AUD/USD Price Forecast: Extra losses on the cards below 0.6200

- AUD/USD reversed a multi-day negative streak on Monday.

- The US Dollar sold off on the back of rising optimism in the risk complex.

- Investors will closely follow the release of the RBA’s Minutes on Tuesday.

On Monday, the US Dollar (USD) met a fresh wave of selling pressure, sending the US Dollar Index (DXY) to three-day lows in the 106.50-106.40 band. This downward bias was bolstered by mixed yields and a marked improvement in the risk-associated universe despite tariff concerns remained well in place.

Meanwhile, the Australian Dollar (AUD) reversed sixth straight days of losses, encouraging AUD/USD to regain upside impulse and revisit the mid-0.6200s. Market expectations, however, suggest the Aussie should remain under pressure as new US tariffs loom on the horizon.

Trade uncertainties in the spotlight

Trade tensions remain a central theme in currency markets. Risk-sensitive currencies like the Australian Dollar tend to suffer when tariff threats flare up. On Thursday, President Trump reiterated that the planned 25% tariff on Canadian and Mexican imports will take effect on March 4.

At the same time, the White House continues to impose a 10% tariff on Chinese goods, while threatening a 25% levy on imports from the European Union (EU). Because China is Australia’s top export destination, any slowdown in Chinese demand could directly impact Australian commodity exports—and, by extension, the AUD.

Speaking about China, business activity readings over the weekend were auspicious, although investors remained sceptical regarding a serious pick-up in the country’s economy.

Central banks and inflation

Even as the US Dollar fluctuates, investors remain wary that rising trade tensions could stoke inflation and keep the Federal Reserve (Fed) leaning toward tighter policy.

In Australia, the Reserve Bank of Australia (RBA) lowered its benchmark rate by 25 basis points to 4.10% in February but emphasized that this doesn’t mark the start of a lengthy easing cycle. Officials expect underlying inflation to hover around 2.7%.

A positive surprise in recent jobs data led the RBA to trim its unemployment forecast to 4.2%. Governor Michele Bullock noted that more rate cuts could be on the table if inflation continues to soften, though any decision will hinge on forthcoming data. Deputy Governor Andrew Hauser added that market pricing—which currently suggests fewer than 50 basis points of cuts over the next year—might be overly optimistic.

In terms of inflation, the latest RBA Monthly CPI Indicator (Weighted Mean CPI) held at 2.5% in January, slightly below analysts’ expectations.

Commodities lend some support

Because Australia’s economy is heavily dependent on commodity exports, it’s especially vulnerable to any downturn in Chinese demand. That said, copper and iron ore prices managed to leave behind part of the recent leg lower and staged a decent bounce at the beginning of the week, propping up the Australian Dollar’s rebound.

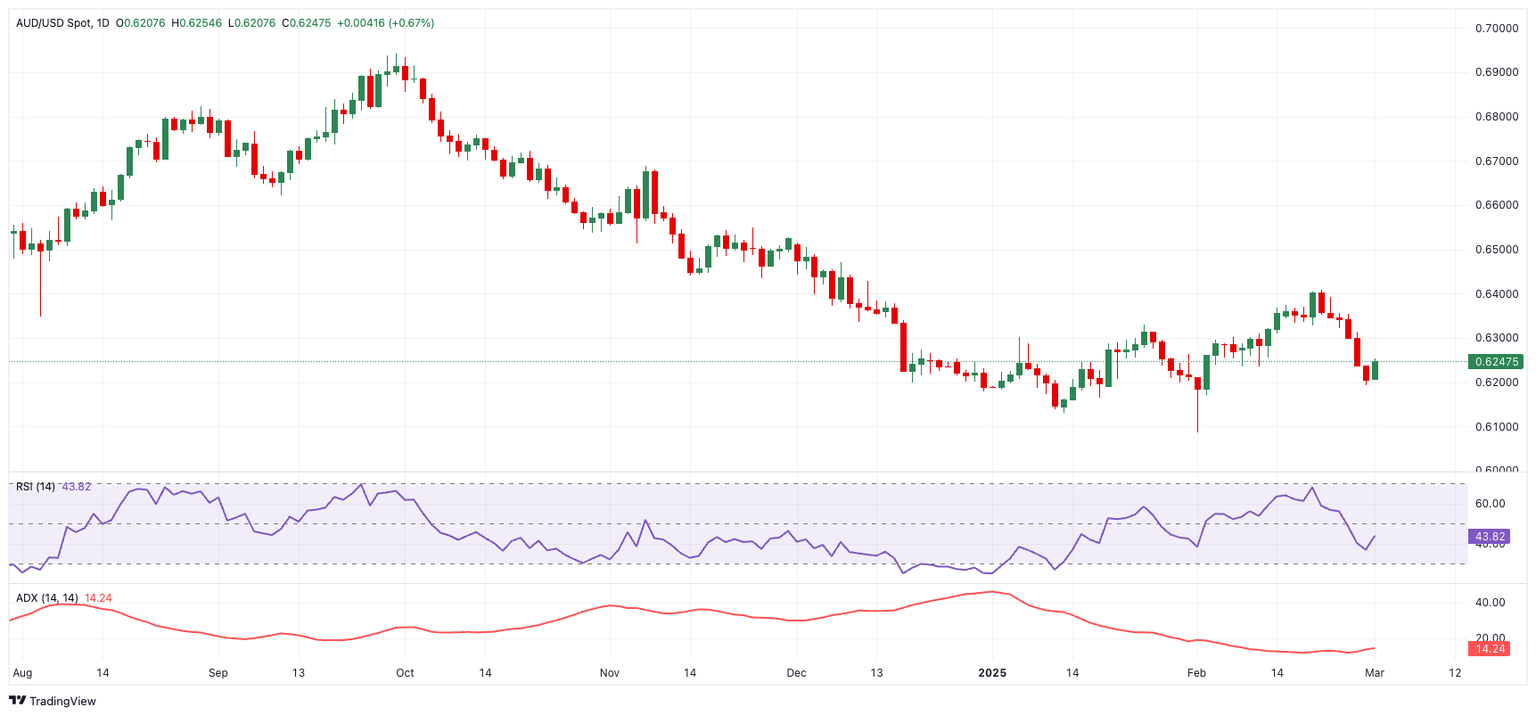

AUD/USD technical picture

From a technical perspective, AUD/USD faces initial resistance at the 2025 peak of 0.6408 (February 21). A break above that could open the way to the November 25 high at 0.6549, which appears reinforced by the proximity of the key 200-day SMA.

On the downside, the weekly low at 0.6192 (February 28) serves as initial support. Below that, watch for the 2025 bottom at 0.6087, followed by the psychological 0.6000 mark.

Momentum indicators point to a possible rebound, with the Relative Strength Index (RSI) recovering to around 44 and the Average Directional Index (ADX) climbing above 15. This suggests some improvement in the trend, albeit a modest one.

AUD/USD daily chart

What’s next

Next on tap in Oz will be the release of the RBA Minutes, Retail Sales, and Current Account figures, followed by the S&P Global Services PMI and the Ai Group Industry Index. The Q4 GDP Growth Rate is set to be published on March 5, and the Balance of Trade data will arrive on March 6 alongside preliminary Building Permits and Private House Approvals.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.