BoJ minutes indicate potential rate hike, Yen slips

The Japanese yen is lower on Friday. USD/JPY is trading at 147.66 in the North American session, up 0.38% on the day.

BoJ minutes show support for rate hikes

The Bank of Japan minutes from the July 31 meeting signaled that the BoJ remains committed to further rate hikes. This reiterates comments from BOJ President Ueda that he will raise rates, provided that growth and inflation are in line with the BoJs forecasts.

At the same time, members expressed concern about the uncetainty due to tariffs. Members acknowledged that the recent trade agreement between the US and Japan had reduced uncertainty and had made it more likely that inflation would be sustainable at the 2% target. Still, members noted that "high uncertainties remain regarding trade policies and their impact".

At the July meeting, the BoJ maintained its policy rate at 0.5% but revised upwards its inflation forecast to 2.7%, up from the previous projection of 2.2%.

On Thursday, the government lowered its growth forecast for this fiscal year due to US tariffs and sticky inflation, which has hurt capital expenditure and consumer demand.

Speaking of consumer demand, Japan's household spending nosedived in in June with a decline of 5.2%. This was a sharp reversal from the May gain of 4.6% and well below the market estimate of -3.0%. Year-on-year, household spending eased to 1.3%, compared to 4.7% in May and shy of the market estimate of 2.6%.

The Federal Reserve is on track to lower rates in September, which would mark the first rate reduction since December 2024. Last week's soft July employment report saw nonfarm payrolls fall to 73 thousand. This was well short of the market estimate of 110 thousand and included sharp downward revisions to the May and June releases.

USD/JPY technical

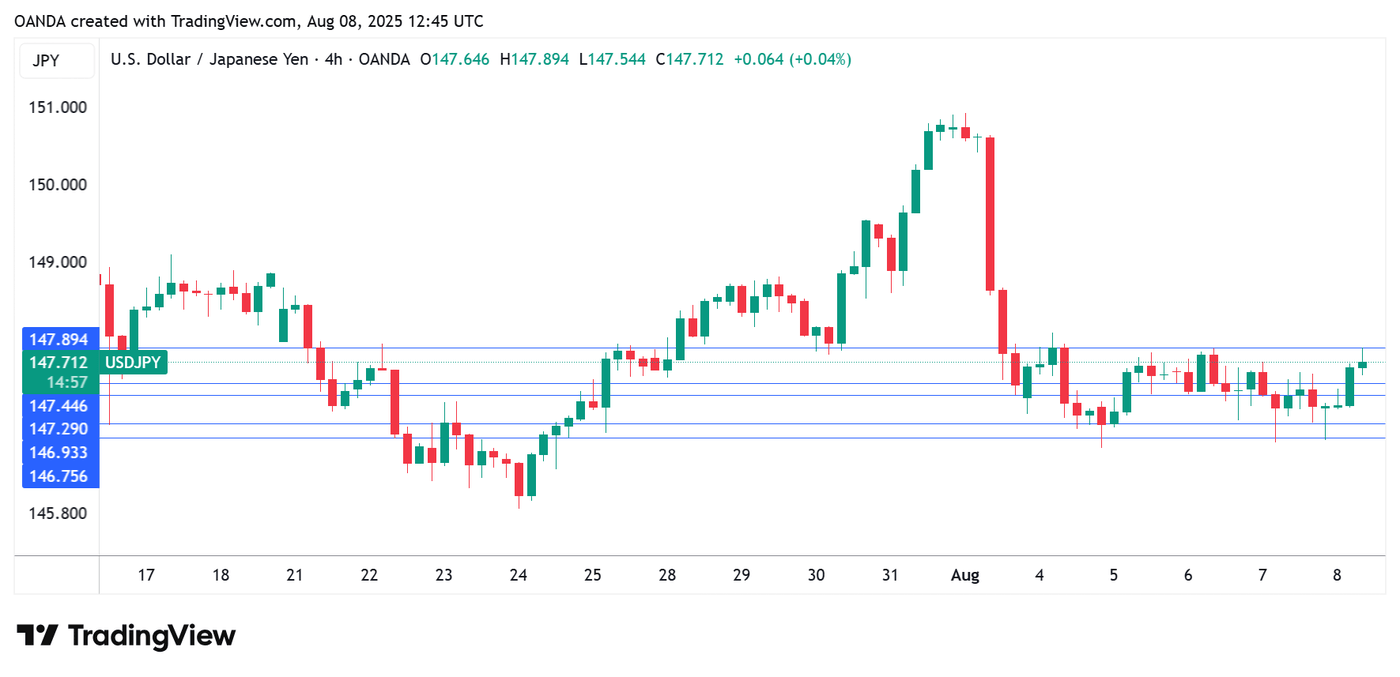

- USD/JPY has pushed above resistance at 147.30 and is testing 147.45. Above, there is resistance at 147.89.

- 1.4694 and 146.75 are the next support levels.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.