AUD/USD Forecast: Waiting for an update on the Australian employment situation

AUD/USD Current Price: 0.7167

- Australia expected to have lost 35,000 jobs in September amid Victoria lockdown.

- Westpac Consumer Confidence beat expectations in October but declined from its previous reading.

- AUD/USD is technically bearish, and the market’s sentiment favors another leg south.

The AUD/USD pair is ending the day as it started around 0.7160, having spent it within a well-limited range. The pair advanced to 0.7190, but it changed course with Wall Street’s slump mid-US session. The Aussie remained subdued, despite Westpac Consumer Confidence resulted in 11.9% in October, better than the 9.9% forecast, although below the previous 18%.

This Thursday Australia will publish its September employment figures. The country is expected to have lost 35,000 jobs in the month, while the unemployment rate is seen at 7.1%, up from 6.8% in August. Additionally, China will publish September inflation figures, with the CPI foreseen at 1.8% YoY.

AUD/USD short-term technical outlook

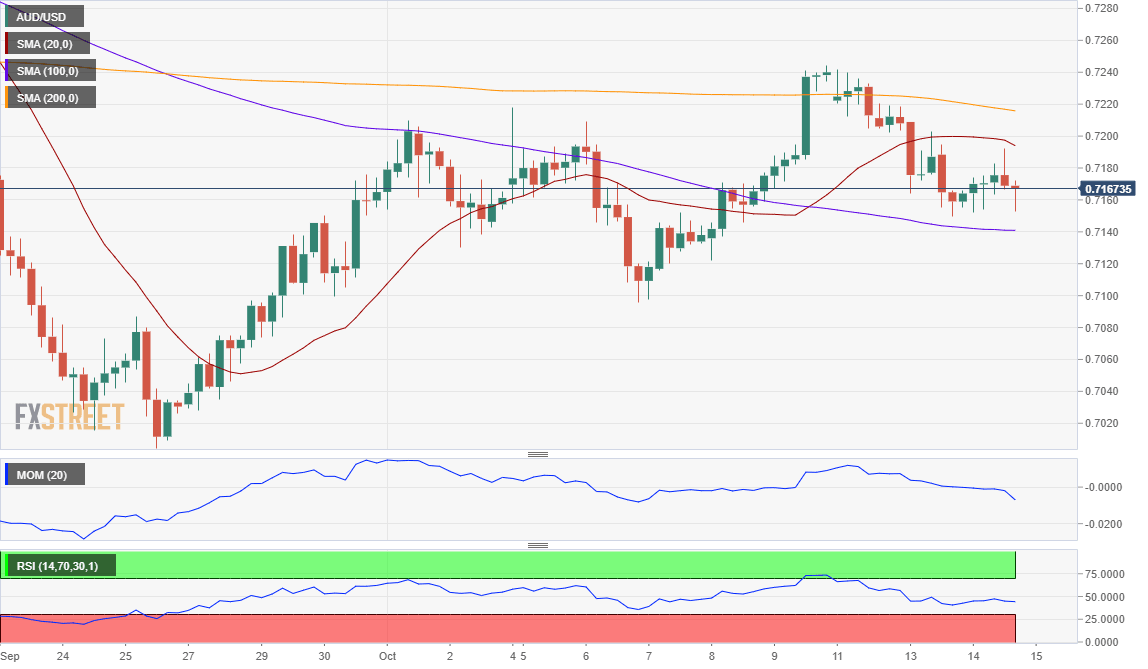

The AUD/USD pair maintains its bearish stance in the short-term, although the upcoming direction will likely be dictated by the outcome of the employment report. The 4-hour chart shows that it keeps trading below its 20 SMA while above a bearish 100 SMA. Technical indicators have stabilized within negative levels, skewing the risk to the downside without confirming further declines ahead.

Support levels: 0.7130 0.7095 0.7050

Resistance levels: 0.7205 0.7240 0.7290

View Live Chart for the AUD/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.