British pound loses ground ahead of the UK GDP data

The New Zealand dollar declined today even after relatively strong economic numbers from the country. The statistics agency reported that the Food Price Index (FPI) rose for the second straight month in January. It rose by 1.6% after rising by 0.1% in the previous month. In the same period, the Business NZ PMI rose from 48.7 to 57.5. A PMI reading of 50 and above is usually a sign that the manufacturing and services sectors improved. Yesterday, the country’s statistics agency reported relatively strong electronic card sales numbers.

The US dollar wavered in the American and Asian sessions after relatively weak economic numbers from the United States. According to the Bureau of Labour Statistics, the number of initial jobless claims fell from 812k in the previous week to 793,000. Economists polled by Reuters were expecting the data to show an increase of 757,000. In the same period, continuing jobless claims fell from 4.69 million to 4.5 million. The numbers came a day after the US published weak inflation numbers.

The British pound moved lower ahead of important economic numbers from the country. The Office of National Statistics (ONS) will publish the GDP and manufacturing and industrial production numbers at 07:00 GMT. Economists expect the data to show that the economy contracted by 8.1% in the fourth quarter. They also see the manufacturing and industrial production falling by 3.3% and 3.8%, respectively. The bureau will also release the construction production and business investment data.

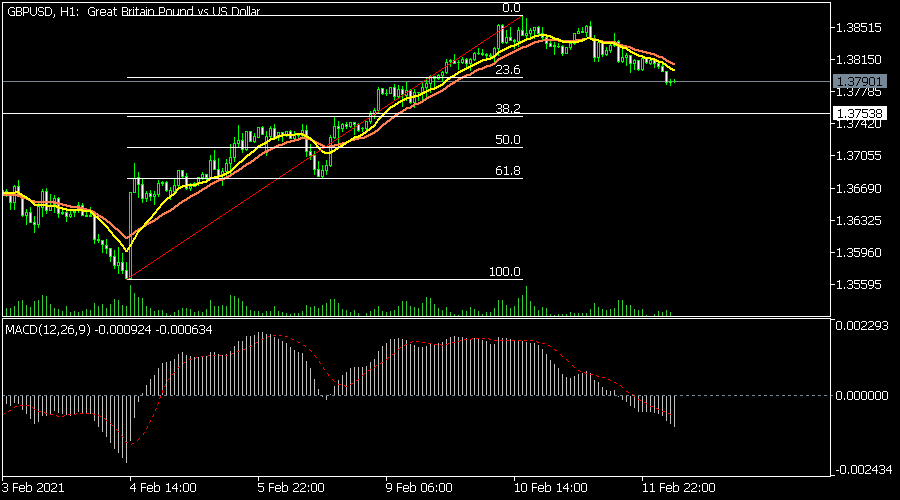

GBP/USD

The GBP/USD price turned lower ahead of the UK GDP numbers. The pair is trading at 1.3790, which is slightly above the important support at 1.3753. On the hourly chart, the 15-day and 25-day exponential moving averages have also made a bearish crossover. It has also moved below the 23.6% Fibonacci retracement level while the MACD has moved below the neutral line. The pair may continue falling as bears target the next support at 1.3753.

EUR/USD

The EUR/USD pair declined in the overnight session after the overall weak US jobless claims numbers. On the hourly chart, the price has declined from a high of 1.2150 to the current 1.2121. The price has also formed a bullish flag pattern that is shown in white. However, it also seems to be forming a bearish divergence pattern as evidenced by the Relative Strength Index (RSI). It has also moved below the 25-day EMA. Therefore, a drop below 1.2100 will be a sign that bears have prevailed while a move above 1.21300 will signal that there are still more bulls out there.

USD/CHF

The USD/CHF price has been in a sharp downward trend recently. It has moved from a high of 0.9044 on February 3rd to today’s 0.8900. On the four-hour chart, the downtrend seems to have found a substantial support level. It is also below the 25-day and 15-day moving averages while the signal line of the MACD has crossed the histogram. The pair may resume the downtrend as bears target the next support at 0.8850.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.