Austria's Central Banks Says More QE is Counterproductive

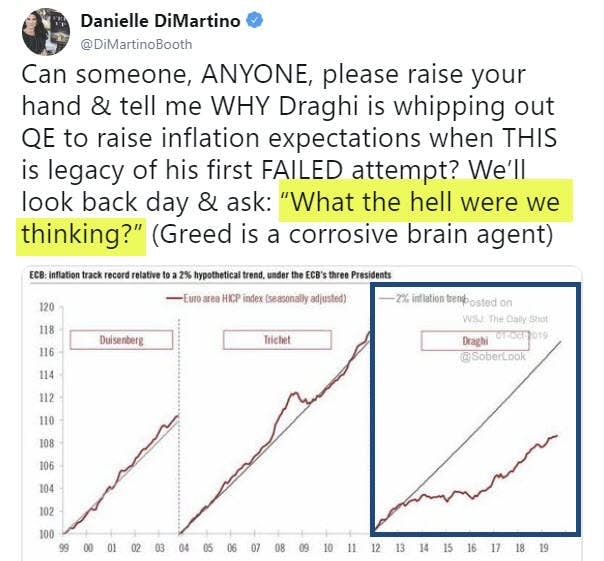

Dissent within the ECB over QE is at unprecedented levels and rising. But what does "counterproductive" really mean?

Several members of the European Central Bank’s Governing Council are against the ECB buying more bonds. Add Austrian central bank Governor Robert Holzmann to the list.

Holzmann says Draghi’s QE Policy Is Counterproductive

“The view was that the attempt to inject even more liquidity isn’t good, even counterproductive,” Holzmann told Austrian public TV broadcaster ORF in an interview. “Several governors didn’t consider this proposal the right policy for the purpose.”

There are concerns about the economic impact of the policy, which ECB President Mario Draghi flagged in a speech at a conference in Sintra, Portugal, without first discussing it in the Governing Council, Holzmann said.

“Draghi’s behavior wasn’t that of a person inclined to consider divergent views,” Holzmann said.

Holzmann was among several governors who dissented publicly with the policy after the ECB’s last policy meeting. Bundesbank President Jens Weidmann, Draghi’s most prominent and longstanding critic, previously told Germany’s tabloid Bild newspaper that the ECB delivered a package that was out of proportion with an economic prognosis that “isn’t that bad.” Dutch Governor Klaas Knot also released a statement explaining his opposition.

Negative Rates and More QE are Destabilizing

QE and negative rates are destabilizing forces.

Negative rates are a drain on bank profits and the Eurozone banks are in dire straits.

Does that make Draghi's efforts counterproductive?

The answer depends on another question.

What's Draghi's Goal?

Before one can state a policy is counterproductive, one must first understand the goal.

What is the goal?

If the goal is to stabilize banks and promote more lending, Austria's Holzmann, Germany's Weidmann, and the Netherlands' Knot are surely correct.

Draghi's Brilliant Plan

If Draghi goal is to bankrupt the banks to get Germany to agree to commingled budgets and an entire Eurozone-wide bank bailout, then Draghi's plan is brilliant.

What the Hell is the ECB Doing?

I discussed the setup and dissent on October 3 in What the Hell is the ECB Doing?

Mario Draghi proposed investigating MMT, a combined Eurozone budget, and "QE for the people" even though these ideas are counter to the Maastricht Treaty of 1992 which formed the Eurozone.

Why?

- That's what it takes to save Italy

- That's what it takes to "preserve the Euro".

Whatever it takes baby, and that's what it takes, not to save German banks, but rather Italian banks and the Eurozone itself.

So, is Draghi's QE counterproductive or not?

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc