tech segment but in the “medium-high-technology" group. These two items are particularly important for Central European countries1. By way of comparison, in Germany and France, the “air/spacecraft” and “pharmaceuticals” categories are significant (hence the large percentage of the high-tech sector).

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.