AUD/USD Price Forecast: Bulls retain control near YTD peak ahead of Fed decision on Wednesday

- AUD/USD attracts fresh buyers on Monday and draws support from a combination of factors.

- Rising Fed rate cut bets undermine the USD and benefit the Aussie amid a positive risk tone.

- Diminishing odds for more RBA rate cuts also act as a tailwind for the pair amid US-China talks.

The AUD/USD pair regains positive traction at the start of a new week and climbs back closer to the year-to-date (YTD) peak during the early part of the European session. The Australian Dollar (AUD) continues with its relative outperformance amid diminishing odds of additional interest rate cuts by the Reserve Bank of Australia (RBA). This, along with a positive tone around the equity markets and the prevalent bearish sentiment surrounding the US Dollar (USD), offsets mostly disappointing Chinese macro data and benefits the risk-sensitive Aussie.

The National Bureau of Statistics (NBS) reported earlier this Monday that China’s Retail Sales rose 3.4% YoY in August vs. 3.8% expected and 3.7% previous. A separate report showed that China's Industrial Production increased 5.2% YoY, compared to the 5.8% forecast and 5.7% in July. Meanwhile, the Fixed Asset Investment came in at 0.5% year-to-date (YTD) in August, missing the 1.4% expected and the previous reading of 1.6%. The markets, however, react little to the data as the focus remains on the second day of trade talks in Spain between the US and China.

The negotiations, led by US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, are the latest attempt to end a trade war between the world's two biggest economies. Bessent said earlier this Monday that the US has “made good progress on technical details with China.” Meanwhile, US Trade Representative Jamieson Greer noted, “We want to maintain a good relationship with our Chinese counterparts.” Top trade delegations from the US and China last met in July, when they struck a deal to extend the tariff truce by another 90 days until 10 November.

Meanwhile, the optimism remains supportive of the upbeat market mood and lends support to the China-proxy Australian Dollar (AUD). The USD, on the other hand, languishes near its lowest level since July 14 amid rising bets for a more aggressive policy easing by the Federal Reserve (Fed). Traders ramped up their bets for a Fed rate cut in September after the recent US macro data pointed to a softening labor market. Moreover, the Fed is expected to deliver two more rate cuts, in October and in December, which weighs on the USD and supports the AUD/USD pair.

It, however, remains to be seen if bulls can retain their dominant position or opt to lighten their bets ahead of this week's key central bank event risk. The Fed is scheduled to announce its decision at the end of a two-day meeting on Wednesday and is widely expected to lower borrowing costs by 25-basis-point (bps). Investors, however, will scrutinize the accompanying policy statement and Fed Chair Jerome Powell's remarks during the post-meeting presser for cues about the future rate-cut path. This, in turn, will drive the USD and provide a fresh impetus to the AUD/USD pair.

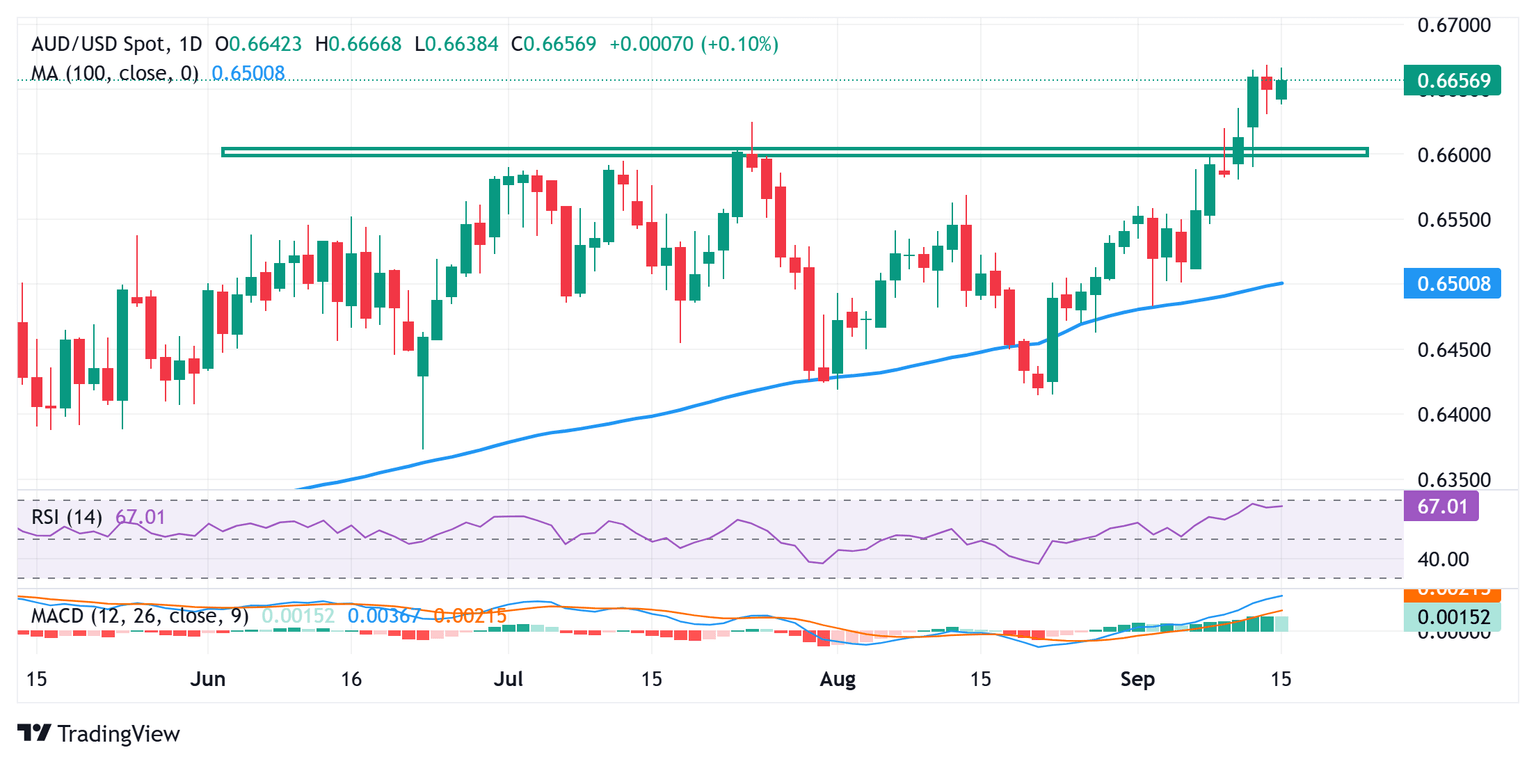

AUD/USD daily chart

Technical Outlook

From a technical perspective, the emergence of some dip-buying on Monday validates the recent breakout through the 0.6600 barrier and favors the AUD/USD bulls. Moreover, positive oscillators on the daily chart suggest that the path of least resistance for spot prices is to the upside. Some follow-through buying beyond the YTD peak, around the 0.6665-0.6670 region, should allow the pair to reclaim the 0.6700 round figure and climb further towards the next relevant hurdle near the 0.6730-0.6735 zone. The momentum could extend further towards reclaiming the 0.6800 mark for the first time since October 2024.

On the flip side, the 0.6635-0.6630 area now seems to have emerged as an immediate support. Any further slide is more likely to find decent support and attract fresh buyers near the 0.6600 resistance breakpoint. The latter should act as a strong base for the AUD/USD pair, which, if broken decisively, could pave the way for deeper losses towards an intermediate support near mid-0.6500s en route to the 0.6500 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.