Canadian Jobs Preview: Erratic figures set to shape USD/CAD's battle with 1.20

- Canada is expected to report a loss of around 20,000 jobs in May.

- Wild swings in data open the door to an upside surprise.

- The figures – alongside US Nonfarm Payrolls – are critical for USD/CAD's battle over 1.20.

How low can USD/CAD go? The currency pair has already hit the lowest since May 2015, but there might be more in store. The Canadian dollar has been benefiting from rising oil prices, hopes for a robust recovery in the US – Canada's critical trade partner – but what about the local labor market?

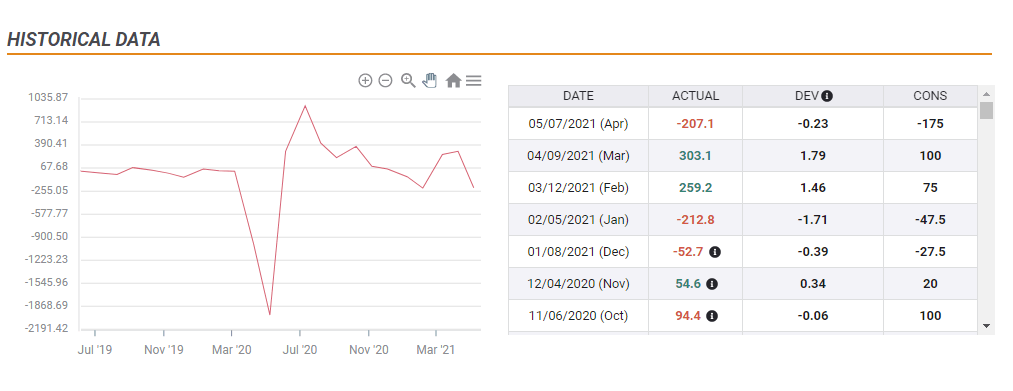

Despite advances in its vaccination campaign, Canada suffered a new wave of COVID-19 cases earlier in the year, resulting in local lockdowns. That is the main explanation for the loss of 207,100 jobs in April. Another reason for the massive labor destruction comes from previous gains – that nation saw an accumulated increase of 562,300 positions in February and March.

The chart below shows the pre-crisis calm and the wild changes afterward:

Source: FXStreet

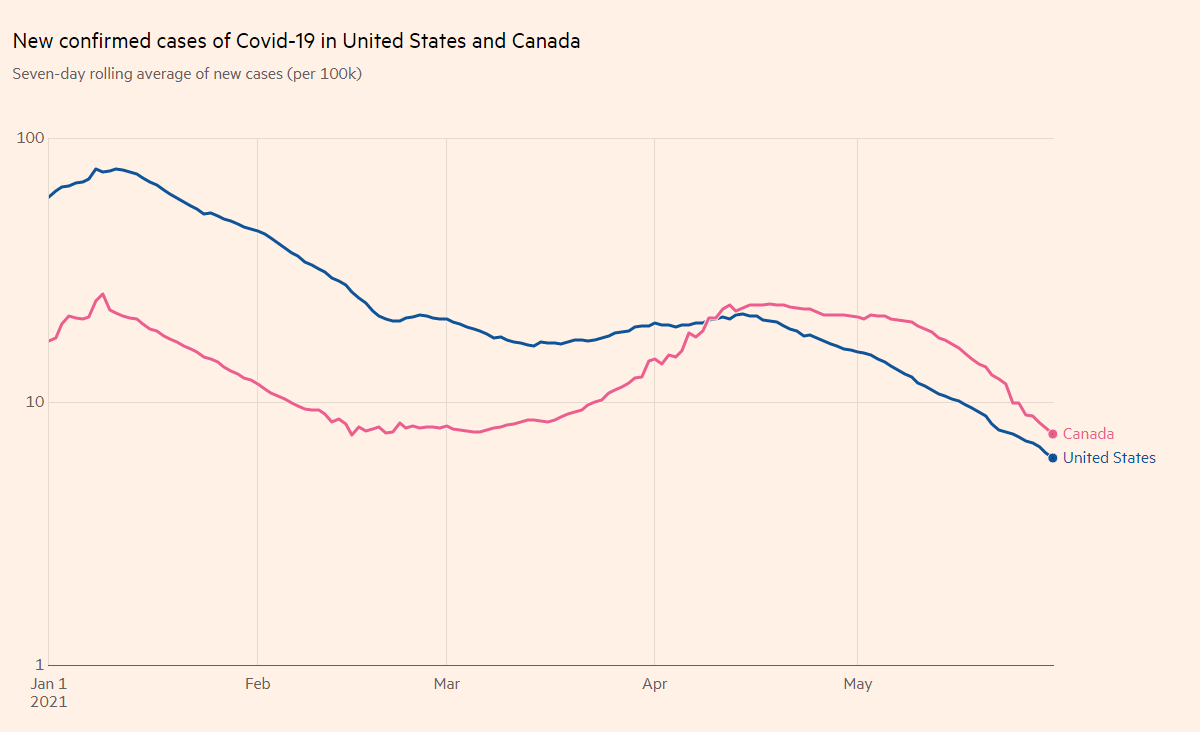

The immunization campaign's pickup and better weather have since contributed to a sharp drop in cases, which led to the easing of restrictions.

This improvement reflected below, implies that Canada may have gained jobs rather than lost them last month.

Source: FT

USD/CAD Reaction

If the assumption above proves correct and a plus sign accompanies the Employment Change figure, the Canadian dollar has room to rise. However, for a meaningful move in USD/CAD, there are additional components to consider.

First and foremost, US Nonfarm Payrolls – America's labor statistics are published at the same time, and they tend to have the upper hand in rocking markets. A big beat in the US could push Dollar/CAD higher even if Canada's labor market springs back. Conversely, a disappointing employment number up north could still be followed by a drop in USD/CAD if the NFP misses for a second consecutive time.

The second factor is oil prices, which have been marching higher and keeping the loonie bid. However, an OPEC+ decision to increase the output of the black gold – and consequent market reactions – could also rattle the C$.

Third, technical positioning is critical. At the time of writing, USD/CAD dipped below the 2017 low of 1.2060 but maintains a safe distance from the round 1.20 level. It is safe to assume that traders have positioned themselves around this psychological barrier. Will a move below 1.20 result in an avalanche or will be firmly rejected? One thing looks certain – volatility is set to be high.

The USD/CAD monthly chart shows that 1.1920 is the next defense before a potential plunge to 1.13. In general, 1.20 is critical battle line.

Conclusion

Canada is recovering and another month of job losses seems pessimistic. A potential upside surprise in labor figures is only one of several factors moving USD/CAD amid its battle around 1.20.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637581410339263173.png&w=1536&q=95)