AUD/USD Outlook: Upside potential seems limited ahead of the crucial Fed decision

- AUD/USD gains some positive traction on Tuesday and snaps a three-day losing streak.

- A positive risk tone undermines the safe-haven USD and benefits the risk-sensitive aussie.

- A combination of factors might hold back bulls from placing fresh bets ahead of the FOMC.

The AUD/USD pair attracts some buying during the Asian session on Tuesday and stalled a three-day-old corrective slide from a multi-week high. A generally positive tone around the equity markets is seen undermining the safe-haven US dollar and benefitting the risk-sensitive aussie. The global risk sentiment get a boost following the better-than-expected release of Caixin Manufacturing PMI from China, which improved to 49.2 in October from 48.1 in the previous month. The greenback is further weighed down by speculations that the Fed will soften its hawkish stance amid signs of a slowdown in the US economy. That said, a combination of factors caps the upside for the major.

Investors remain concerned about the economic headwinds stemming from China's strict zero-COVID policy amid the resurgence of cases in Shanghai and Wuhan. This, along with the protracted Russia-Ukraine war, should keep a lid on any optimistic move in the markets and limit the downside for the greenback. Apart from this, firming expectations that the Fed will deliver another supersized 75 bps rate hike at the end of a two-day policy meeting on Wednesday should act as a tailwind for the buck. This, along with the Reserve Bank of Australia's (RBA) decision to hike interest rates by 25 bps - despite last week's inflation shock - might hold back bulls from placing fresh bets around the AUD/USD pair.

In fact, the markets started pricing in the possibility of a 50 bps rate hike by the RBA after the official data showed that CPI had jumped to 7.3 YoY in September. Furthermore, the RBA's preferred core remained well above the 2-3% target. Adding to this, worries about a deeper global economic downturn suggest that the path of least resistance for the AUD/USD pair is to the downside. Market players, however, are likely to move to the sidelines ahead of the key central bank event risk - the highly-anticipated FOMC decision on Wednesday. In the meantime, traders on Tuesday will take cues from the release of the US ISM Manufacturing PMI later during the early North American session.

Technical Outlook

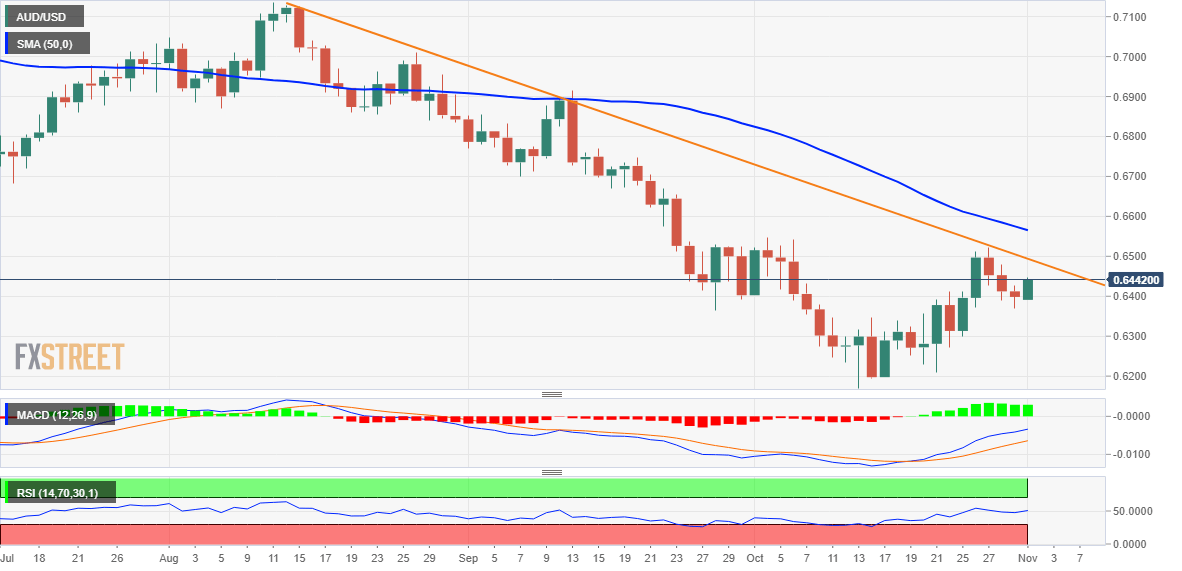

From a technical perspective, any further move beyond the 0.6450-0.6455 immediate hurdle has the potential to lift the AUD/USD pair back towards the 0.6500 psychological mark. This is closely followed by last week's swing high, around the 0.6520-0.6525 region, which now coincides with a nearly three-month-old downward sloping trend-line. Some follow-through buying above the 50-day SMA, around the 0.6555 area, will be seen as a fresh trigger for bulls and set the stage for additional gains. Spot prices might then accelerate the momentum towards the 0.6600 round-figure mark before eventually climbing to the next relevant hurdle near the 0.6670-0.6675 zone.

On the flip side, the 0.6400 mark now seems to protect the immediate downside ahead of the overnight swing low, around the 0.6370-0.6375 region. Failure to defend the said support levels will make the AUD/USD pair vulnerable to retesting the 0.6300 round figure. The downward trajectory could further get extended towards intermediate support near mid-0.6200s en route to the 0.6200 mark and the YTD low, around the 0.6170 region touched in October.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.