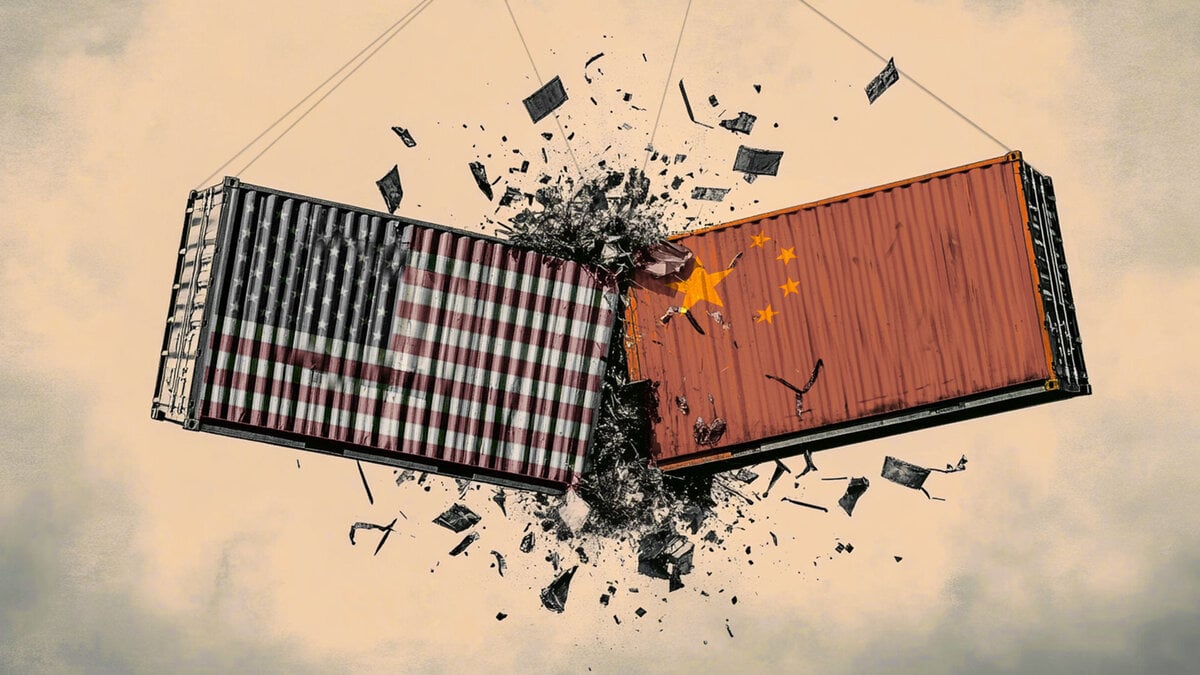

Beijing tightens the spigot: Rare Earths become the new chips in the great power trade war

Markets have long understood that China’s leverage doesn’t lie only in what it consumes but in what it controls. And now, weeks before Donald Trump and Xi Jinping are set to sit down for what could be the most consequential trade parley since tariffs first became a household word, Beijing has reached for one of its sharpest tools — rare earths. The Ministry of Commerce’s new export curbs, framed under the banner of “national security,” go far beyond bureaucratic fine print. They mark a deliberate tightening of the spigot on the minerals that power the modern world’s nervous system — from semiconductors to missile guidance systems.

In trader terms, this isn’t saber-rattling; it’s showing the other side the chips you’re willing to cash. China supplies roughly 70% of the world’s rare earth elements — a quiet dominance forged over decades of vertical integration. And just as Washington weaponized chips, Beijing has now turned its own critical-materials complex into a pressure valve. Starting November 8, not only will key rare earths like holmium, europium, ytterbium, thulium, and erbium fall under new scrutiny, but also graphite, lithium-ion batteries, and even synthetic diamonds — a wink to the fact that the future battlefield of technology isn’t just silicon but chemistry.

The subtext is strategic theater. Beijing is saying: you can’t decouple from what you still need to build your own decoupling. Every rare earth molecule embedded in a U.S. or European chip design now carries geopolitical weight. The new licensing rule that applies to “trace” Chinese content ensures that even the cleanest Western supply chains will still have to look over their shoulder before shipping. It’s the ultimate game of sanctions ping-pong — each volley landing closer to the industrial heart.

The policy’s fine print does something even more telling: it explicitly denies exports for defense use. That may sound procedural, but for markets, it’s a red flare. It turns what was once administrative oversight into discretionary enforcement. Beijing now has a scalpel it can use to carve up who gets what, when, and why. That uncertainty is leverage — not just in diplomacy, but in pricing power. Rare earth contracts are notoriously illiquid, but expect volatility to spike as traders begin pricing in the probability of selective throttling.

This move also hits Western efforts to insulate themselves. The Pentagon’s $400 million bet on MP Materials for a magnet plant suddenly feels like buying an umbrella in a hurricane. The technology and machinery needed to process these minerals — still overwhelmingly Chinese-made — now fall under the same restrictions. It’s a reminder that in the global supply chain, owning the mine doesn’t mean you own the means of production.

China’s addition of 14 foreign organizations, including defense contractor BAE Systems, to its “unreliable entity list” adds another layer of warning. It signals a willingness to personalize retaliation — turning corporate risk into diplomatic currency. The message to Western boardrooms is clear: you are now in the negotiation too.

From a market standpoint, this development lands squarely in the middle of a fragile détente narrative. The Trump-Xi meeting had been penciled in as a possible reset — an opportunity for mutual tariff relief or at least a managed pause. Instead, the chessboard just got rewired. Rare earths, once an obscure corner of the commodities market, have now joined the pantheon of strategic assets, alongside chips and oil, as instruments of economic statecraft.

For traders, this escalation isn’t just about material scarcity; it’s about the repricing of geopolitical risk. It compresses volatility across energy, metals, and tech — effectively tethering the EV and AI trades to the next round of diplomatic brinkmanship. Futures on copper, lithium, and even semiconductors may start to trade less on fundamentals and more on the choreography of Washington–Beijing posturing. The playbook is shifting: political risk is the new yield curve.

So while the headlines scream about export curbs, the real story lies beneath the surface — in how Beijing is reshaping leverage itself. This is not the same play as the 2010 rare earth embargo on Japan. It’s subtler, more layered, and entirely global in scope. Think of it as China’s version of a covered call: limit the upside for adversaries while keeping downside control in your own hands.

In the weeks ahead, as traders parse every pre-summit headline, expect the phrase “rare earth premium” to return to market vocabulary. Beijing has shown that it’s willing to weaponize the mundane to move the magnificent. In a world addicted to AI, EVs, and chips, the dirt under China’s soil just became the most strategic asset class of all.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.