AUD/USD Forecast: Bullish, and ready to challenge March’s high

AUD/USD Current Price: 0.6670

- Risk-on sent led to substantial gains in equities and commodity-linked currencies.

- AUD/USD could extend its rally on a break above 0.6684, the immediate resistance.

The Aussie was among the most benefited from the upbeat market’s mood, reaching a fresh 2-month high of 0.6671 and heading into the Asian session trading a few pips below such high. The American dollar came under selling pressure as market players turned into riskier assets amid optimism related to economic recoveries. Equities rallied ever since the day started, pushing the pair though the 0.6600 level. Gold edged lower despite dollar’s weakness but held above $1,700.00 a troy ounce.

Australia didn’t publish macroeconomic data so far this week, and this Wednesday will release a minor report, Q1 Construction Work Done, foreseen at -1.5% from -3.0% in the last quarter of 2019.

AUD/USD short-term technical outlook

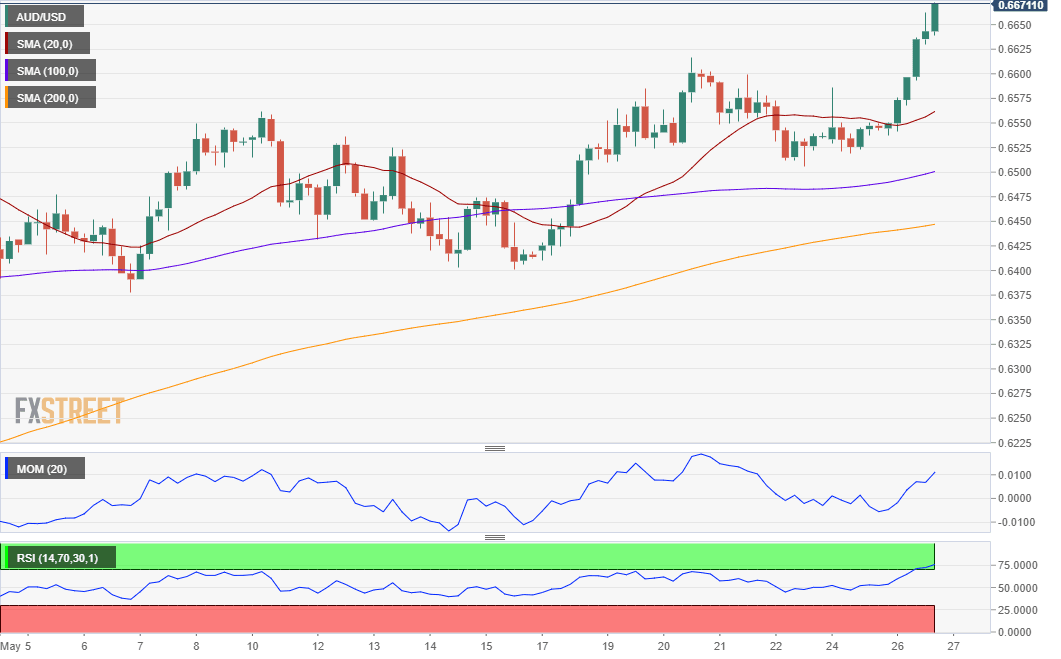

The AUD/USD pair is approaching March’s high at 0.6684 an immediate resistance level, overbought in the short-term, but with no signs of upward exhaustion. The 4-hour chart shows that technical indicators maintain their upward slopes, with the Momentum at levels not seen since early May and the RSI currently at 77. The pair is above all of its moving averages, with the 20 SMA accelerating north at around 0.6560. Bulls may give up if the pair losses this last support.

Support levels: 0.6610 0.6560 0.6515

Resistance levels: 0.6685 0.6720 0.6750

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.