BoE February meeting reaction: Hawkish vote on rates sends GBP higher

The Bank of England raised interest rates for the second time in as many months on Thursday, while suggesting that it may be prepared to continue tightening policy in an aggressive manner at upcoming MPC meetings.

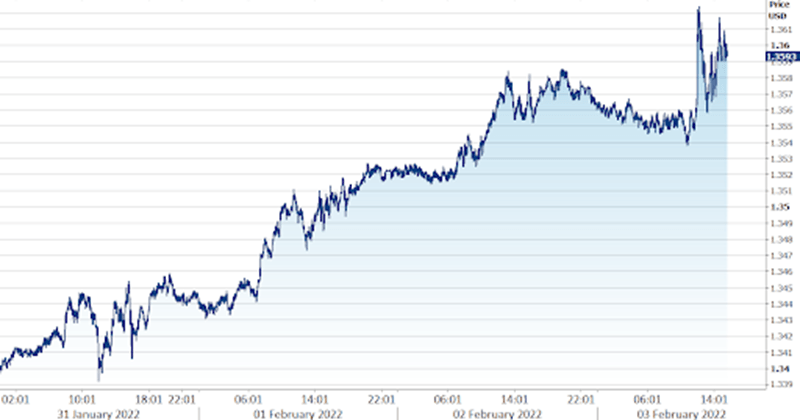

As anticipated, rates were increased by 25 basis points to 0.5% on Thursday, marking the first back-to-back hikes since 2004. The Monetary Policy Committee was unanimous in favour of raising rates at this week’s meeting with December’s lone dove, Silvana Tenreyro, joining her colleagues in voting for an immediate hike. There was, however, a significant hawkish surprise, with four of the nine voting members, Ramsden, Saunders, Haskel and Mann, all in favour of a 50 basis point move in rates. This caught investors completely wrong-footed, and triggered a sharp move higher in the pound to a two-week high above the 1.36 level versus the US dollar (Figure 1).

Figure 1: GBP/USD (31/01/2022 – 03/02/2022)

Source: Refinitiv Date: 03/02/2022

Prior to today’s meeting, financial markets were fully pricing in a 25 basis point increase in rates, so while the announcement itself came as little surprise, the split decision on the size of move was very much unexpected. We see this as a clear sign that the MPC isn’t in a mood to mess about when it comes to raising interest rates this year, and that policymakers are growing increasingly concerned with UK inflation. In its statement, the MPC cited ‘current tightness of the labour market and continuing signs of greater persistence in domestic cost and price pressures’ as rationales for the hike. The hawkish faction also argued that a larger move was needed ‘in order to reduce the risk that recent trends in pay growth and inflation expectations became more firmly embedded’.

The Bank of England remains one of the most hawkish central banks in the G10, in large part due to the continued overshoot in UK inflation, which rose to a 30-year high 5.4% in December. As we anticipated, the BoE has revised its near-term inflation forecasts sharply higher and now expect headline price growth of 5.2% in a year’s time, versus the 3.4% expected in November. UK inflation is also now projected to peak at an unfathomable 7.25% in April, partly a consequence of rising energy costs. The UK government announced earlier on Thursday that the average household energy bill was set to increase by £693 this year, and that is clearly at least partly behind today’s hawkish vote. Meanwhile, the bank’s growth forecast for this year was revised modestly lower, as we had predicted. Policymakers now see growth of 3.75% in 2022, versus the 5% expected in November.

Figure 2: Bank of England Inflation Forecasts [February 2022]

Source: Refinitiv Date: 16/12/2021

In his press conference, Governor Andrew Bailey adopted a more measured approach on rates. He said that inflation could fall faster than the BoE’s central scenario if energy prices ease as the market expects. While he acknowledged that further tightening would likely be warranted, he also urged the market not to get too carried away with expectations for rate increases, noting that it would be a mistake to assume that rates are now ‘on an inevitable long march upwards’. His tone tempered the market’s initial excitement, and by the end of his press conference the pound was trading only modestly higher for the day.

Despite Bailey’s cautious tone, we see today’s hawkish vote on rates as vindication of our bullish sterling view. We expect to see a continuation of this aggressive hike cycle at upcoming meetings, and still believe that the Bank of England will be among the most aggressive in raising interest rates in the G10 in 2022. Markets have been quick to react, and at the time of writing are already fully pricing in another 25 basis point hike at the 17th March meeting, with a total of four to five additional rate increases now expected by the end of the year. This seems viable, in our view, although all now depends on the speed at which UK inflation returns back towards the bank’s 2% target.

Author

Matthew Ryan, CFA

Ebury

Matthew is Global Head of Market Strategy at FX specialist Ebury, where he has been part of the strategy team since 2014. He provides fundamental FX analysis for a wide range of G10 and emerging market currencies.