Bitcoin ‘bart simpson’ returns as BTC price dives 7% in hours

Bitcoin (BTC) firmly recommitted to its trading range on June 7 after a fresh move higher was met with a swift sell-off.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

“Some of the best chop we’ve seen”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rejecting decisively at resistance it last encountered on June 1.

The pair had delivered daily gains in excess of 6%, but the approach to $32,000 changed the mood, and Bitcoin gave back almost $2,500 in a matter of hours.

A classic “Bart Simpson” structure thus formed on hourly timeframes as frustrated traders came to terms with the existing paradigm remaining unchallenged.

“Standard price action again on Bitcoin in which all the lows are swept,” Cointelegraph contributor Michaël van de Poppe wrote in a Twitter update.

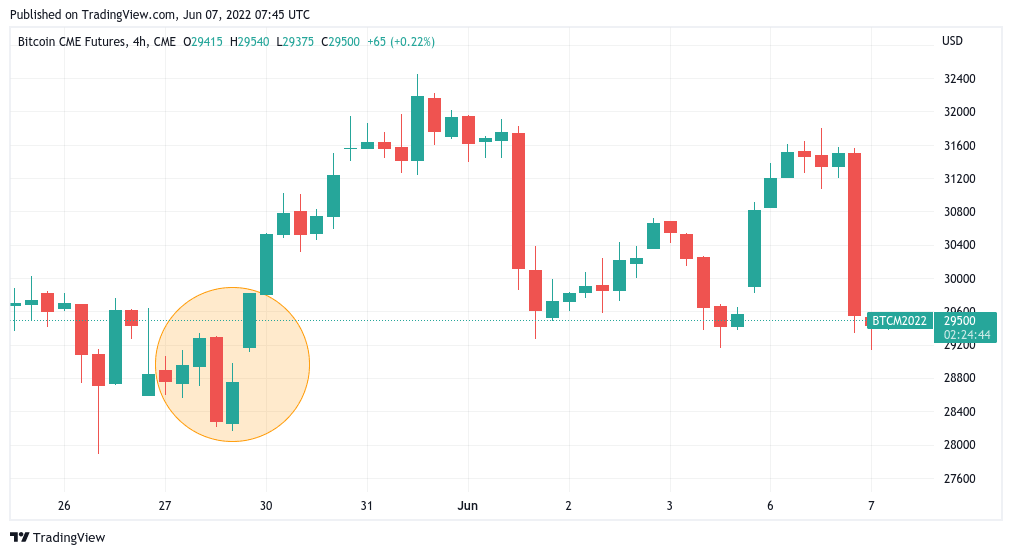

If we hold around $29K, still presumably enough reason to go for a slight run. (And $29K area is still CME gap territory).

CME Bitcoin futures 4-hour candle chart with unfilled gap highlighted. Source: TradingView

In addition to the CME futures gap providing a potential target at levels seen before the gains, on-chain analytics resource Material Indicators noted significant buy interest already lined up at those levels.

Should that not hold, targets focused on the area around $28,000 next.

“I will simply be looking for short opportunities in this range,” fellow trading account Crypto Tony continued, nodding to the overall downtrend continuing.

Either we lose the range low and will short a retest, or if we retest the EQ of the range and reject i will look for a short position. Flat until one of these triggers plays out.

One market participant not at all surprised by the short-timeframe action was Filbfilb, co-founder of trading platform DecenTrader.

“Some of the best chop we’ve seen tbh, high quality stuff,” he joked.

I’d say it’s always the same, people desperate not to miss the ‘bottom’ but this one is particularly funny how it’s instantly reversing. Trade chasers getting absolutely ruined.

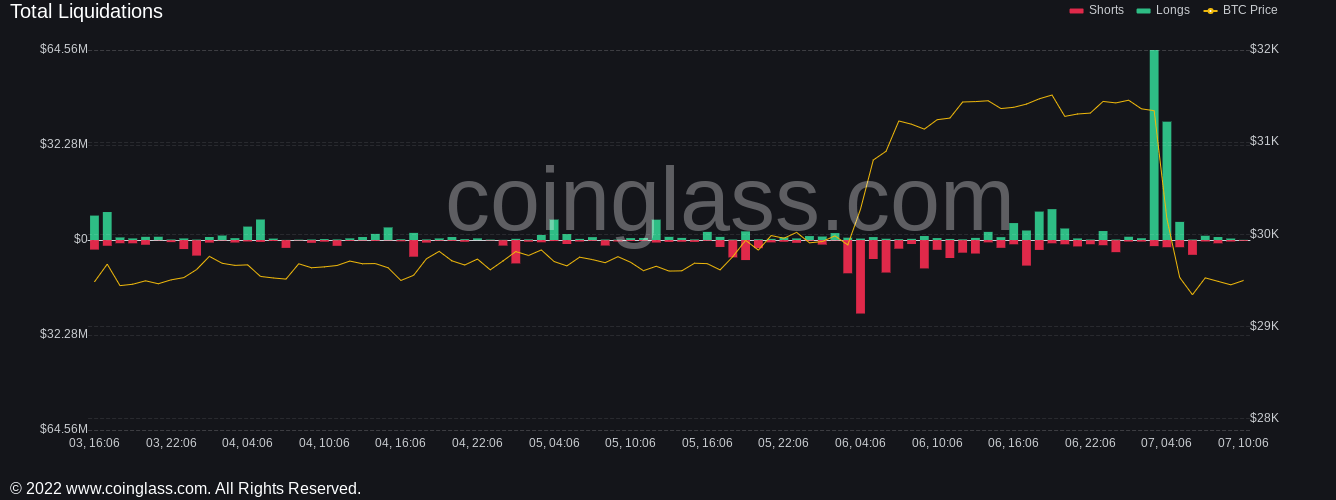

Long traders battling volatility sparked 24-hour liquidations totaling $60 million for BTC and another $158 million on altcoins, data from analytics platform Coinglass confirmed.

Crypto liquidations chart. Source: Coinglass

Stocks correlation blurred

Bitcoin altcoins thus severely underperformed compared with notionally correlated United States equities.

Both the S&P 500 and the Nasdaq Composite Index finished the June 6 trading session above the open, putting their relationship with crypto in question.

Yassine Elmandjra, a crypto asset analyst at ARK Invest, nonetheless noted that Bitcoin’s overall correlation to the S&P had reached new all-time highs on a rolling 30-day basis.

Discussing BTC price action further, he argued that "major" trendlines remained intact on BTC/USD, even given May's dip to $23,800. This, as Cointelegraph reported, was still ripe for a retest in the eyes of many.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.