AUD/USD Price Forecast: Post-RBA failure near 200-day SMA warrants caution for bulls

- AUD/USD drifts lower following the RBA’s dovish 25 bps rate cut earlier this Tuesday.

- Dovish Fed expectations drag the USD to a nearly two-week low and support the pair.

- The US-China trade optimism could support the Aussie and warrants caution for bears.

The AUD/USD pair comes under some renewed selling pressure on Tuesday and reverses a major part of the previous day's positive move to the very important 200-day Simple Moving Average (SMA) pivotal resistance. The Australian Dollar (AUD) weakens following interest rate decisions from the People's Bank of China (PBoC) and the Reserve Bank of Australia (RBA). The PBoC lowered its one-year Loan Prime Rates (LPRs) from 3.10% to 3.00%, while the five-year LPR was reduced from 3.60% to 3.50%. Meanwhile, the Australian central bank also lowered its benchmark interest rate by 25 basis points to 3.8%, citing rising global risks, and acknowledged that inflation continues to ease. This keeps the door open for more rate cuts, which, in turn, exert pressure on the AUD.

In fact, the Board judged that upside risks to inflation appear to have diminished, and international developments are expected to weigh on the economy. Moreover, the updated staff projections showed that the headline inflation is expected to be around the mid-point of the 2–3% range through much of the forecast period. Furthermore, RBA Governor Michele Bullock stated in a press conference that the central bank remains prepared to take further action if necessary and signaled that additional adjustments could be made in the future. The markets were quick to react and are now pricing in the possibility of two more rate cuts by the end of this year, which, in turn, dragged the AUD/USD pair back closer to the 0.6400 mark. However, a weaker US Dollar (USD) helps limit deeper losses.

Traders increased their bets for further interest rate cuts by the Federal Reserve (Fed) in 2025 following last week's softer-than-expected release of the US Consumer Price Index (CPI) and the Producer Price Index (PPI). Adding to this, the disappointing US monthly Retail Sales data increased the likelihood of several quarters of sluggish growth and should allow the Fed to stick to its policy easing bias. This, along with a surprise downgrade of the US government's credit rating on Friday, drags the USD Index (DXY), which tracks the Greenback against a basket of currencies, to a nearly two-week low. Apart from this, the optimism over the US-China trade truce for 90 days lends some support to the AUD/USD pair, warranting caution for bears and before positioning for a further depreciation.

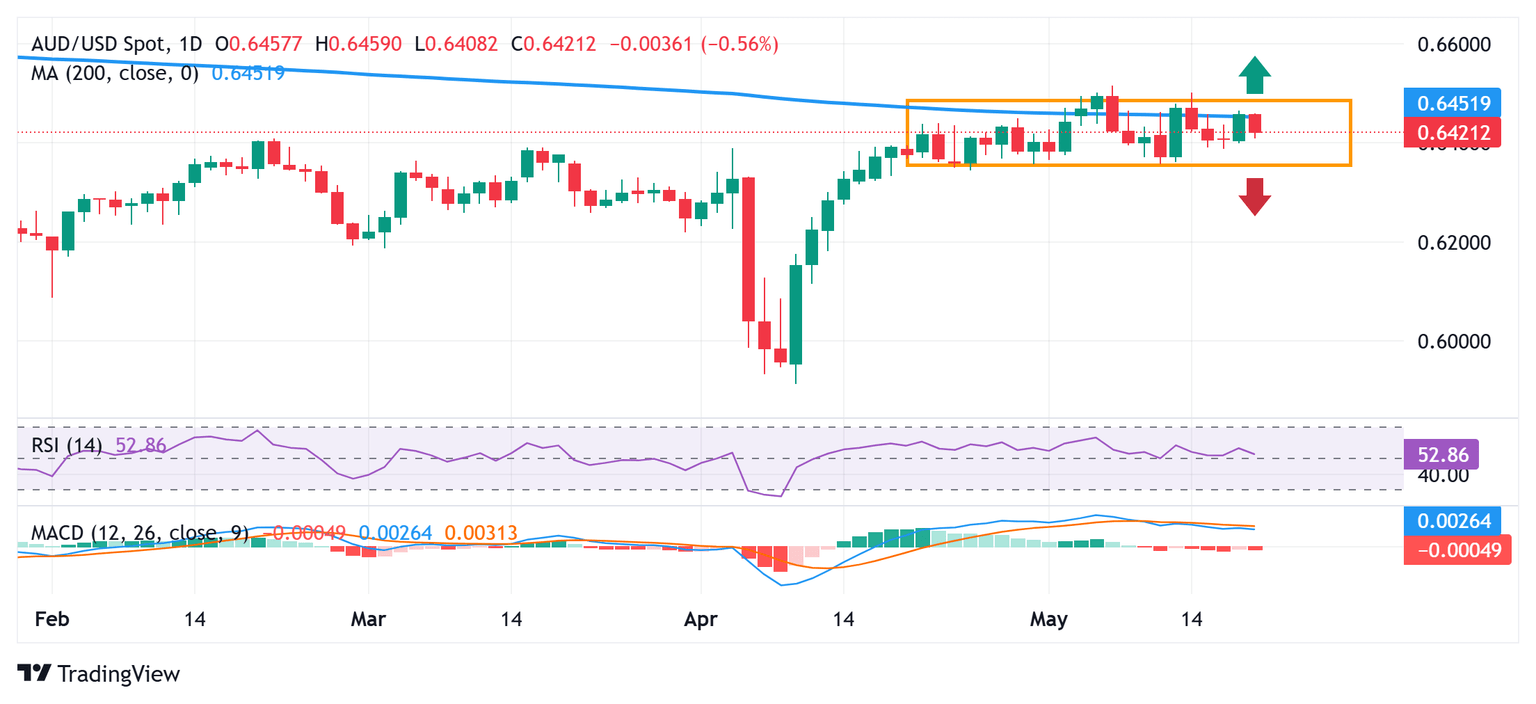

AUD/USD daily chart

Technical Outlook

The AUD/USD pair remains confined in a multi-week-old trading range and so far, has been struggling to breakout through the technically significant 200-day SMA. Moreover, repeated failures to find acceptance above the 0.6500 psychological mark warrant some caution for bullish traders. However, positive technical indicators on the daily chart make it prudent to wait for a convincing breakdown through the trading range support, around the 0.6360-0.6355 region, before positioning for deeper losses.

The AUD/USD pair might then accelerate the slide towards testing the 0.6300 confluence resistance breakpoint– comprising the 100-day SMA and the 38.2% Fibonacci retracement level of the October 2024-April 2025 downfall. The subsequent downfall could expose the 0.6245 intermediate support before spot prices eventually drop to test sub-0.6200 levels.

On the flip side, the 0.6500 mark might continue to act as an immediate hurdle, above which the AUD/USD pair could climb to the next relevant hurdle near the 0.6545 region, or the 61.8% Fibo. level. A sustained strength beyond the latter should pave the way for additional gains towards reclaiming the 0.6600 round figure for the first time since November 2024 en route to the 0.6635-0.6640 resistance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.