AUD/USD Outlook: Bears have the upper hand near YTD low ahead of RBA on Tuesday

- AUD/USD rebounds after hitting a fresh YTD low, though the upside potential seems limited.

- The USD stalls the post-NFP positive move and prompts some short-covering around the pair.

- Elevated US bond yields favour the USD bulls and could cap gains ahead of the RBA on Tuesday.

The AUD/USD pair stages a modest recovery from the 0.6485 area, or its lowest level since November 17 touched this Monday and trades with a mild positive bias during the early European session. The US Dollar (USD) struggles to capitalize on its modest intraday uptick to a nearly two-month peak and fails ahead of the 100-day Simple Moving Average (SMA), which, in turn, is seen as a key factor lending support to spot prices. The fundamental backdrop, however, favours the USD bulls and suggests that the path of least resistance for the currency pair remains to the downside, warranting some caution before positioning for any meaningful appreciating move.

Investors further scaled back their expectations regarding the timing and pace of rate cuts by the Federal Reserve (Fed) in the wake of Friday's blockbuster US jobs data. The headline NFP showed that the US economy added 353K new jobs in January as against the 180K anticipated. Moreover, the previous month's reading was also revised higher to 333K from the 216K reported. Meanwhile, other details of the report revealed that the Unemployment Rate held steady at 3.7% and Average Hourly Earnings rose to 4.5% on a yearly basis, both beating consensus estimates. The data pointed to resilience in the US labor market and that the economy remains in good shape, giving the Fed more headroom to keep monetary policy steady for the time being.

Adding to this, Fed Chair Jerome Powell, speaking in an interview with the US TV show 60 Minutes, reiterated that the March meeting is likely too soon to have the confidence to start cutting interest rates. The markets were quick to react, with the probability of a 150-bps rate cut in 2024 dwindling to just 25% from being nearly certain previously. This, in turn, remains supportive of a further rise in the US Treasury bond yields and favours the USD bulls. Furthermore, geopolitical risks stemming from conflicts in the Middle East, along with worries about slowing economic growth in China, temper investors' appetite for riskier assets. This further benefits the safe-haven Greenback and contributes to keeping a lid on the risk-sensitive Aussie.

In the latest developments surrounding the Israel-Gaza war, media reports suggest that Hamas is set to reject the Gaza ceasefire deal proposed in Paris. Adding to this, Israel's Prime Minister Benjamin Netanyahu said that the country will not end the war before it completes all of its goals, which are the elimination of Hamas, the return of all the kidnapped people, and the promise that Gaza will not pose a threat. Furthermore, US Central Command said forces conducted a strike in self-defence against a Houthi a land attack cruise missile and struck four anti-ship cruise missiles prepared to launch against ships in the Red Sea. Meanwhile, the US has signalled further strikes on Iran-backed groups in response to a deadly attack on American troops in Jordan.

This, to a larger extent, overshadows the recent optimism led by the People's Bank of China's (PBoC) move to cut the Reserve Requirement Ratio (RRR) by 50 bps, which is expected to pump in 1 trillion Chinese Yuan in the economy. China Securities Regulatory Commission (CSRC) vowed on Sunday to prevent abnormal fluctuations and said that would guide more medium- and long-term funds into the market and crack down on illegal activities including malicious short selling and insider trading. The CSRC, however, offered no specifics on how they plan to do so. Meanwhile, a private survey showed that business activity in China's services sector remained in expansionary territory for 13 straight months, though grew less than expected in January.

Bulls might also refrain from placing aggressive bets around the Australian Dollar (AUD) in the wake of growing acceptance that the Reserve Bank of Australia's (RBA) tightening cycle is over and that the next move would be down. The bets were lifted by soft consumer and producer inflation data released last week, which ramped up expectations that prices will fall at an accelerated pace in the coming months. Hence, the market focus will remain glued to the RBA monetary policy meeting on Tuesday. Heading into the key central bank event risk, traders on Monday will take cues from the release of the US ISM Services PMI and speeches by influential FOMC members, which will drive the USD and produce short-term opportunities around the AUD/USD pair.

