Australian GDP beats forecast, Aussie edges higher

The Australian Dollar has extended its gains on Wednesday. AUD/USD is trading at 0.6271 in the European session, up 0.20% on the day. The Australian dollar jumped 0.75% on Tuesday, driven by the hawkish Reserve Bank of Australia minutes and a solid retail sales report.

Australian GDP rises 1.3%

Australia’s economy expanded by 1.3% y/y in the fourth quarter of 2024, up from 0.8% in Q3 and above the market estimate of 1.2% and the RBA’s forecast of 1.1%. This marked the fastest pace of growth since Q4 2023.

Quarterly, GDP grew by 0.6%, following 0.3% in Q3 and higher than the market estimate of 0.5%. This was the fastest pace of growth since Q4 2022. The strong gain was driven by strong increases in household spending and exports.

The positive GDP report follows last week’s rate cut, after the central bank held rates for over a year. The cash rate is currently at 4.10%, its lowest level since Oct. 2023. The RBA has remained hawkish, even with the rate cut. The minutes of the meeting stated that members remained concerned that further cuts could jeopardize maintaining inflation in the target range of 2%-3%.

The markets are more dovish and expect the cash rate to fall to 3.6% by the end of the year, which would mean two more cuts of 25 basis points. The central bank’s rate path will largely depend on the inflation levels as well as the strength of the labor market, which has been surprisingly robust despite high interest rates and a weak economy.

In China, this week’s PMIs are pointing to slightly stronger growth. The Caixin Manufacturing PMI for February improved to 50.8, up from 50.1 in January and above the market estimate of 50.3. The Caixin Services PMI rose to 51.4, up from 51.0 in January and above the market estimate of 50.8.

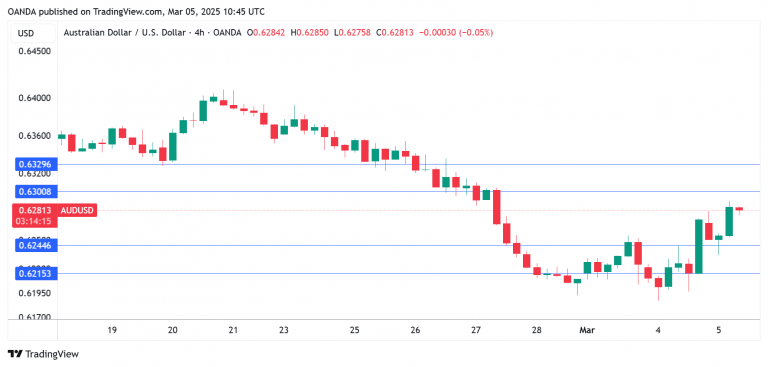

AUD/USD technical

-

AUD/USD is testing resistance at 0.6228. Above, there is resistance at 0.6251.

-

0.6200 and 0.6177 are providing support.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.