CB consumer confidence beats expectations, US stocks rebound, Crude dives, central banks panel ahead

Previous trading day events – 27 June 2023

-

Yesterday’s Canadian inflation data showed lower figures suggesting that it is slowing down significantly. Canada's annual inflation rate came in at 3.4% in May.

-

The BOC hiked its overnight rate to a 22-year high of 4.75% earlier in June as a response to undesirable inflation data. After the last rate increase, the Bank said it would be assessing the upcoming data for deciding whether it would increase borrowing costs. This latest data suggests that a pause is on the table.

-

The inflation reading "might give the Bank of Canada some reason to skip July," said Derek Holt, vice president of capital markets at Scotiabank. While Holt sees another hike coming this year, he characterised it as "fine-tuning" and now more likely in September.

-

"With the labour market also loosening in May, the case for another rate hike in July is not quite as strong as it seemed a few weeks ago," said Stephen Brown, deputy chief North America economist at Capital Economics. But Brown still says a hike in July "is more likely than not."

-

According to the U.S. Consumer Confidence report yesterday, consumers are more optimistic about the labour market and economic expansion. The CB index rose to 109.7 this month from 102.5 in May.

-

A measure of consumer expectations for a six-month outlook rose to 79.3. A measure of expected inflation dropped to the lowest level since 2020.

-

"Greater confidence was most evident among consumers under age 35, and consumers earning incomes over $35,000," said Dana Peterson, chief economist at The Conference Board. "Nonetheless, the expectations gauge continued to signal consumers anticipating a recession at some point over the next 6 to 12 months."

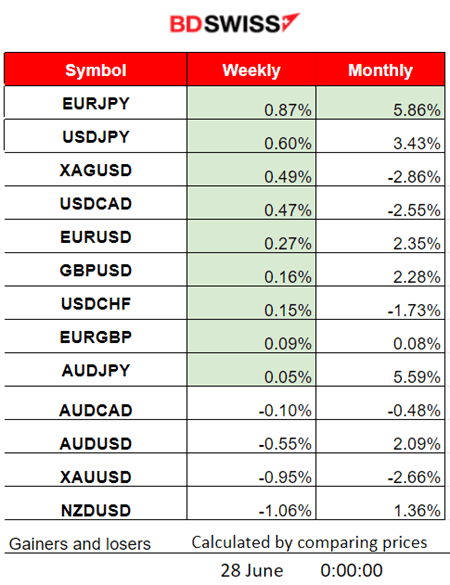

Summary daily moves – Winners vs losers (27 June 2023)

- EURJPY is on the top this week with 0.87% gains.

- It is also on the top of the winner’s list this month with an overall price change of 5.86%.

News reports monitor – Previous trading day (27 June 2023)

Server Time / Timezone EEST (UTC+03:00)

1. Midnight – Night session (Asian)

No significant news announcements, no special scheduled releases.

2. Morning – Day session (European)

At 15:30, the CPI data for Canada were released. Inflation seemed to slow down in May but economists are still expecting the Bank of Canada to proceed with another rate hike next month. At the time of the release, the intraday shock was minimal with no notable impact on the CAD pairs.

U.S. CB Consumer Confidence report showed improvement for June. The Expectations rose to 79.3 (1985=100) from 71.5 in May. Expectations remained below 80, the level associated with a recession within the next year. At the time of the release, at 17:00, the USD was affected with moderate appreciation against other currencies.

General verdict

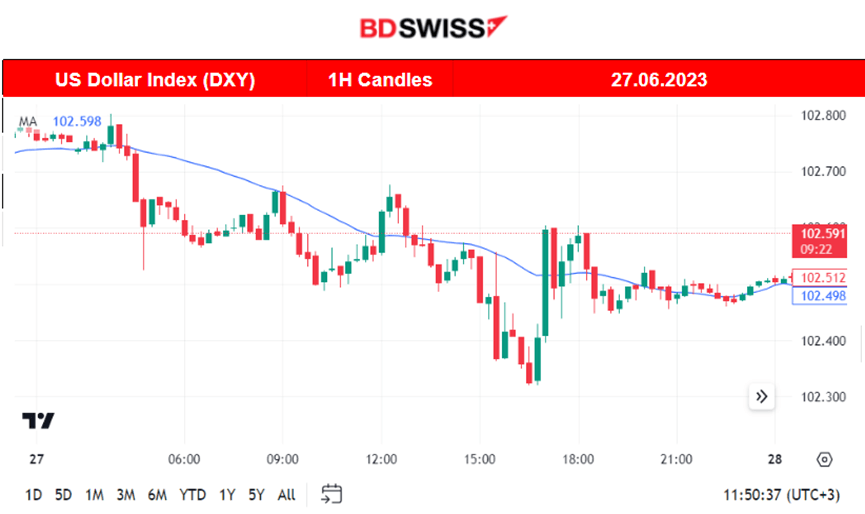

- Higher than typical volatility with no major shocks.

