Bank of Canada Preview: Canadian Dollar set to climb on hawkish hold, market positioning

- Investors expect the Bank of Canada to hold interest rates at 4.50% in March.

- Softer inflation figures have depressed projections for the path of borrowing costs moving forward.

- A vibrant labor market may push the BoC to leave the door open to new rate hikes.

- The RBA's dovish hike lowers expectations for Canada.

Is being first a good thing? The Bank of Canada (BoC) has been reiterating its intentions to pause raising rates, and now it is time to deliver – ahead of its peers. The "pivot" announcement has hurt the Canadian Dollar, as investors now expect the BoC to cut borrowing costs as its next moves. However, nothing is guaranteed, and I will lay out why I expect the Canadian Dollar to jump in response to the decision, to be released on Wednesday at 15:00 GMT.

Canadian inflation is down, employment is booming

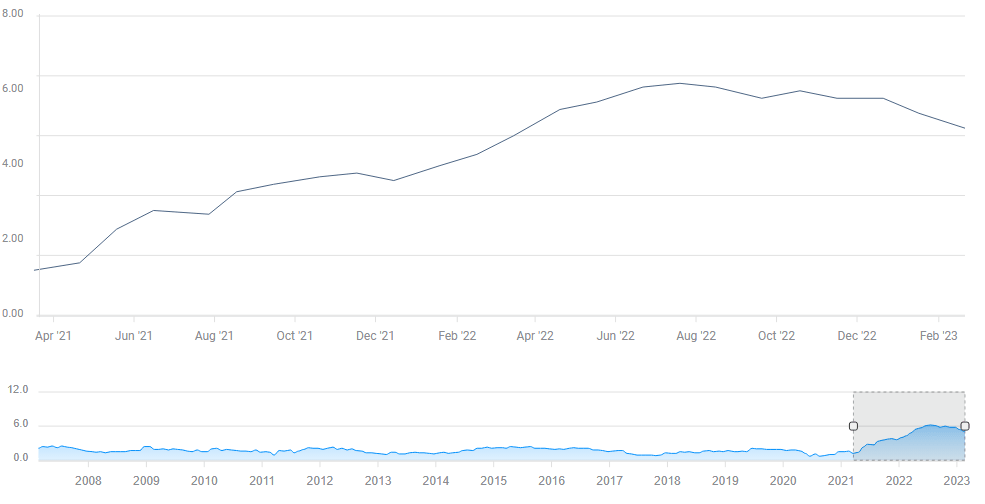

The Ottawa-based institution last announced its decision in late January, raising the overnight rate to 4.50%. Back then, it clearly stated that it is about to pause, and inflation data backed this move. Canada’s Core Consumer Price Index (Core CPI) decelerated from a peak of 6.2% to 5% YoY in the latest read for January 2023.

Source: FXStreet

Core CPI excludes volatile prices of food and energy, representing costs that tend to stick for longer, such as services that depend on wages. The Bank of Canada closely watches the US Federal Reserve (Fed) and the latter's focus on work-related inflation.

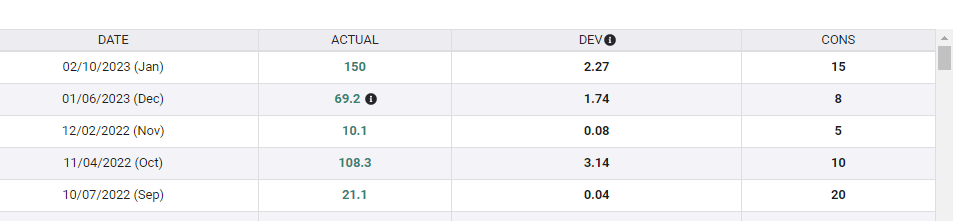

On the other hand, the Fed has expressed its intent to continue hiking rates and one of the reasons is America's tight labor market. Canada is no different, with five consecutive months of better-than-expected increases.

Source: FXStreet

Demand for workers remains high in Canada, which accepts more immigrants, yet still has a low unemployment rate of 5.1%. With a fast expansion in the labor market, Canada could soon see not only lower interest rates but also higher wages.

The BoC could lean on the booming labor market to leave the door open to fresh interest rate hikes, sending the Canadian Dollar higher. A pause in hikes could be the first step before cutting rates, but also just a stop on the way up.

Low expectations after the RBA's dovish decision

Bank of Canada officials announce their rate decision one day after the Reserve Bank of Australia (RBA) signaled a less hawkish stance – hinting at an early end to rate hikes. As both countries are exporters of commodities, markets tend to draw conclusions from one central bank to another.

Investors are probably eyeing a signal of a long pause from Canada, eventually leading to a cut, also based on the RBA's decision. However, Canada is highly dependent on the United States and its buoyant economy, rather than Australia, which is slowing down as China's growth prospects look dimmer.

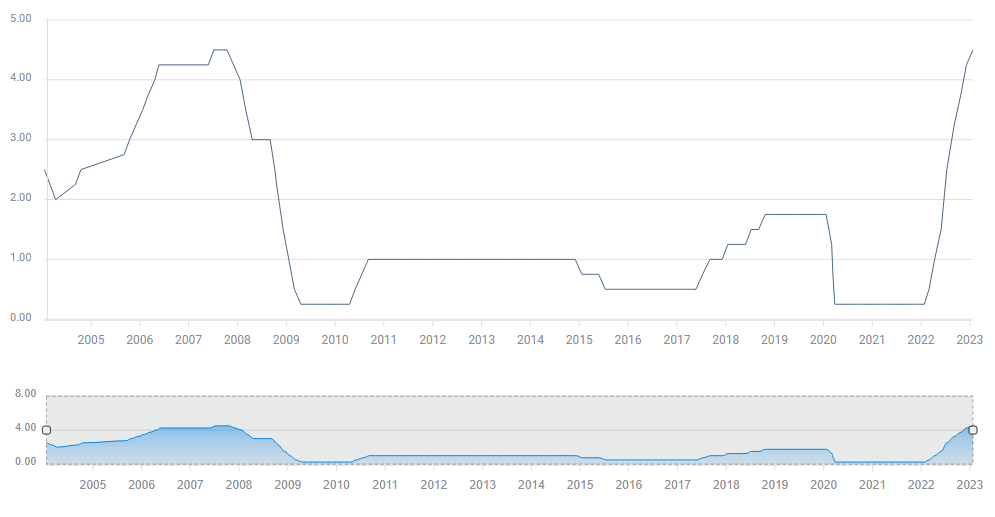

Overall, the BoC is set to leave rates at 4.50%, which was the pre-financial crisis peak – but that does not mean a repeat of the rapid cuts seen nearly 16 years ago.

Source: FXStreet

Final thoughts

The Bank of Canada is set to be the first major central bank to pause its rate hike cycle, and the outcome depends on the bank's future intentions. There is no press conference this time, which means volatility could be significant in case the statement is vague. Yet, BoC Governor Tiff Macklem and his colleagues tend to be clear about their intentions.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.