AUD/USD Price Forecast: Approaches YTD peak ahead of Nonfarm Payrolls revisions, inflation data

- AUD/USD attracts buyers for the third straight day amid a broadly weaker USD.

- Rising Fed rate cut bets and a positive risk tone continue to weigh on the buck.

- Diminishing odds for more RBA rate cuts benefit the Aussie and remain supportive.

The AUD/USD pair prolongs its uptrend for the third consecutive day on Tuesday and advances to levels beyond the 0.6600 mark, or the highest since July 24 during the first half of the European session. The momentum is sponsored by the prevalent selling bias surrounding the US Dollar (USD), which fell to its lowest level since July 28 amid rising bets for a more aggressive policy easing by the US Federal Reserve (Fed).

An unexpectedly weak US jobs data released last Friday provided further evidence of a softening labor market and led markets to price in three interest rate cuts by the US central bank through the year-end. Moreover, the CME Group's FedWatch Tool indicates a small possibility of a jumbo 50-basis-point (bps) rate cut at the Fed’s upcoming policy meeting next week. Moreover, US President Donald Trump has shown his discontent towards Fed Chair Jerome Powell for being too late to act on borrowing costs. Furthermore, Trump's calls to dismiss Fed governors fueled concerns about the central bank's independence, which keeps the USD depressed and benefits the AUD/USD pair.

Meanwhile, the tech-heavy Nasdaq Composite Index notched a record high close on Monday amid dovish Fed expectations, and the spillover effect led to a rise in the global equity markets. This is seen as another factor undermining the Greenback's relative safe-haven status and driving flows towards the risk-sensitive Aussie. The Australian Dollar (USD) draws additional support from last week’s upbeat Q2 GDP print, which showed that the domestic economy grew at the fastest annual pace in almost two years during the second quarter. This, along with hotter July inflation data, dampens expectations of additional Reserve Bank of Australia (RBA) rate cuts and favors the AUD/USD bulls.

Market participants now look forward to the preliminary estimate of the annual revision of Nonfarm Payrolls (NFP) later today, which might influence the USD price dynamics. The focus, however, will remain glued to the US Producer Price Index (PPI) and the Consumer Price Index (CPI), due on Wednesday and Thursday, respectively. The crucial data would determine the next leg of a directional move for the buck and the AUD/USD pair. Nevertheless, the aforementioned supportive fundamental backdrop suggests that the path of least resistance for spot prices is to the upside. Hence, any corrective pullback could be seen as a buying opportunity and is more likely to remain limited.

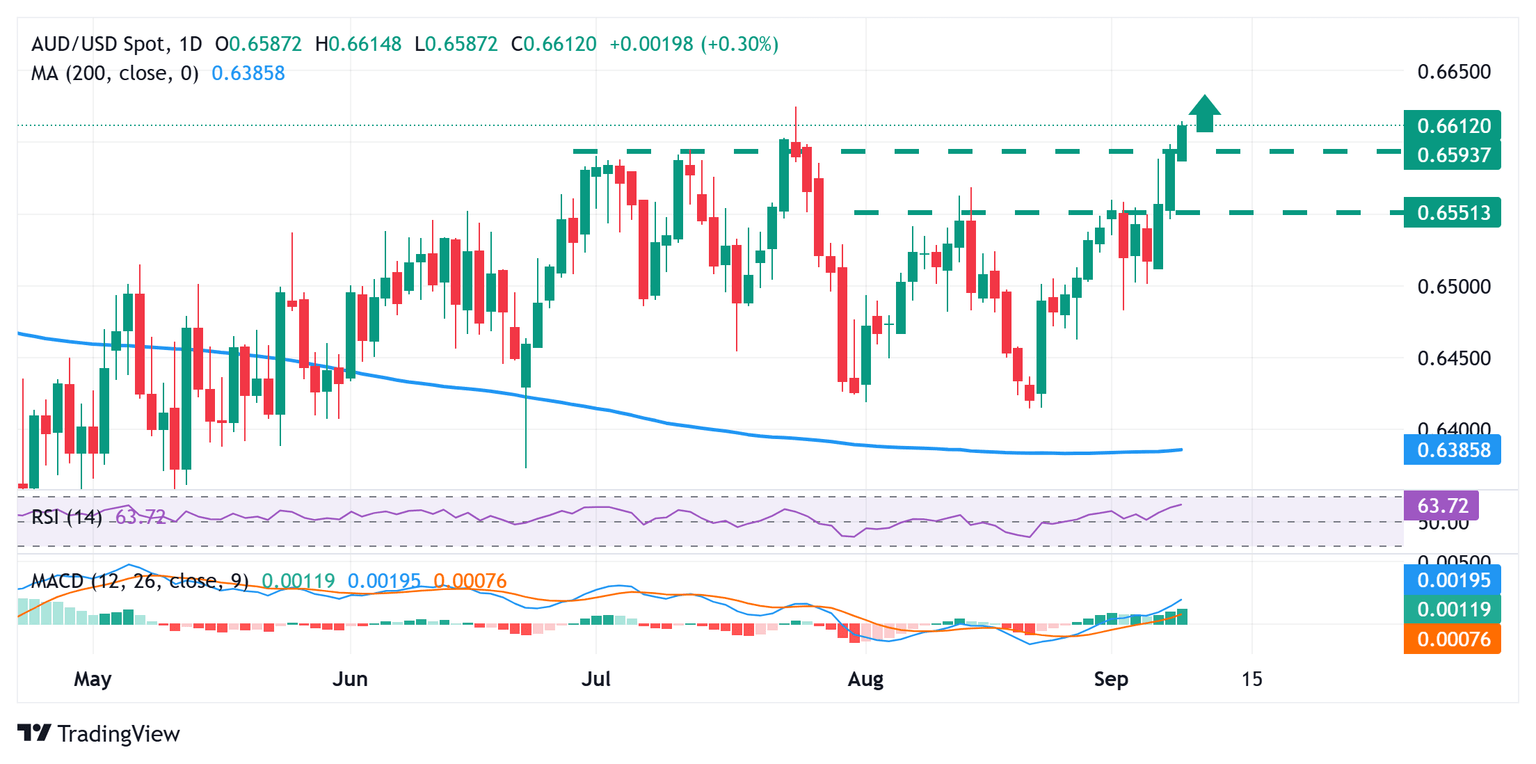

AUD/USD daily chart

Technical Outlook

From a technical perspective, any intraday move and acceptance above the 0.6600 round figure could be seen as a fresh trigger for the AUD/USD bulls. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought territory. This, in turn, validates the near-term positive outlook and should allow spot prices to surpass the year-to-date high, around the 0.6625 region, touched in July, and climb further towards the 0.6670-0.6675 intermediate hurdle en route to the 0.6700 mark. A sustained strength beyond the latter will set the stage for additional gains towards the 0.6750 region before spot prices eventually reclaim the 0.6800 round figure for the first time since October 2024.

On the flip side, any corrective pullback below the Asian session low, around the 0.6585-0.6580 region, could attract buyers near the mid-0.6500s. This should help limit the downside for the AUD/USD pair near the 0.6520-0.6515 horizontal support. The latter is closely followed by the 0.6500 psychological mark, which, if broken decisively, could make spot prices vulnerable to accelerate the fall towards the 0.6420 horizontal support.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.