Banking game of chicken

S&P 500 didn‘t maintain premarket momentum as fresh banking doubts resurfaced, pulling down cyclicals. It wasn‘t though a full-blown panic as (tech) megacaps, semiconductors and communications were benefiting alongside long-dated Treasuries. 2y yield is though clear on what it expects from the Fed – no more serious tightening (fuelling PMs). That would translate into compromising on the fight against inflation, and towards backstopping the financial system ($300bn balance sheet expansion in a week plus $160bn over the discount window is handily outdoing the Great Financial Crisis actions).

This time, it‘s not the result of making recless loans, but an unintended, poorly hedged consequence of the fastest rate raising cycle since mid 1990s as I argued in Monday‘s extensive analysis. In normal circumstances, banks don‘t have to worry about sitting on Treasuries‘ losses if they hold to maturity. When they though have to sell because of depositors withdrawing funds, that‘s a different story. Sure that T-Bills at 5% (and CDs, money market funds) provide such an incentive, which has been newly amplified by bank health worries (aka the dreaded bank run, difficult to stop once underway), which has the power to negatively impair even the healthier banks.

The Fed though acted fast and decisively, and the market gyrations within S&P 500, XLF and KRE witnessed, reflect more so uncertainty about the problem‘s magnitude and future path (we are talking many hundreds of billions in underwater instruments – again, unless they have to be forcefully sold, the issues won‘t manifest to their full extent) than doubt about the central bank‘s resolve.

The Fed had no other choice, and it‘ll be interesting to see how it balances the banking system stability with inflation fight. ECB might have done a face saving 50bp hike (no promises next), and Fed is likely to hike by 25bp on Wednesday. Even though inflation is retreating, it‘s still uncomfortably high, and pretty much everything services related still hot, meaning the inflation fight is far from over. Debt ceiling ahead is another issue on the radar screen. Still, the Fed is likely to keep if not tightening, then at least not lowering rates this, meaning any time, soon.

Let‘s move right into the charts.

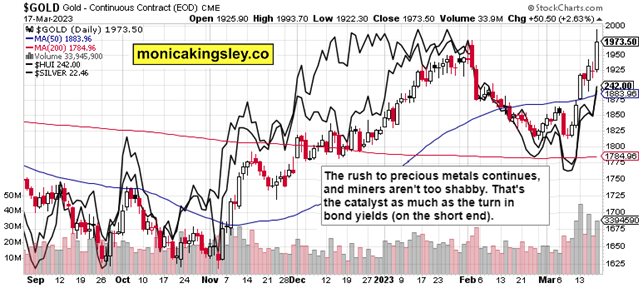

Gold, Silver and Miners

Source: www.stockcharts.com

Precious metals have very clearly turned the corner, and will continue rising even as inflation is to retreat (but remain sticky). This is the main asset class star of 2023.

Crude Oil

Source: www.stockcharts.com

Crude oil really hasn‘t found bottom yet, $66 support discussed early last week, was reached fast. Energy woes aren‘t yet over, but mid year should be approaching $90 again. Short-term outlook though remains problematic even if we do really bounce nicely as black gold usually gets the upcoming recession first.

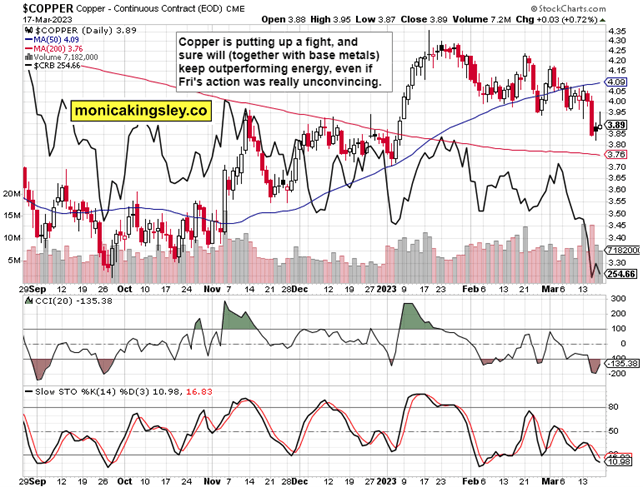

Copper

Source: www.stockcharts.com

Great resilience in copper overall, but some further basing seems required. Still, it would be first gold, then silver with copper recovering from any setbacks this year.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.