AUD/USD Price Forecast: Could appreciate further amid dovish Fed-inspired USD weakness

- AUD/USD prolongs its uptrend amid the prevalent USD selling bias and a positive risk tone.

- Bets for a more aggressive policy easing by the Fed continue to undermine the Greenback.

- The recent breakout through 0.6600 backs the case for further appreciation for spot prices.

The AUD/USD pair edges lower during the early part of the European session and for now, seems to have snapped a two-day winning streak to the highest level since November 2024 touched this Friday. Any meaningful corrective slide, however, seems elusive in the wake of the prevalent selling bias surrounding the US Dollar (USD), fueled by rising bets for a more aggressive policy easing by the Federal Reserve (Fed).

In fact, traders ramped up their bets for three interest rate cuts by the Fed this year after data released on Thursday showed the US Weekly Initial Jobless Claims rose to the highest level since October 2021. This comes on top of last Friday's disappointing US Nonfarm Payrolls (NFP) report and pointed to the softening labor market, overshadowing a higher-than-expected US consumer inflation reading. The US Bureau of Labor Statistics (BLS) reported that the headline Consumer Price Index (CPI increased by a seasonally adjusted 0.4% in August, pushing the annual inflation rate to 2.9% compared to 2.7% recorded in July. Meanwhile, the core inflation gauge, which excludes volatile food and energy prices, climbed 0.3% for the month and 3.1% on a yearly basis in August, matching the previous month's print and consensus estimate.

Meanwhile, the markets have now almost fully priced in three rate cuts for the rest of the year. According to the CME Group’s FedWatch Tool, traders see a 100% chance of a 25-basis-point (bps) rate cut at the upcoming FOMC policy meeting next week and expect two more rate cuts, in October and in December. The outlook dragged the yield on the benchmark 10-year US government bond to a five-month low and keeps the USD bulls on the defensive. Moreover, the underlying bullish sentiment is seen as another factor undermining the safe-haven buck and benefitting the risk-sensitive Aussie. Wall Street's three major indices registered record closing highs on Thursday amid dovish Fed expectations, and the spillover effect remains supportive of a generally positive tone around the global equity markets.

Traders now look to the Preliminary release of the University of Michigan Consumer Sentiment and Inflation Expectations Index, due later during the North American session. The data might influence the USD and provide some impetus to the AUD/USD pair heading into the weekend. Nevertheless, the aforementioned fundamental backdrop suggests that the path of least resistance for spot prices is to the upside and backs the case for an extension of the recent well-established uptrend witnessed over the past three weeks or so. Hence, any corrective pullback could be seen as a buying opportunity and is more likely to remain limited.

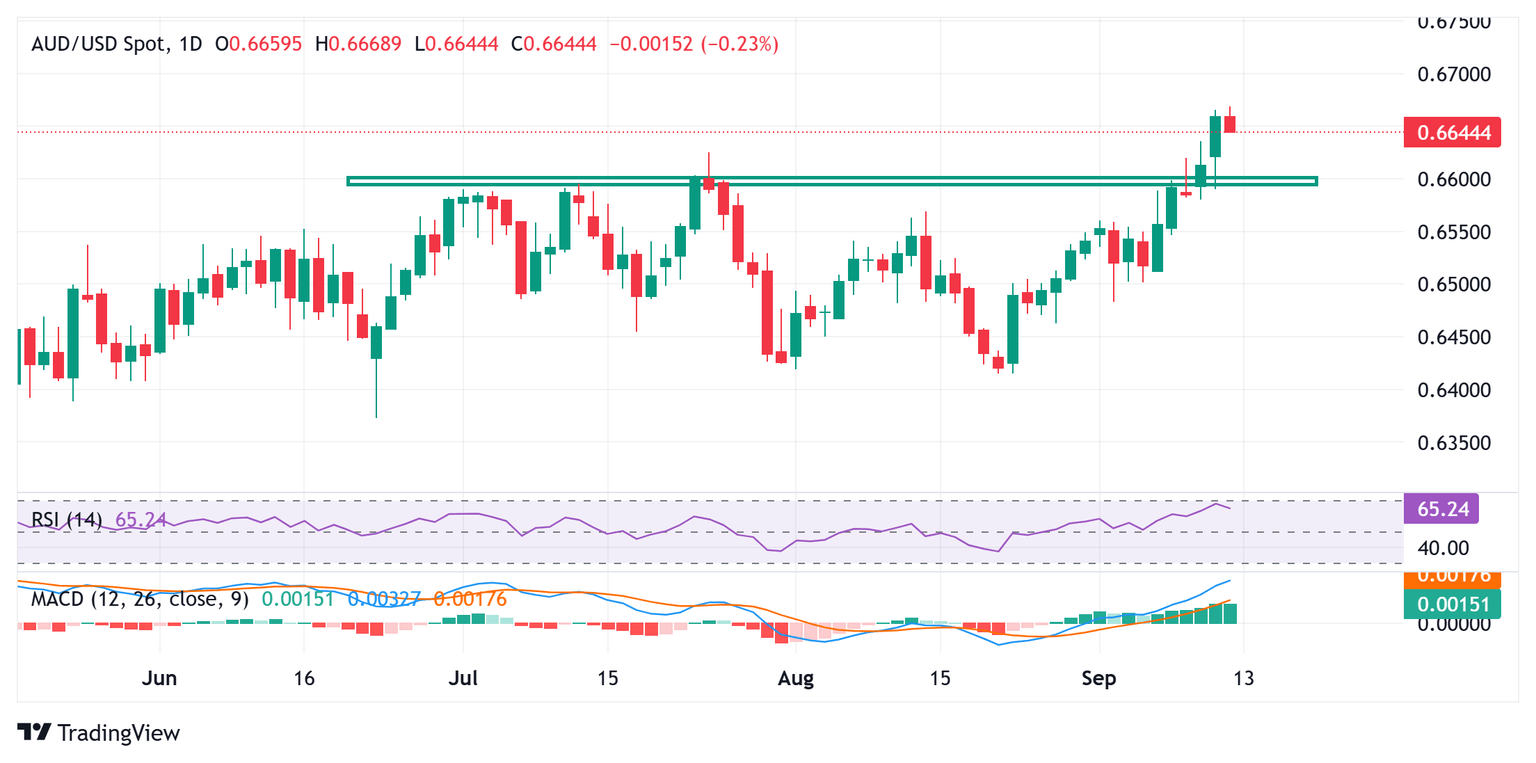

AUD/USD daily chart

Technical Outlook

The recent breakout through the 0.6600 barrier was seen as a key trigger for the AUD/USD bulls and validates the near-term positive outlook. That said, the daily Relative Strength Index (RSI) has moved to the verge of breaking into overbought territory and making it prudent to wait for some near-term consolidation or a modest pullback before the next leg up.

Meanwhile, any meaningful corrective slide is more likely to find decent support and attract fresh buyers near the 0.6600 resistance breakpoint. However, some follow-through selling below the 0.6580 region, or the weekly low, could pave the way for deeper losses towards an intermediate support near mid-0.6500s en route to the 0.6500 psychological mark.

On the flip side, momentum beyond the 0.6665-0.6670 region should allow the AUD/USD pair to reclaim the 0.6700 round figure and climb further towards the next relevant hurdle near the 0.6730-0.6735 zone. Bulls might them aim towards reclaiming the 0.6800 mark for the first time since October 2024.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.