AUD/USD turning on its head at HFT selling zone

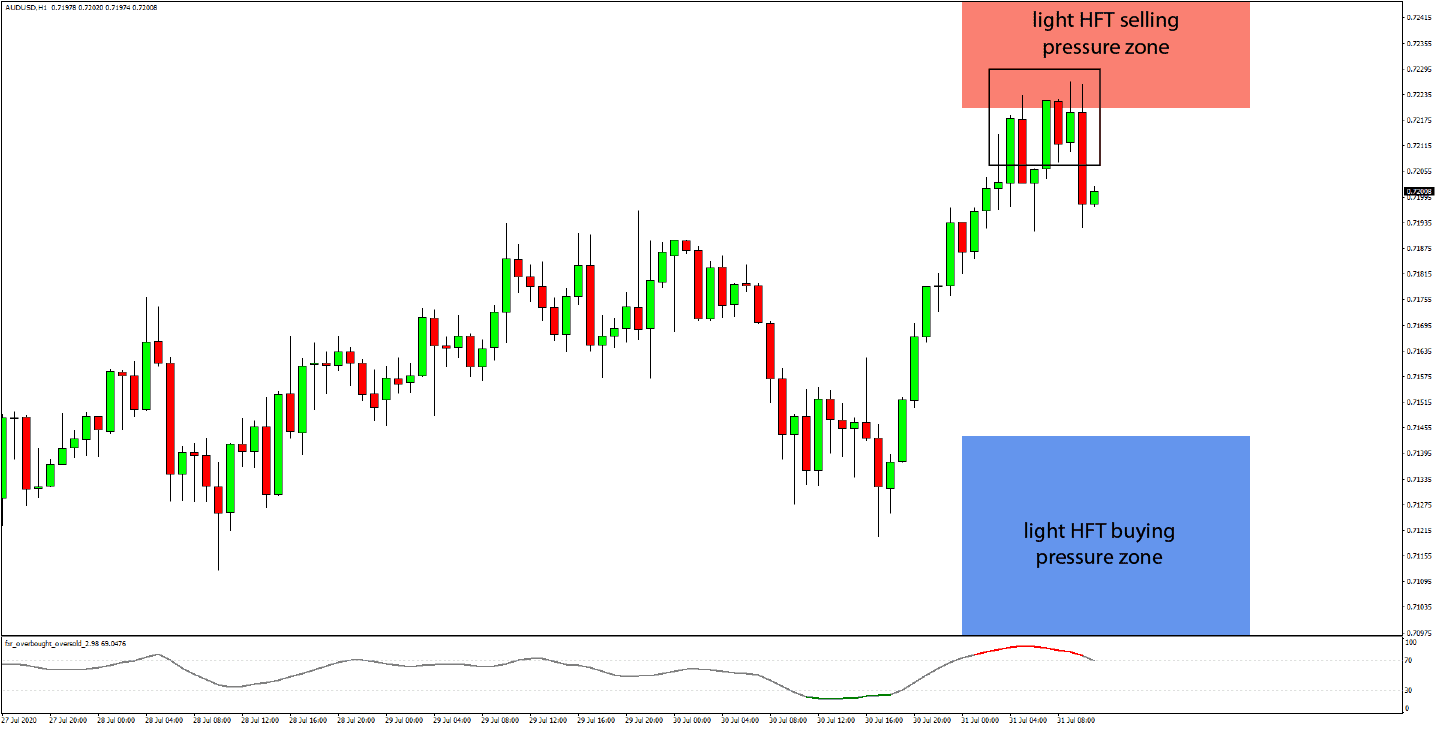

This morning's analysis of HFT algorithms shows bearish that bearish signals are starting to appear on the AUDUSD 1-hour timeframe.

Earlier in the session, the AUDUSD pair reached the light HFT selling pressure zone that is noted at 0.722 and above. The price reaction was strong here, and the attempt was soon reversed. At least three bearish candle formations have appeared here so far.

An additional factor playing in favor of the bears at this stage is the fact that the 1-hour AUDUSD chart is in overbought territory. Namely, the advanced and highly accurate FxTR overbought/oversold indicator confirms the overbought state here. AUDUSD is now coming down from the overbought area, a situation that is considered a reliable sell signal in technical analysis.

Traders will look for potential targets to the downside at the light HFT buying pressure zone, today noted at 0.7143 and below.

AUD/USD Current Trading Positions

FX Trading Revolution - Your Revolutionary Forex Source

FX Trading Revolution - Your Revolutionary Forex Source

Author

FX Trading Revolution Team

FX Trading Revolution

The FX Trading Revolution website is a free independent FOREX source, and was founded to provide true and unbiased information about FOREX trading.