Technical Outlook

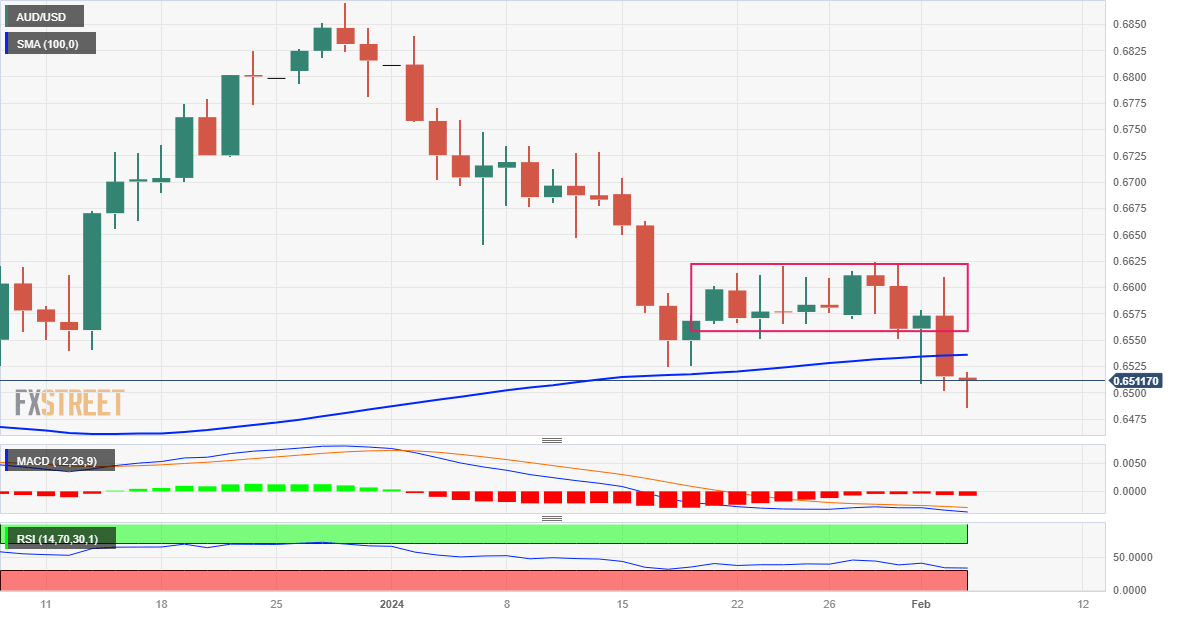

From a technical perspective, Friday's close below the 100-day Simple Moving Average (SMA) for the first time since November was seen as a fresh trigger for bearish traders against the backdrop of last week's breakdown through a short-term range. Apart from this, oscillators on the daily chart are holding deep in the negative territory and are still away from being in the oversold zone. This, in turn, validates the near-term negative outlook for the spot prices, suggesting that any subsequent move-up might still be seen as a selling opportunity.

The 100-day SMA, currently pegged near the 0.6525-0.6530 area, could act as an immediate hurdle ahead of the aforementioned trading range support breakpoint, around the 0.6565-0.6570 region. This is closely followed by the 0.6600 round figure and the 0.6620-0.6625 supply zone, which if cleared decisively might prompt aggressive short-covering and lift the AUD/USD pair to the 0.6700 neighbourhood. Some follow-through buying could allow spot prices to extend the positive move further towards the next relevant hurdle near the 0.6730 region.

On the flip side, the Asian session low, around the 0.6485 region, now seems to protect the immediate downside, below which the AUD/USD pair could accelerate the slide further towards testing the 0.6400 round figure. The downward trajectory could eventually drag spot prices to the 0.6340-0.6335 support zone, or the November 2023 swing low, en route to the 0.6300 mark and the 2023 trough, near the 0.6270 area.

AUD/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.