AUD/USD Price Forecast: Bulls look to seize control on hawkish RBA, weaker USD

- AUD/USD prolongs its uptrend in reaction to the RBA’s hawkish on-hold decision.

- Fed rate cut bets and the looming US government shutdown weigh on the USD.

- Traders now look forward to the US macro data and Fedspeak for a fresh impetus.

The AUD/USD pair attracts buyers for the third successive day on Tuesday and reclaims the 0.6600 mark during the first half of the European session in the wake of the Reserve Bank of Australia's (RBA) hawkish outlook. As was widely expected, the RBA's rate-setting board voted to keep the Official Cash Rate (OCR) unchanged at 3.6% at the end of the September meeting. In the accompanying policy statement, the central bank noted that the decline in underlying inflation has slowed and that inflation in the September quarter may be higher than expected at the time of the August meeting.

This comes on the back of last week's data, which showed that consumer prices in Australia rose at the fastest annual pace in a year during August. The RBA also said it required more time to gauge the full effects of a cumulative 75 basis points of rate cuts so far in 2025. This, in turn, casts doubt over the possibility of a rate cut in November, which, along with the underlying bullish sentiment, provides a goodish intraday lift to the risk-sensitive Australian Dollar (AUD). Apart from this, the prevalent selling bias surrounding the US Dollar (USD) contributes to the AUD/USD pair's intraday positive move.

Despite signs of economic resilience, traders have been pricing in a greater chance that the US Federal Reserve (Fed) will lower borrowing costs two more times by the end of this year. The CME Group's FedWatch Tool indicates a 90% chance that the Fed will cut rates by 25 basis points in October and a nearly 70% possibility for another rate reduction in December. Moreover, fears of a US government shutdown drag the USD lower for the third straight day. In fact, the last-gap meeting hosted by US President Donald Trump with top Republican and Democratic congressional leaders yielded no breakthrough.

The Aussie bulls, meanwhile, seem rather unaffected by mixed Chinese PMIs. The National Bureau of Statistics (NBS) reported that China’s Manufacturing PMI rose from 49.4 in the previous month to 49.8 in September, beating market estimates for a reading of 49.6. This, to a larger extent, was offset by an unexpected fall in the Non-Manufacturing PMI to 50, versus 50.3 in August, and does little to provide any meaningful impetus to antipodean currencies and the China-proxy AUD. Traders now look to the US macro data and speeches from influential FOMC members for a fresh impetus.

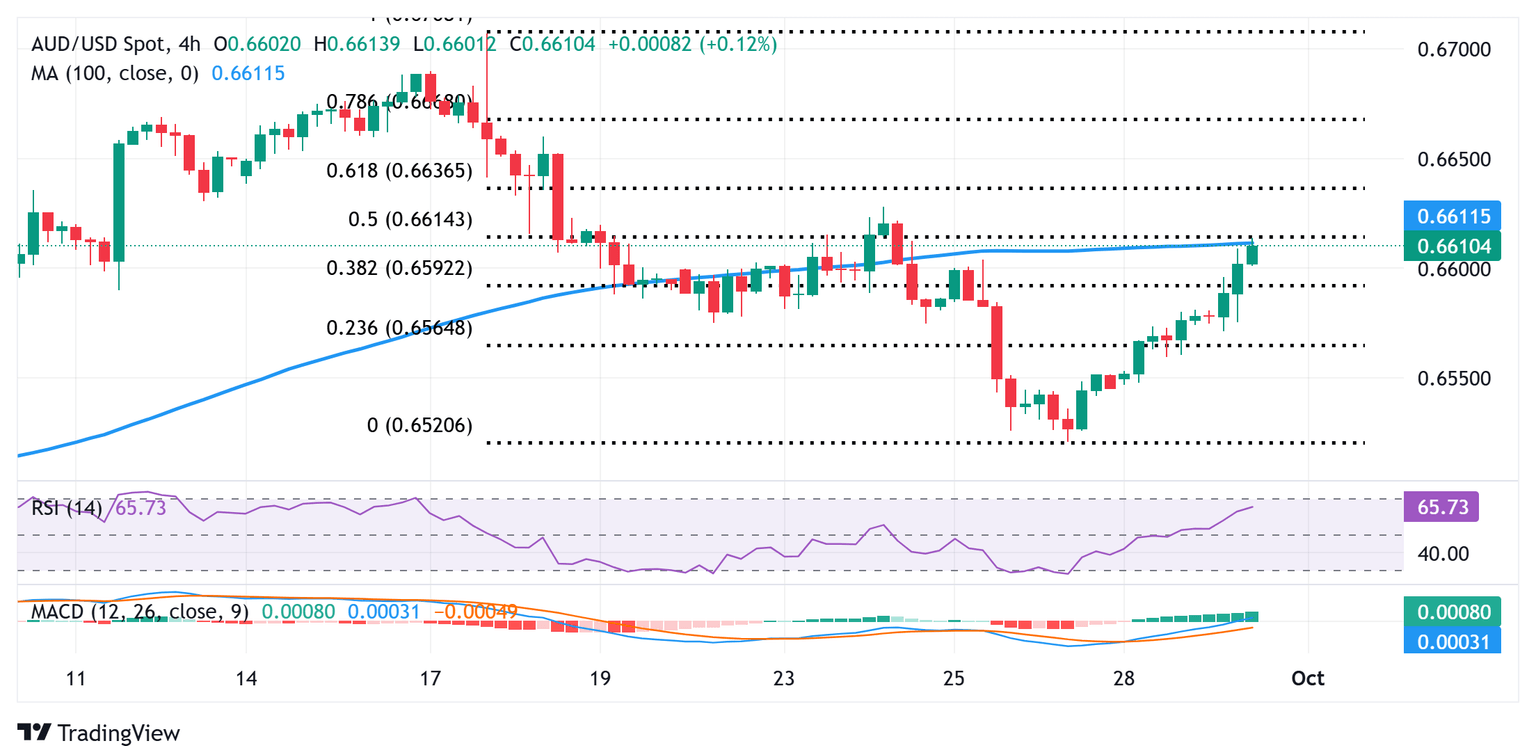

AUD/USD 4-hour chart

Technical Outlook

The strong intraday move up lifts the AUD/USD pair to a confluence hurdle comprising the 100-period Simple Moving Average (SMA) on the 4-hour chart and the 50% Fibonacci retracement level of the downfall from the year-to-date high touched earlier this month. A sustained strength beyond will be seen as a fresh trigger for bulls. Given that oscillators on the said chart have been gaining positive traction, spot prices might then climb to last week's swing high, around the 0.6625-0.6630 region, which nears the 61.8% Fibo. retracement level, before aiming to reclaim the 0.6700 mark.

On the flip side, the 0.6580-0.6575 zone could protect the immediate downside, below which the AUD/USD pair could resume its downtrend and test the 0.6550 intermediate support before eventually dropping to last week's swing low, around the 0.6520 area. Some follow-through selling, leading to a subsequent break below the 0.6500 psychological mark, might shift the bias back in favor of bearish traders and expose the August monthly swing low, around the 0.6415 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.