AUD/USD Price Forecast: Further choppy trade looks likely

- AUD/USD added to Monday’s uptick beyond the 0.6300 mark.

- The US Dollar faced renewed downside pressure amid declining US yields.

- The RBA’s Monthly CPI Indicator takes centre stage on Wednesday.

On Tuesday, the Australian Dollar (AUD) remained well bid, encouraging AUD/USD to extend its weekly rebound further north of the key 0.6300 barrier. The pair’s uptick reached new three-day highs near 0.6330 and traded at shouting distance from the temporary 100-day SMA.

The pair’s rebound came on the back of renewed weakness surrounding the US Dollar (USD, amid some alleviating tariff concerns and auspicious news from the geopolitical front. That said, the US Dollar Index (DXY) left behind a multi-day advance and put the 104.00 contention region to the test amid declining US yields across the board.

Trade frictions remain a key market headwind

Investor sentiment remains on edge over the prospect of further US trade measures, which could invite retaliation from America’s trading partners. The mere suggestion of a broader trade war continues to pressure risk-sensitive currencies like the Aussie.

Australia, heavily dependent on exporting commodities to China, could be hit hard if US tariffs trigger a slowdown in its biggest export market. Any significant dip in Chinese demand would undoubtedly ripple through the Australian economy.

Central banks grapple with inflation

Fears that tariff-driven inflation might push the Federal Reserve (Fed) toward a more prolonged tightening cycle are colliding with worries about a potential US economic slowdown—this in the context of a still-strong labour market and stubbornly high inflation.

Last week, the FOMC held its benchmark rate at 4.25–4.50%, as widely expected. Furthermore, the Committee’s unanimous decision came with a slightly altered statement highlighting persistent uncertainty. Fed Chair Powell reiterated his stance from March 7, saying, “We do not need to be in a hurry, and are well positioned to wait for greater clarity.” While overall rate projections remain unchanged, the details now hint at fewer rate cuts ahead.

In its updated economic forecasts, the Fed lowered real GDP growth estimates and revised inflation expectations higher. Powell attributed much of the inflation uptick to tariffs, explaining that they “tend to bring growth down and they tend to bring inflation up.”

RBA weighs its options

Across the Pacific, the Reserve Bank of Australia (RBA) cut its benchmark rate by 25 basis points in February to 4.10%. Governor Michele Bullock emphasized that any further moves depend on incoming inflation data, while Deputy Governor Andrew Hauser cautioned against assuming a quick series of cuts. Nonetheless, many analysts believe the RBA could slash rates by up to 75 basis points if trade tensions intensify.

Recent RBA meeting minutes revealed policymakers debating whether to hold rates steady or opt for a smaller cut, before finally settling on the 25-basis-point reduction. Officials noted this move does not necessarily signal a drawn-out easing cycle, adding that Australia’s peak rate remains relatively low by global standards—largely thanks to a resilient labour market.

Speaking of employment, February saw a 52.8K drop in jobs, wiping out the previous month’s gains, while the Unemployment Rate held steady at 4.1%.

Next of note in Oz will be Wednesday’s release of the RBA’s Monthly CPI Indicator for the month of February (prev 2.5%).

Aussie sentiment still bearish

On the positioning front, net short positions in the Australian Dollar rose to multi-week highs of around 70.5K contracts for the week ending March 18, according to the latest CFTC data. Bearish bets have been in place since mid-December and have found fresh momentum in the face of escalating tariff threats.