- The dollar weakened in general but found support due to the release of the CB Consumer Confidence report which caused it to reverse from the drop.

- U.S. Stocks moved higher, Gold and Oil lower.

Forex markets monitor

USD/CAD (27.06.2023) chart summary

Server Time / Timezone EEST (UTC+03:00).

Price movement

The pair was moving with high volatility around the mean until the European session started. Since then, the pair started to move upwards at a steady pace. The inflation data did not have much impact on the CAD at the time of the release but showed steady depreciation afterwards and major pairs gained a lot of ground against the CAD during the rest of the trading day.

Equity markets monitor

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price movement

The index has rebound with surprise. 14820 was an important support that broke on the 26th causing a further downward movement for the index until it found a support at near 14700. It reversed the next day after the NYSE opening significantly moving above the 30-period MA.

Commodities markets monitor

USOIL (WTI) 4-day chart summary

Server Time / Timezone EEST (UTC+03:00)

Price movement

Crude moved significantly lower. Breaking 67.60 will probably cause it to move lower.

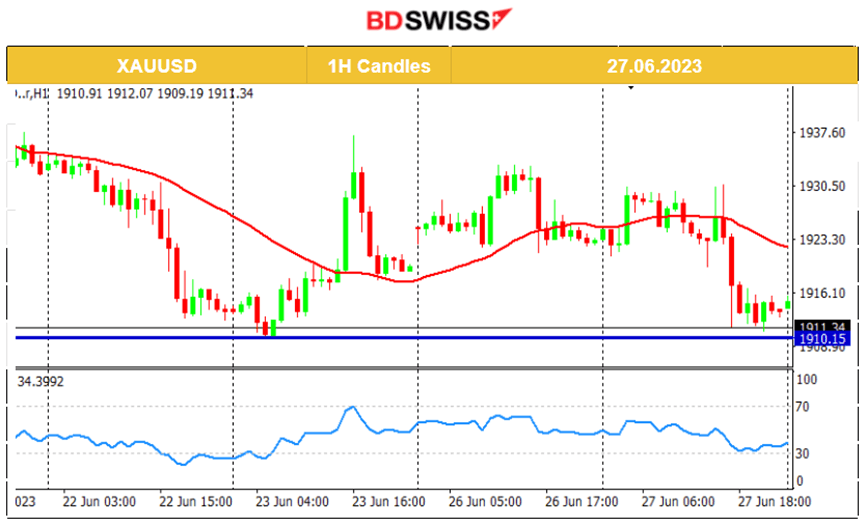

XAU/USD (Gold) 4-day chart summary

Server Time / Timezone EEST (UTC+03:00)

Price movement

Gold moved above the 30-period MA recently and sideways with high volatility. On the 7th of June, it broke an important support near 1919 USD/b and moved lower. 1910 is the next important support that, if it breaks, Gold will probably move further downwards.

News reports monitor – Today trading day (28 June 2023)

Server Time / Timezone EEST (UTC+03:00)

1. Midnight – Night session (Asian)

The monthly CPI change rose 5.6% annually in May. The figure was lower than the 6.8% in April. Seems that the surprise increases from the RBA had the desired effect. AUD depreciated at the time of the release, something expected. AUDUSD dropped more than 40 pips.

2. Morning – Day session (European)

At 16:30 Central Bank governors are participating in a panel discussion titled "Policy panel" at the ECB Forum on Central Banking, in Sintra. Depending on the comments, volatility might reach high levels.

At 17:30 the U.S. Crude oil inventory changes will be released. The price of oil remains low. The number of barrels remaining in inventories grows. Today it is expected a lower negative number -1.4M versus the previous -3.8M change.

General verdict

- No major news is scheduled. More sideways movements.

- AUD pairs experienced a shock and retracements with more volatility are expected for these. Further drop for AUD pairs after breaking important support levels is more possible.

- Indices have shown volatility yesterday. Looking for more today. Probable retracements to take place.

Author

BDSwiss Research Team

BDSwiss

BDSwiss is a leading financial institution, offering bespoke CFD trading and investment products to more than 1.7 million registered clients, in over 180 countries.