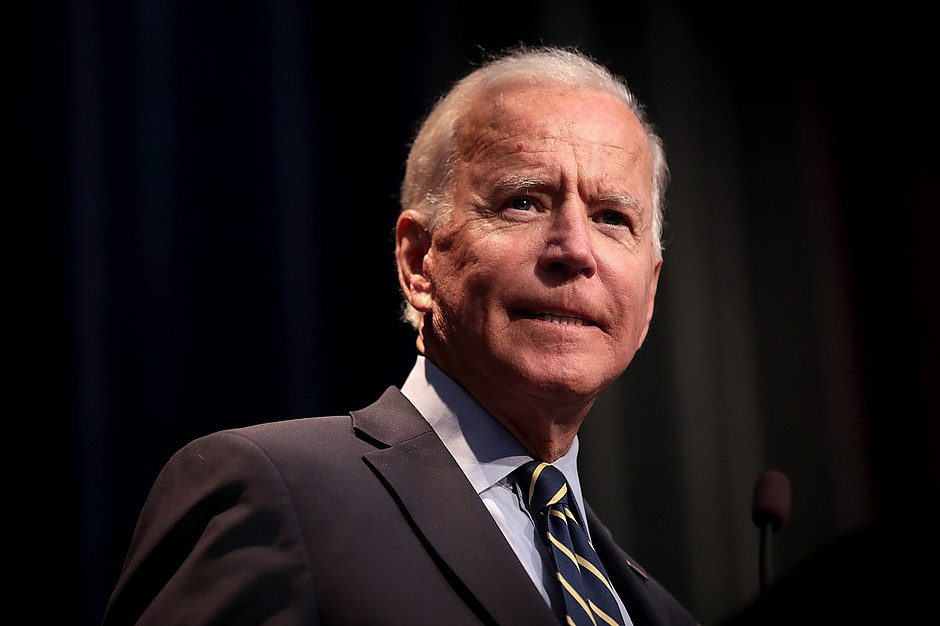

Biden steps down, adding fresh uncertainty into the race for the White House

-

European markets on the rise.

-

PBoC cuts key interest rates.

-

Biden steps down, adding fresh uncertainty into the race for the White House.

European markets are on the rise in early trade, coming off the back of yet another tumultuous weekend for Western politics. Coming off the back of a week that saw the ECB hold off in the face of continued inflation pressures, we have seen the 10-year yields weaken in a sign of continued confidence that a September rate cut remains highly likely. Donald Trump has sought to interfere in the Fed’s decision-making, warning against a rate cut before the election. However, as things stand markets can remain optimistic at the prospect of a rate cut from the FOMC, ECB and BoE.

The Hang Seng enjoyed a welcome boost in the wake of a surprise rate cut from the PBoC, with the Chinese central bank finally opting to cut key interest rates in a bid to prop up an economy that continues to stutter. Coming off the back of the recent GDP decline, the bank cut the 7-day, 1-year rate (the benchmark for most corporate and household loans) and 5-year rate (a reference for property mortgages) by 10-basis points. With questions remaining for the Chinese outlook in the face of potential trade wars and real estate concerns, traders are left wondering whether to be worried about the direction of the economy, or optimistic that the PBoC are taking a more proactive stance.

Following a period of intense focus on the French election, the past two weekends have seen the markets fixate upon the battle for the White House. Interestingly, it appears to be the case that an assassination attempt aimed at removing Donald Trump from this Presidential race instead put the final nail in the coffin for Joe Biden’s reelection hopes. An already ailing reelection campaign saw support and funds begin to dry up, forcing a change aimed at limiting the hopes of a Republican victory that looked like it could bring a victory across both sides of congress. For markets, the ‘Trump trade’ gains served to highlight the perception that a victory for the Republican leader would be good for US businesses, crypto, and stocks. However, we now enter a period of uncertainty, with traders weighing up whether it will be Kamala Harris to take on Trump and what changes the Democrats would seek to bring in the event of a victory. Questions have been asked of Harris’ ability to take on Trump, with her rather uninspiring ratings serving to highlight the hard yards needed to turn the polls back in her favour. Ultimately, markets have been served up a fresh bout of uncertainty, and the coming period will likely see some jitters as we seek to gauge whether the Trump-led gains should be reversed.

Author

Joshua Mahony MSTA

Scope Markets

Joshua Mahony is Chief Markets Analyst at Scope Markets. Joshua has a particular focus on macro-economics and technical analysis, built up over his 11 years of experience as a market analyst across three brokers.