August employment: Size of September rate cut remains

Summary

The August employment report indicated that while the jobs market is not unraveling, it continues to clearly weaken. Employers added 142K jobs in August, which was a bit less than expected, but came on the heels of another significant downward revision to prior months' hiring. Over the past three months, employers have added 116K jobs, a notable deceleration from the 207K average pace in the first half of the year. The breadth of hiring improved slightly over the month but continues to be concentrated in less-cyclically sensitive industries.

The unemployment rate ticked down to 4.2% in August from 4.3%, offering some comfort that labor market conditions are not deteriorating in a non-linear way. However, joblessness has continued to rise on trend, with the Sahm Rule indicator, at 0.57, still above the threshold historically associated with recession. The rise in the broader U-6 measure of unemployment, which also captures under-employment, to a new cycle high demonstrates further signs of softening beyond the Employment Situation report's marquee nonfarm payroll numbers.

An especially strong or weak employment report could have crystallized the 25 or 50 bps rate cut debate for the FOMC's upcoming meeting. Instead, today's data have offered something for both the hawks and the doves on the Committee.

We have been projecting a 50 bps rate cut at the September FOMC meeting for the past month, and for now we are leaving that forecast unchanged. That said, neither outcome would surprise us at this point, and we will be listening to the remaining remarks from Fed officials before the black out period and waiting for Wednesday's CPI report for final clues. Regardless of what shakes out in September, we are confident that a series of rate cuts are coming in the months ahead. Any additional labor market cooling would be unwelcome for the FOMC, and as a result shifting the stance of monetary policy from restrictive to neutral over the next year or so remains our base case.

Labor market still cooling, but expansion remains intact

Nonfarm payrolls grew by 142K in August, a bit weaker than the Bloomberg consensus forecast that was looking for a 165K gain and our expectation for a 145K increase. Downward revisions to job growth in the prior two months pushed the three-month moving average for nonfarm payroll growth down to 116K. This marks a notable deceleration from the average monthly job growth of 207K in the first half of the year and 251K in 2023. Furthermore, the hefty 818K downward revision to the level of employment in March implied by the preliminary annual benchmark revision suggests the current pace of hiring could be even lower if the Bureau of Labor Statistics' methodology is continuing to overstate the boost to payrolls generated by new firms.

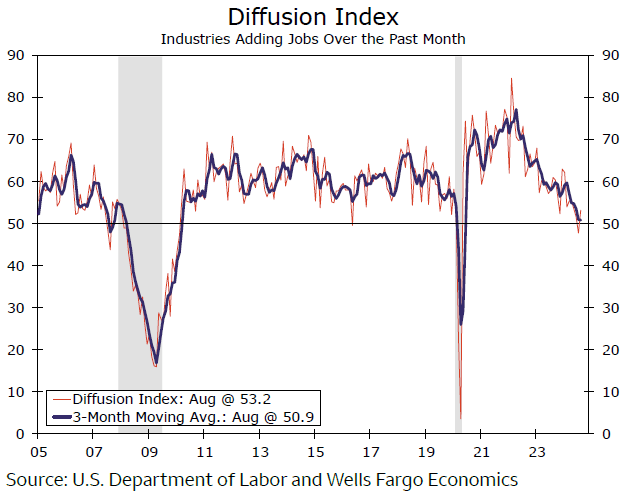

Job growth in August was a bit more broad-based than it was in July. The labor market diffusion index, a measure of the breadth of hiring across industries where higher numbers imply more broad-based hiring, rose to 53.2 from 47.8 in July, but this remains a fairly narrow hiring base relative to earlier in this expansion and the 2010s cycle (chart). Employment growth continues to be led by hiring in less cyclically-sensitive industries such as health care & social assistance (+44K), leisure and hospitality (+46K) and government (+24K). Construction employment also posted a strong 34K increase in the month, but elsewhere hiring was tepid with just a 8K increase for profession and business services and contractions in manufacturing (-24K), retail trade (-11K) and information (-7K).

Author

Wells Fargo Research Team

Wells Fargo