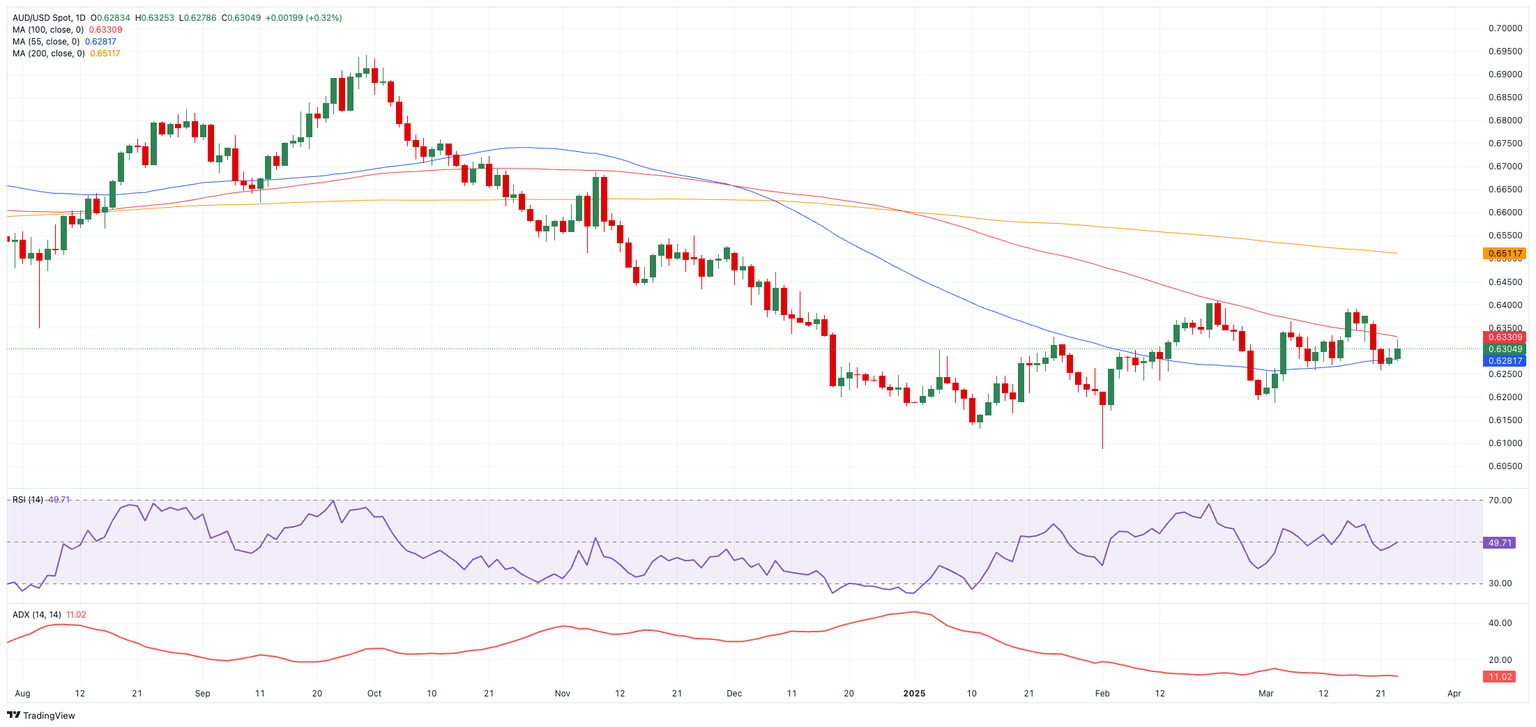

AUD/USD technical outlook

If the pair can decisively clear the 2025 peak at 0.6408 (February 21), it could target the 200-day SMA at 0.6514, with the November 2024 high at 0.6687 (November 7) looming further ahead.

If bears regain the upper hand, the March low of 0.6186 (March 4) offers immediate support, followed by the 2025 trough at 0.6087, and then the psychologically critical 0.6000 level.

Momentum indicators remain mixed: the Relative Strength Index (RSI) rising to around 50 suggests improving bullish impetus, while the Average Directional Index (ADX) below 11 signals a generally subdued trend.

AUD/USD daily chart

Key events ahead

Looking forward, traders will be closely watching the RBA’s Monthly CPI Indicator release on March 26.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.