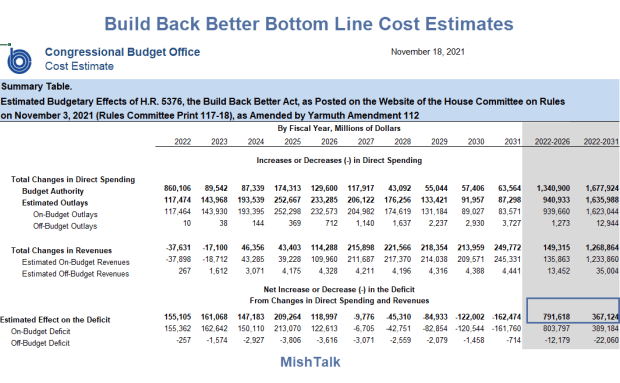

CBO admits Biden shortfall is $367 billion over 10 years, a whopping $792 billion initially

The CBO at long last issued its assessment of Build Back Better.

Despite repeated lies by the administration that Build Back Better is fully paid for, Congressional Budget Office Analysis says that it isn't.

The CBO is a nonpartisan committee.

You can download the complete spreadsheet at the above link.

Front Loaded Shortfalls

Note how the costs and shortfalls are front-loaded.

Through 2026 the shortfall is $791.616 billion. Over 10 years the alleged shortfall is only $367.124 billion.

Fine Print

Page 2 of the spreadsheet contains a footnote stating the shortfall would be less.

CBO expects that the provisions in title VI and title XIII that would increase funding for tax enforcement activities would increase revenues. However, under guidelines agreed to by the legislative and executive branches, that change in revenues is not included in the cost estimate, but it would be reflected in CBO’s baseline budget projections if the legislation was enacted. (For more information on those guidelines, see https://www.cbo.gov/publication/56507.) CBO estimates that as a result of these increases in outlays, revenues would increase by a total of $207 billion over the 2022-2031 period.

Democrats will allege that's peanuts but they will not admit the 10-year lie.

10-Year Lie

The 10-year lie is that Progressives say the front-loaded benefits will expire. Meanwhile they pledge to do everything in their power to ensure they don't.

Nor did the CBO look at ancillary costs such as inflation.

History shows that government entitlement programs only get bigger, they don't expire.

The White House cost estimate for Build Back Better is $1.870 trillion. Wharton's estimate is $4.262 trillion.

Yellen's Comment

ZeroHedge pointed out Yellen's comment from yesterday.

Janet Yellen issued a statement saying that “the combination of CBO’s scores over the last week, the Joint Committee on Taxation estimates, and Treasury analysis, make it clear that Build Back Better is fully paid for, and in fact will reduce our nation’s debt over time by generating more than $2 trillion through reforms that ask the wealthiest Americans and large corporations to pay their fair share."

Dear Joe Biden

"Inflation is taking a toll," says Senator Joe Manchin, a Democrat from West Virginia. He has the power to kill Build Back Better, and he should.

The bill was written by socialists for socialists. It deserves to die.

Dear Joe, just kill it. Better yet, declare yourself an independent, then caucus with the Republicans.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc