AUDUSD Forecast: Aussie poised to decline, but employment data in the way

AUDUSD Current Price: 0.6725

- The US Dollar met demand amid a worsening market mood.

- Australia to report October employment data early on Thursday.

- AUDUSD could correct lower according to near-term technical readings.

The AUDUSD pair trades around 0.6720, shedding some ground on Wednesday amid a worsening market mood. The US Dollar found modest demand, particularly in the American session, and as stock markets edged lower. Market participants turned risk-averse amid the latest development in the Russian-Ukraine war but also spooked by fears global inflation may continue to harm economic growth. Global stocks edged lower, dragging alongside the Australian Dollar.

According to the Australian Bureau of Statistics, Australia published the Wage Price Index, which rose by 1% in the third quarter of the year. The annualized figure hit 3.1% in the three months to December, the highest in almost two decades. Nevertheless, it is still half the country’s inflation as the Consumer Price index stands at 7.3% YoY.

Australia will publish October employment figures on Thursday. The country is expected to have added 15,000 new job positions in the month, while the unemployment rate is foreseen to tick higher, to 3.6% from the current 3.5%.

AUDUSD short-term technical outlook

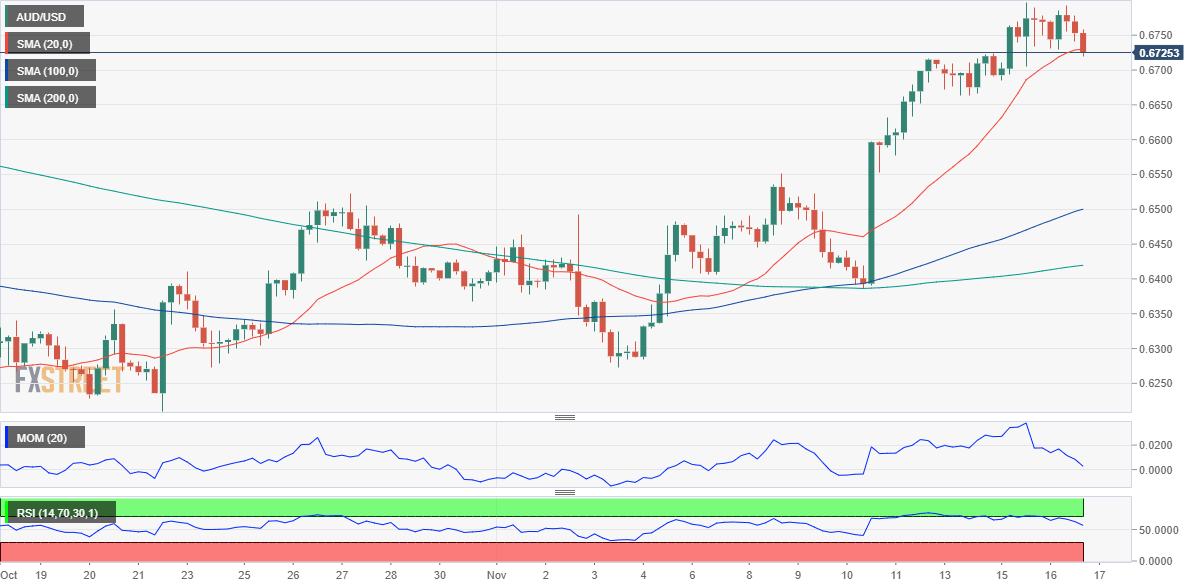

The AUDUSD pair trades near its daily low ahead of the US close, which somehow skews the risk to the downside. In the daily chart, the pair is holding above a flat 100 SMA, providing support at around 0.6700, while the 20 SMA maintains its bullish slope well below the longer one. Technical indicators, in the meantime, eased from oversold readings but remain directionless well into positive territory.

In the near term, and according to the 4-hour chart, chances are of a bearish correction. The pair is currently piercing a mildly bullish 20 SMA while technical indicators head south within positive levels. The longer moving averages maintain their bullish slopes far below the current level. Further declines could be expected on a break below the 0.6660/70 area, were the pair met buyers in mid-November.

Support levels: 0.6700 0.6665 0.6620

Resistance levels: 0.6770 0.6805 0.8650

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.